NASDAQ 100

The NASDAQ 100 has been all over the place during the past week, but it is probably worth noting that we have put up a big fight. I think the real question can be stated whether or not we can break above the highs of this week, and it is worth noting that on Friday one of the Federal Reserve members mentioned that the Federal Reserve was willing to provide stability for the market if it was needed. I’ll be watching the high of the week, and if we do break above there, the worst of the selling might be done.

USD/CAD

The US dollar got absently hammered against the Canadian dollar as we have seen bonds sold off quite viciously. That being said, we are now testing a major area of support based on “market memory” as we had seen a lot of resistance at the 1.39 level. With that being said, the candle is very ugly, and therefore I think you have to pay close attention to what happens next. This will be a very interesting pair for me, because this could be an excellent entry to the upside if things do stabilize a bit in the US. If they do not, we could very easily see the Canadian dollar starts to strengthen again, perhaps driving this pair down to the 1.36 level.

EUR/USD

The euro has spiked against the US dollar, as the bond market has been sold off quite drastically in the United States. That being said, we are getting close to the 1.15 level, which is an area that has been important in the past. If we can break above there, then I think the euro probably continues to go much higher, and then you probably see the US dollar suffering at the hands of most things, not just this currency. That being said, we are over extended, and it would not be surprising at all to see this market turnaround at the first signs of amicable trade relations.

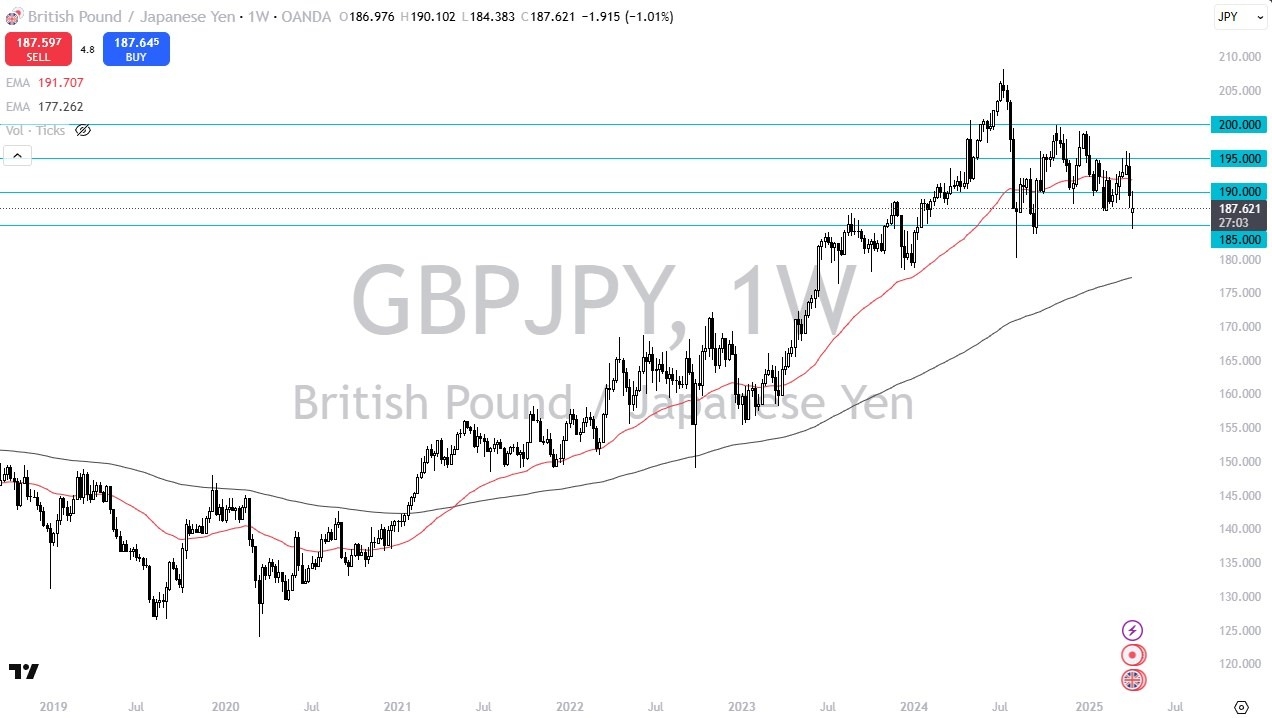

GBP/JPY

The British pound has been back and forth during the course of the trading week, touching the ¥190 level for resistance, and the ¥185 level as support. We ended up forming a very neutral candlestick, telling me that we are at the bottom of the major range, and this might be one of the best plays to the upside this coming week, if we see the Japanese yen loosen its grip on financial markets. In other words, if the market were to be somewhat, or at least positive overall, then the market goes higher here.

GBP/USD

The British pound initially fell against the US dollar during the week, reaching down to the 1.29 level. This is an area where we see both the 50 Week EMA and the 200 Week EMA indicators, so it has added even more interest in this market. We turned around and rallied to go well above the 1.30 level, but it is worth noting that this currency is underperforming many others when it comes to how it trades against the greenback. The next target could be 1.35, but if the US dollar starts to strengthen at all this week, the British pound might be the first place you see it.

EUR/CHF

The euro gapped lower against the Swiss franc to kick off the week, turned around to fill that gap, found plenty of resistance near the 0.95 level, only to turn around and show some type of massive selloff that sent this pair back down to the bottom. It’s worth noting that the Swiss franc continues to be one of the stronger currencies out there, and I have seen the same type of pattern in anything CHF related. If this market were to break down below the 0.92 level, the bottom could fall out, but you also then have to start asking questions as to when the Swiss National Bank gets involved?

DAX

The German DAX initially fell during the week to test the €19,000 level but has since turned around to rally quite significantly. We are above the 50 Week EMA again, and at one point in time even pierced the crucial €21,000 level. That being said, we gave back some of the gains, but it looks like we are trying to use the €20 level as an area of potential interest. Short-term pullbacks probably get bought into, unless of course you see a major “risk off event” coming.

USD/CHF

The US dollar initially gapped lower against the Swiss franc, turned around to show signs of strength, and then got hammered. The Swiss franc is strengthening against most things, and the US dollar course won’t be any different. With that being the case, I think you have to look at this through the prism of a market that is a bit of a runaway market right now, so short-term rallies probably will end up being selling opportunities unless of course to see the US dollar suddenly take off against everything.

Ready to trade our weekly Forex forecast? Here are the best Forex brokers to choose from.