Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 37.90.

- Set a stop-loss order below 37.45.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 40.50.

Bearish Entry Points:

- Place a sell order for 40.35.

- Set a stop-loss order at or above 41.50.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 37.15.

Turkish Lira Analysis:

The USD/TRY exchange rate has remained stable just below the 38-lira level for the third consecutive week, completely disregarding the sharp volatility witnessed in global markets that has led to significant declines in global stock markets and sharp fluctuations in the currency market. The lira’s stability is an unusual occurrence during such times, as the Turkish currency receives support from domestic financial institutions aiming to maintain relative stability in its price after significant losses experienced about three weeks ago following the arrest of Istanbul Mayor Ekrem İmamoğlu, the opposition Republican People’s Party’s candidate for the upcoming presidential elections.

Meanwhile, the leader of Turkey’s Republican People’s Party vowed to expand the scope of protests by organizing weekly demonstrations in various cities and gatherings in Istanbul every Wednesday and supporting boycott calls that could increase pressure on the economy.

Despite the unrest, the latest data released at the end of last week revealed a decline in inflation during March. Monthly inflation recorded 2.46%, lower than the 2.9% forecast. Annual inflation fell to 38.1% from 39.1% in February but remains higher than the Central Bank’s target of 24%. Producer price inflation rose by 1.9% monthly, while it declined annually to 23.5%, supported by exchange rate stability and improved import costs.

Core inflation rose by 1.5% monthly and declined annually to 37.4%, with a notable improvement in the services index and a slowdown in rent inflation, which rose by less than 4%.

The food sector was the largest contributor to monthly inflation at 1.23 percentage points, followed by alcohol, tobacco, and housing. In contrast, the clothing sector contributed to a 0.15 percentage point decrease in inflation. Finally, goods inflation stabilized at 30.5% annually. Meanwhile, core goods inflation fell below 20% for the first time since November 2021. Services inflation also continued its decline to 56.3%, its lowest level since the summer of 2022.

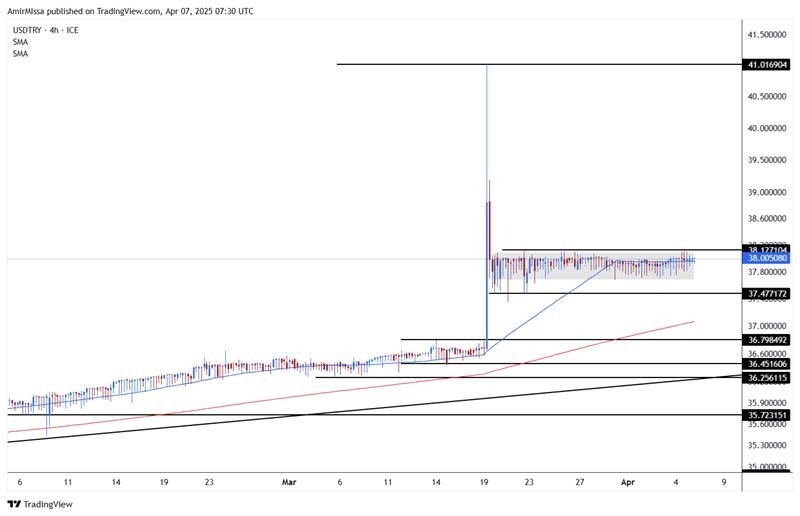

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair has not witnessed any significant changes, maintaining its trading within a limited range inside a rectangle pattern, which supports the sideways movement of the lira’s price. At the same time, the price stabilized around the 50-period moving average on the four-hour timeframe, reflecting medium-term stability. Turkish lira price forecasts include price fluctuation within the same limited range as long as the pair remains within the rectangle pattern, while in the longer term, the Turkish currency is expected to decline, targeting 38.50 and 39.00 lira levels, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.