- Raymond James trims price target on AMZN from $275 to $195.

- Analyst Beck suggests that exposure to tariffs will hurt outlook, earnings.

- Amazon releases Q1 earnings on May 1, next week.

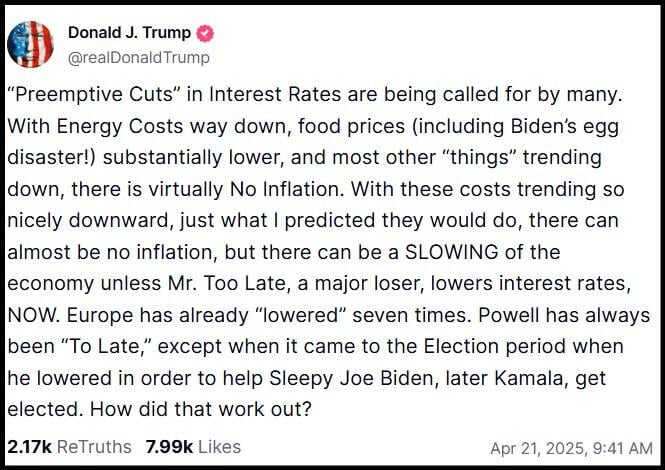

- Trump slams Fed Chair Powell again, bullying him to lower interest rates.

Amazon (AMZN) stock sold off at the start of the week on Monday after a prominent Wall Street investment bank downgraded its price target on the US’ largest ecommerce purveyor. AMZN shares traded 3.5% lower to below $167.

The major US equity indices all slumped as the market took stock of President Donald Trump chipping away at Federal Reserve (Fed) independence. All three US indices traded below 2% at times during Monday morning, and the NASDAQ was in the worst shape with a 2.5% decline. The Dow Jones Industrial Average (DJIA) was somewhat better, down 2%.

On Friday, as markets were closed, Trump advisor Kevin Hassett suggested that the President was considering firing Federal Reserve (Fed) Chair Jerome Powell since he is disappointed that Powell hasn’t been quicker to lower interest rates.

This followed Powell’s speech in Chicago last week, where he said that Trump’s tariffs could reignite inflation and make it harder for the central bank to cut rates.

Then on Monday morning, Trump posted further negative statements about Powell on his Truth Social platform.

[T]here can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW. Europe has already “lowered” seven times. Powell has always been “To Late,”

Truth Social post from Donald Trump on April 21, 2025

Wall Street is generally unhappy when the Fed’s independence is challenged. Powell’s four-year term is up regardless in May 2026, about a year from now. Investors worry that heavy cuts to interest rates could exacerbate inflation and lead to a future rate-hiking cycle. The short-term US Treasury tenures saw yields decline on Monday, while yields rose for the 10-year and 30-year bonds. Yields on the 30-year rose 1.6%, while they declined 1.45% on the 2-year.

Amazon stock news

Investment bank Raymond James cut its 12-month price target on Amazon stock from a lofty $275 to $195. This amounts to a 29% trim of the price target. The reason was given as earnings headwinds stemming from the Trump tariffs, particularly on China.

Analyst Josh Beck said that since 30% of Amazon’s gross merchandise value and 15% of its ads were exposed to China, there would be a period of transition with supply chains that would likely injure near-term profitability.

The Trump administration has raised its general tariff on Chinese goods to an incredible 145%, while China has responded with its own 125% tariff on US goods. Reports have surfaced that Amazon has chosen, in some cases, to refuse to accept orders from China in order not to pay the tariff. This could injure many of its business relationships with Chinese suppliers over the longer term.

The difficulty is heightened, according to Beck, by Amazon’s “steepening investment intensity” in its AWS unit during the present cycle of macro turbulence. This factor should also weigh on profitability in the short term, though Raymond James remains strongly bullish in the long term on Amazon.

Beck changed the outlook on Amazon stock from Strong Buy to an Outperform rating.

