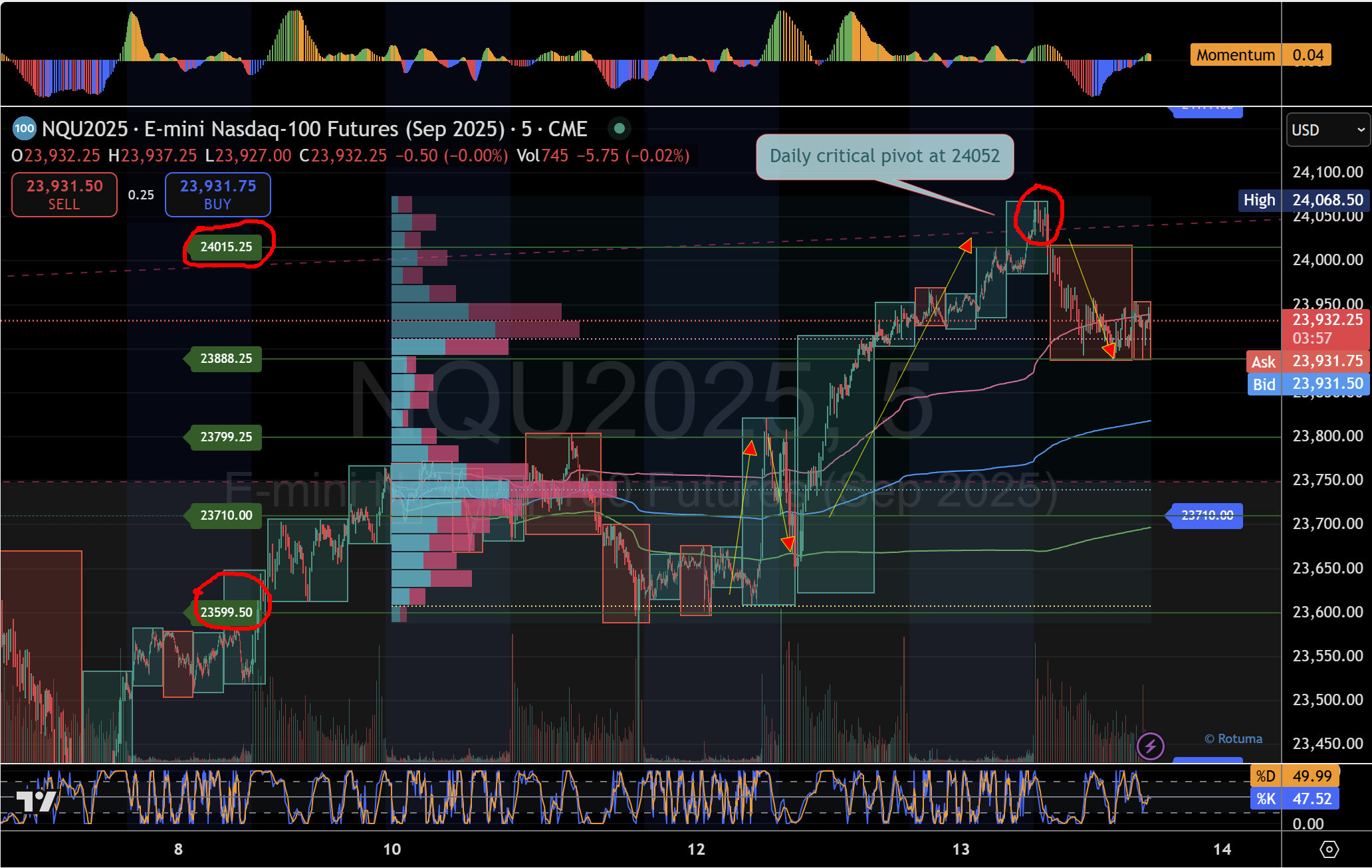

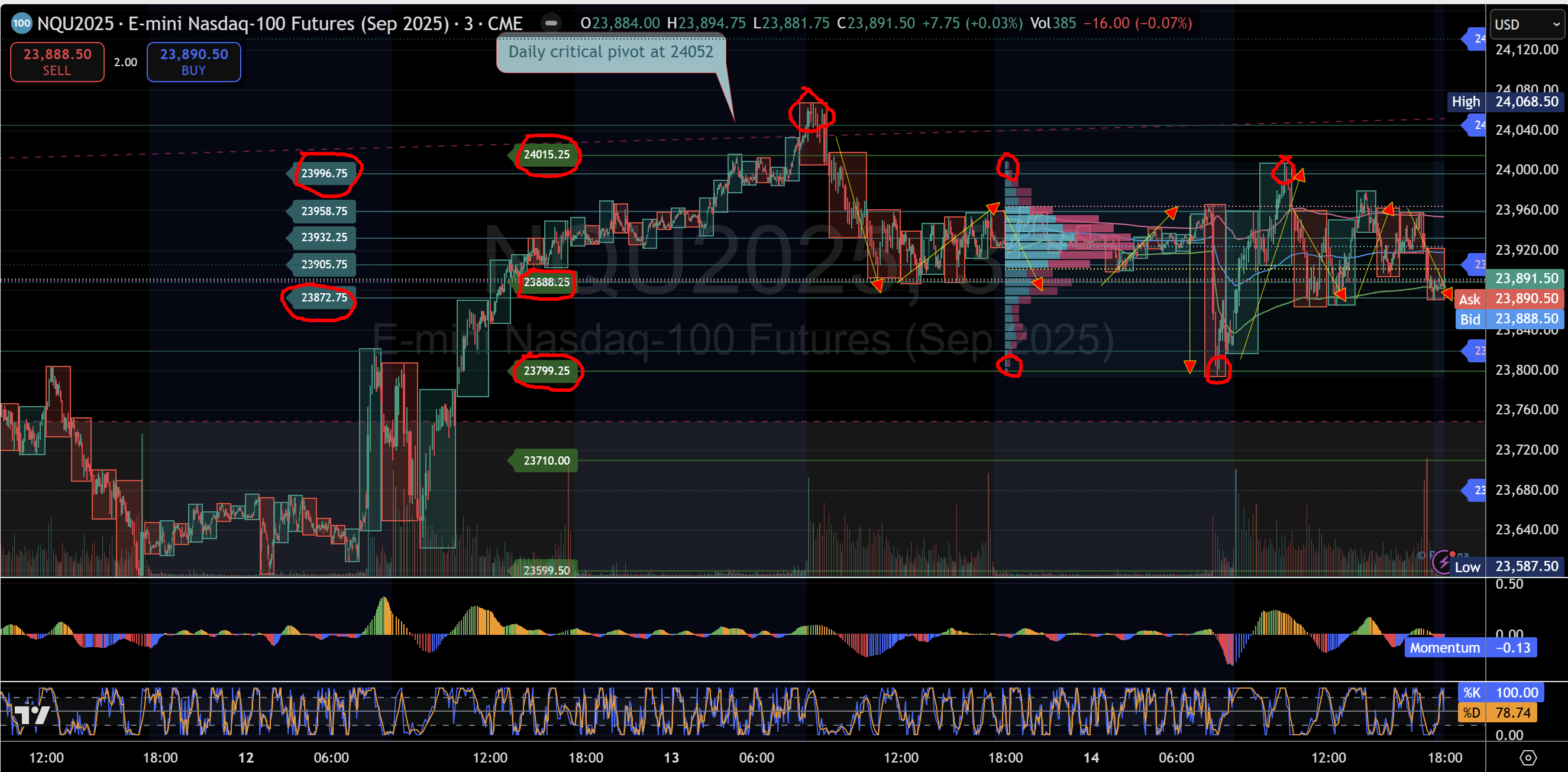

Range defined by Micro-5 24,015 and Micro-4 23,888. Mini-micro 23,872 is today’s floor—acceptance above 24,052 targets 24,068 → 24,131; a failure below 23,872 risks 23,799 → 23,680 → 23,594.

Overview (August 14, NY close-in view)

We’re finishing Thursday with price rotating inside a tight band framed by the MacroStructure pivots. Wednesday’s breakout through Micro-5 (24,015) stalled at the daily critical pivot 24,052, keeping the larger trend on pause. Through Asia/London and most of NY, price repeatedly tested Micro-4 (23,888) and Mini-micro-4 (23,958) while volume concentrated around VAH.

Nasdaq September Futures August 13 chart analysis

Intraday read and opportunities

- NY open: A rejection from 23,958 (Mini-micro-4) + VAH sent price down to Pivot 23,819 and Micro-3 23,799. Momentum flipped red/sub-zero—short per playbook (sell into Micro-5/4 failures).

- Rebound: Buyers stepped in at the VWAP lower band, turning momentum blue/green and driving a two-hour squeeze from Mini-micro-1 23,872 → Mini-micro-5 23,996—a textbook long from Micro-1/2.

- Ceiling confirmed: Another failure at 23,996/24,015 (confluent with Wednesday’s cap) set a sequence of lower highs, pulling price back to 23,872. This level now anchors the session.

Nasdaq September Futures August 14 chart analysis

What matters next (sessions ahead)

- Bullish pathway:

- Reclaim 24,015 and accept above 24,052 (15-min closes + hold).

- Targets: 24,068 first reference, then 24,131 (recent swing print).

