GBP/USD Price Forecast: Finds support near 1.3300 after breaking below ascending channel

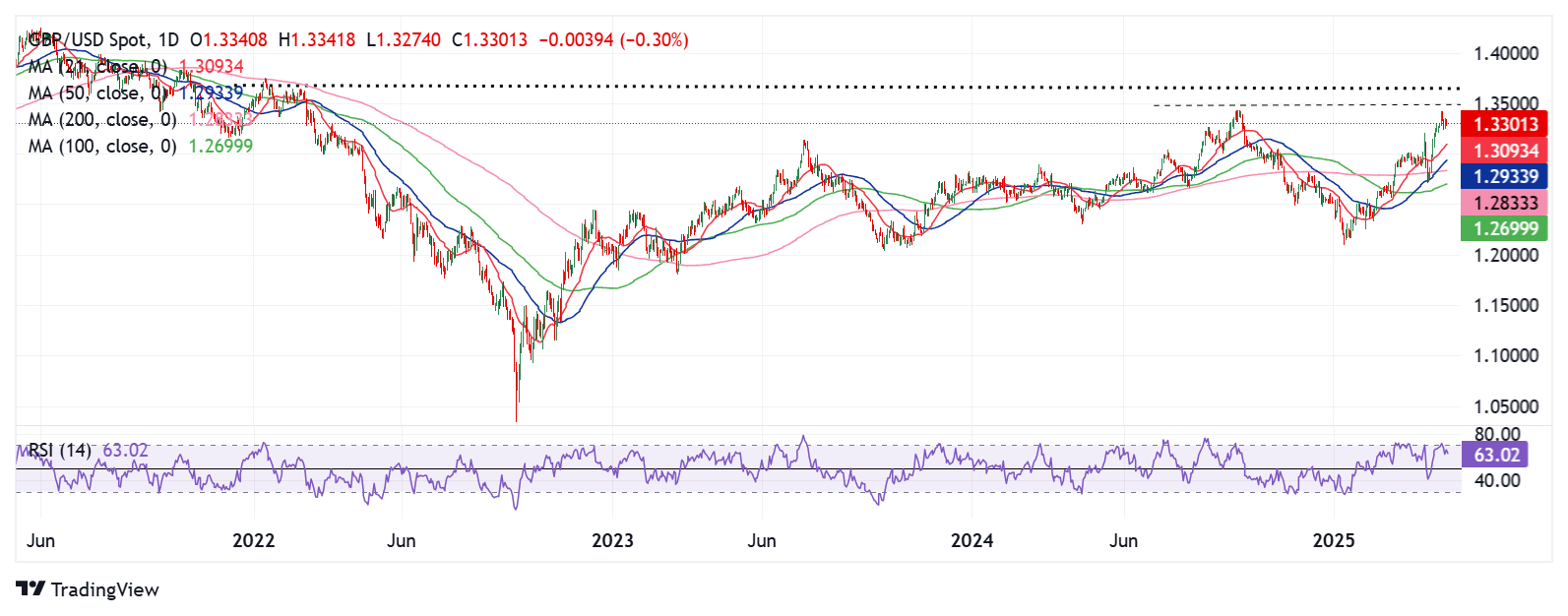

The GBP/USD pair steadies around 1.3320 during Asian trading hours on Monday, after posting losses in the previous session. Technical analysis on the daily chart suggests a weakening bullish trend, as the pair breaks below its ascending channel pattern.

However, the GBP/USD pair continues to trade above the nine-day Exponential Moving Average (EMA), reinforcing short-term bullish momentum. Additionally, the 14-day Relative Strength Index (RSI) holds above 50, further supporting the bullish bias. Read more…

GBP/USD Weekly Outlook: Pound Sterling stands resilient to Trump’s tariff play

The Pound Sterling (GBP) extended its winning momentum against the US Dollar (USD), driving the GBP/USD pair briefly to levels above 1.3400. GBP/USD mainly remained at the mercy of the US Dollar dynamics, induced by US President Donald Trump’s erratic tariff moves and some flickers of optimism on surprisingly resilient US corporate earnings.

The Greenback yo-yoed wildly this week, tumbling nearly 1% against its major rivals at the start of the week on Monday after Trump threatened to fire Fed Chair Jerome Powell for not lowering interest rates quickly enough, only to surge 1.5% a day later as Trump softened his rhetoric about China and the independence of the US Federal Reserve. Read more…

GBP/USD consolidates around 1.3300 mark; downside potential seems limited

The GBP/USD pair kicks off the new week on a subdued note and oscillates in a narrow band around the 1.3300 round-figure mark during the Asian session.

The US Dollar (USD) preserves last week’s recovery gains from a multi-year low amid the uncertainty over US-China trade talks, which, in turn, is seen as a key factor acting as a headwind for the GBP/USD pair. US Treasury Secretary Scott Bessent said on Sunday that he did not know if US President Donald Trump had talked to Chinese President Xi Jinping. This keeps a lid on the optimism led by Trump’s assertion that tariff talks with China were underway and underpins the USD’s relative safe-haven status. Read more…