Amazon stock forecast

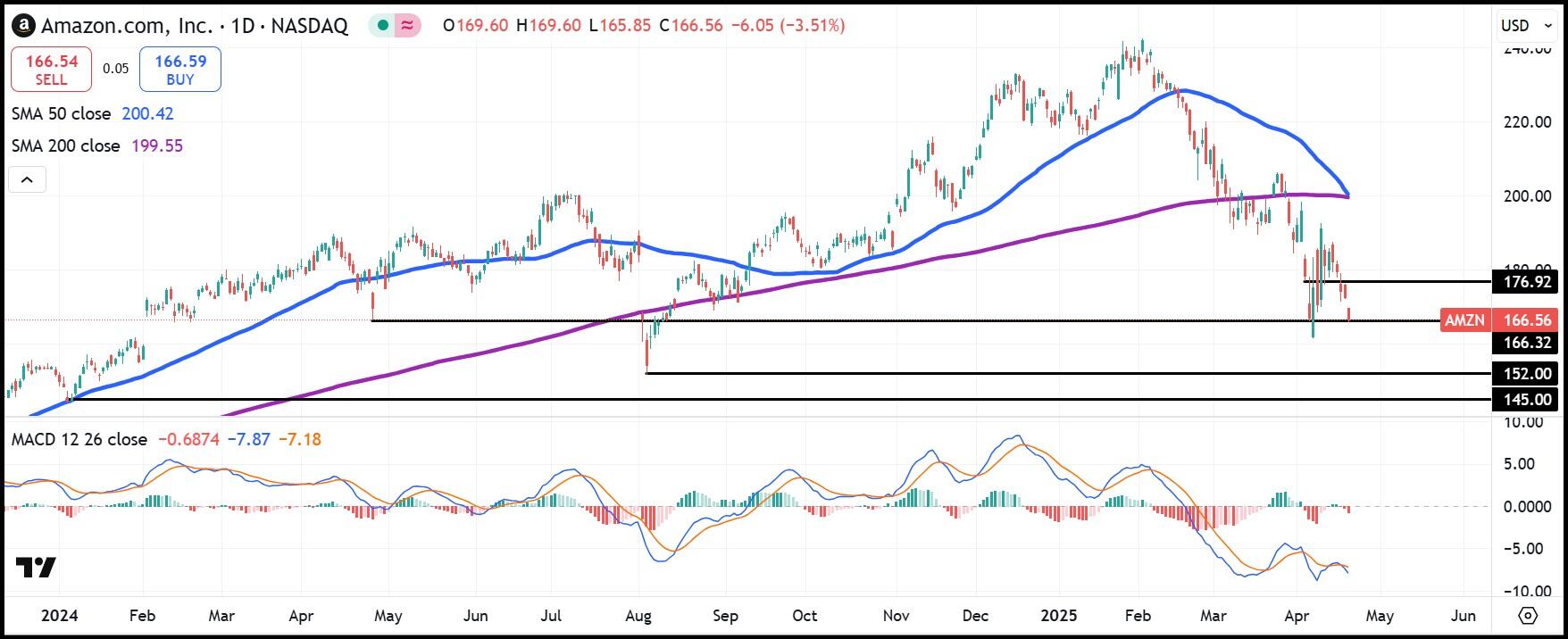

Amazon stock has further cause for concern on Monday. Monday’s intraday low fell below prior support at $166.32 from April 25, 2024. That leads us to expect AMZN to fall further to $152 or $145, both prominent support levels since January of last year.

The Moving Average Convergence Divergence (MACD) indicator looks terrible as it traded below the -5 level and shows no signs of a reversal. Additionally, bears will notice that the stock is about to enter a Death Cross pattern in which the 50-day Simple Moving Average (SMA) breaks below its 200-day counterpart. Typically, that event signals a long-term downtrend.

AMZN daily stock chart