- The US dollar has been stable during the Good Friday trading session against the Japanese yen, as you would expect.

- The market had sold off quite viciously over the last couple of weeks, as traders continue to run toward the Japanese yen, and away from the US dollar in general.

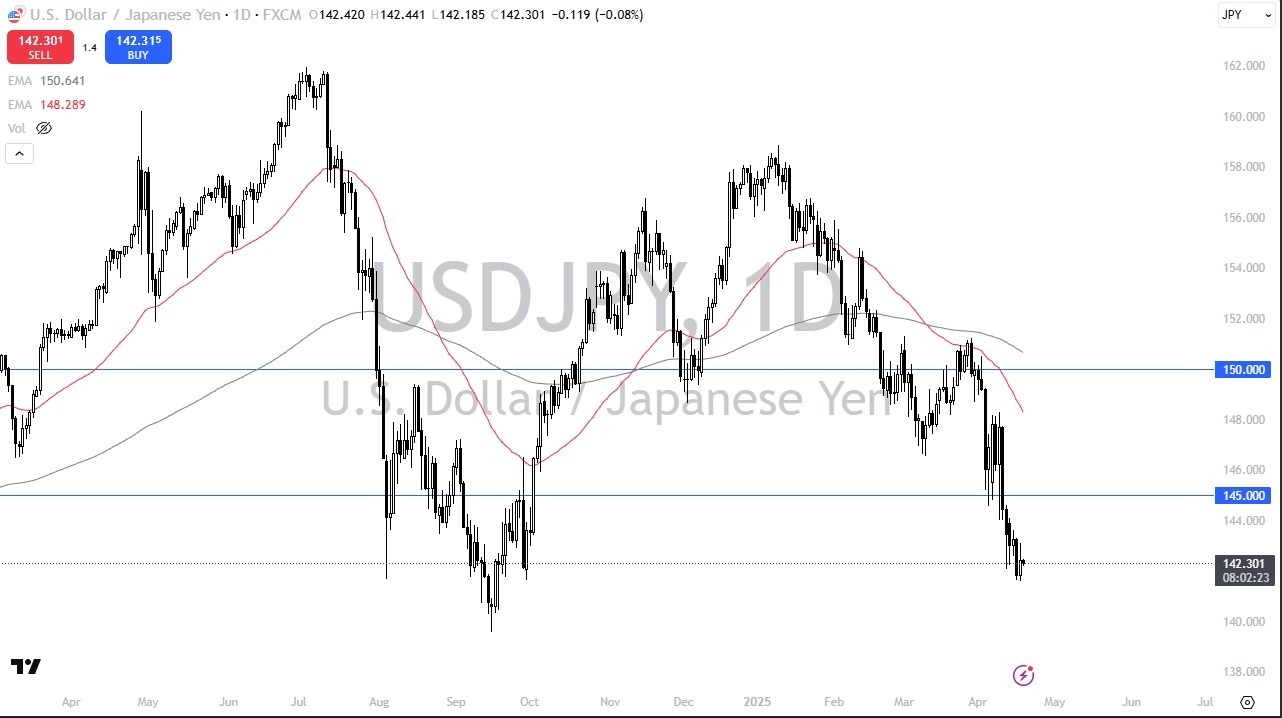

- That being said, the market is starting to approach a significant support level in the form of the ¥142 level.

Technical Analysis

The technical analysis for this USD/JPY pair is rather ugly, but it’s worth noting that the market has seen the ¥142 level offer massive support more than once, and I do think that a lot of people will continue to see this as a potential buying opportunity. If we do get some type of agreement from the trade tariffs standpoint, we could see this pair turn right back around. With good news, perhaps even coming from Japan itself as the United States and Japan seem to be fairly close to some type of agreement, then we could see this pair rallied toward the ¥145 level. That being said, the market is likely to be very noisy, but if we were to continue to see negativity, the ¥140 level is the area I would be looking at very closely.

On a breakdown below the ¥140 level, then we could see this market drop pretty significantly. That being said, I don’t necessarily think that the Japanese will like that idea, because of course it is an export driven economy. All things being equal, you get paid to hang onto pairs that are denominated in yen, which is something that the Bank of Japan is perfectly fine with, as long as it is somewhat orderly, unlike the uptrend that we had seen a few months ago.

All things being equal, I think this is a pair that will try to form some type of basing pattern in this area, but it is still early days when it comes to this. Looking at this chart, I think you have a situation where the market will continue to be very choppy, and in the short term, barring any type of tariff agreement, I think that short-term rallies will probably get sold into.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.