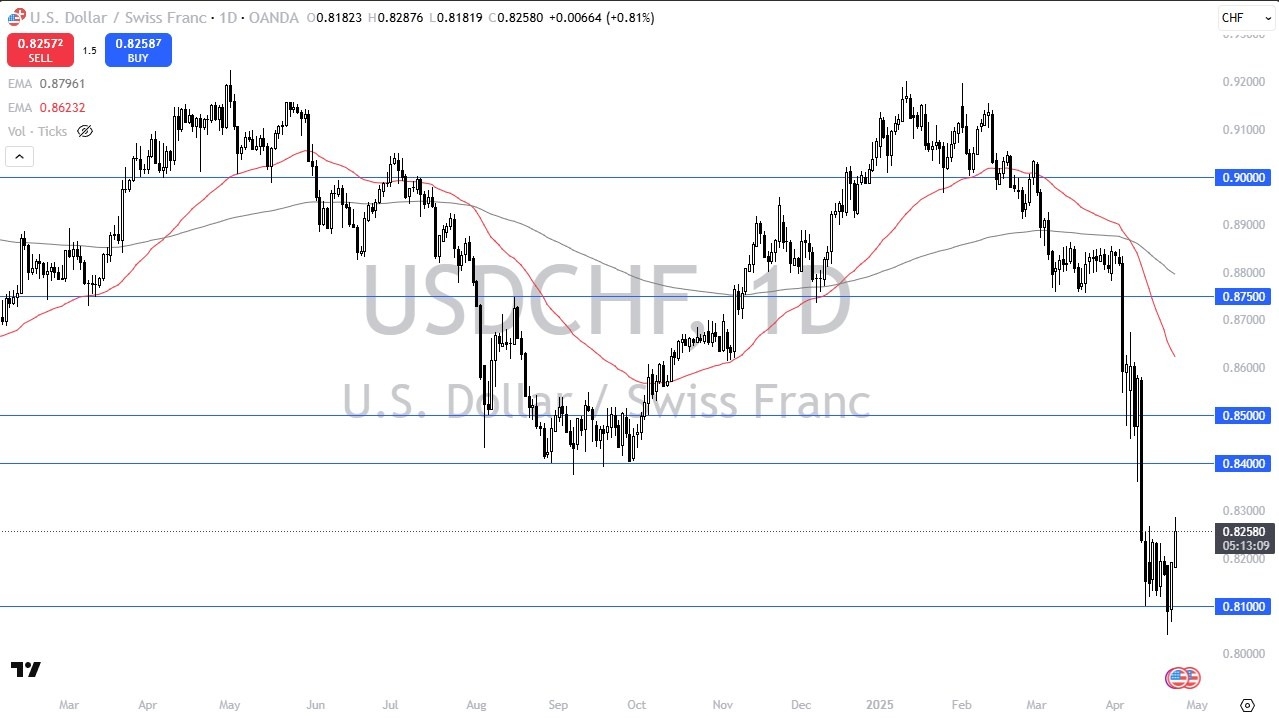

- The US dollar has had a strong session against the Swiss franc during Wednesday’s trading session, but at this point in time, you have to keep in mind that we had sold off so violently that a bit of a recovery makes a certain amount of sense.

- For those of you extremely long term minded, you could probably call this a megaphone pattern of some sorts, but I don’t know that it’s a tradable pattern.

- What I do know is that the US dollar is starting to claw its way back against several currencies, such as the Japanese yen and the Australian dollar. So, the Swiss franc isn’t any different.

I don’t know if we have escape velocity yet, but I do understand that if there’s any hope whatsoever of an economic recovery, the Swiss franc will get hit first and the Swiss national bank would love that. They cut rates to cheapen their currency months ago and they’ve seen it strengthen ever since then.

Tariff War and the Franc

If we get an end to the tariff war or agreement between the United States and several other major powers, even if it’s not China yet, that probably kicks the ball off for the move to the upside. After all, the Swiss franc is considered to be the safety currency of choice for foreign traders. And if there’s any hint that the US is going to be able to pick up trade again with places like China or Japan or the EU, that’s going to drive money back into the dollar. And in fact, I think we’re already kind of seeing that, but this is going to be a grind higher.

You do get an interest rate differential payment at the end of the day, so that’s a good thing. But do keep in mind that this is a hard fight to the upside. The 0.81 level underneath is your floor. Anything below there opens up a move to the 0.80 level, which in turn has me watching the euro against the Swiss franc because if that gets too low, the Swiss will intervene. They’ve done it multiple times in the past.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.