- Bearish pathway:

- Lose 23,872 (and VWAP lower band) → test 23,819 and Micro-3 23,799.

- A break there opens 23,680, then 23,594 as deeper profile magnets.

- Likely Asian/London range: 23,888 – 24,015, unless/until 24,052 is accepted.

Why the micro and mini-micro lens helps

Drilling from the daily pivot (24,052) down to Micro and Mini-micro layers exposes where participation truly shifts—VAH/VWAP interactions, failure/reclaim signals, and momentum flips. That precision turns the MacroStructure playbook into a step-by-step map: buy Micro-1/2 pullbacks with confirmation; fade Micro-5/4 failures; don’t chase.

Key levels (cheat sheet)

- Breakout/validation: 24,052 (daily pivot)

- Ceiling zone: 23,996 – 24,015 (Mini-micro-5 / Micro-5)

- Range pivot: 23,888 (Micro-4)

- Session floor: 23,872 (Mini-micro-1)

- Supports below: 23,819 (Pivot) → 23,799 (Micro-3) → 23,680 → 23,594

- Upside references: 24,068 → 24,131

Bottom line

Until 24,052 is accepted, expect range trading between 24,015 and 23,888, with 23,872 the intraday decision point. Acceptance above 24,052 signals the next leg up; a failure below 23,872 puts 23,799/23,680 back in play.

The views expressed are for informational and educational purposes only and do not constitute financial advice, a recommendation, or a solicitation to buy or sell any instrument. Trading futures, options, FX, and crypto is highly speculative and involves significant risk of loss. You are solely responsible for your decisions. Past performance is not indicative of future results.