XRP (XRP) price is up 7% on April 28 following news that the US Securities and Exchange Commission (SEC) has approved ProShares Trust’s proposal to launch three XRP futures-based exchange-traded funds (ETFs) on April 30.

At the time of writing, XRP trades at $2.34, up 10% over the last seven days. Its trading volume has increased by 132% over the same period, reinforcing the intensity of the demand-side activity. Is XRP’s bull run back?

ProShares’ XRP Futures ETFs: A New Investment Frontier

ProShares is launching three new futures-based XRP ETFs on April 30, following approval by the SEC, as shown in the filings. The three new ETFs include Ultra XRP ETF, Short XRP ETF, and Ultra Short XRP ETF, and are aimed at offering investors diverse strategies to engage with XRP’s price movements without directly holding the asset.

The Ultra XRP ETF provides 2x leveraged exposure, aiming to deliver twice the daily returns of XRP’s price. At the same time, the Short and Ultra Short ETFs allow investors to profit from price declines with 1x and 2x inverse leverage, respectively.

These funds, set to track XRP prices through an index using futures contracts and swap agreements, cater to both bullish and bearish traders.

The SEC’s decision not to object during the review period, following ProShares’ January filing, underscores a more crypto-friendly regulatory stance under the current administration.

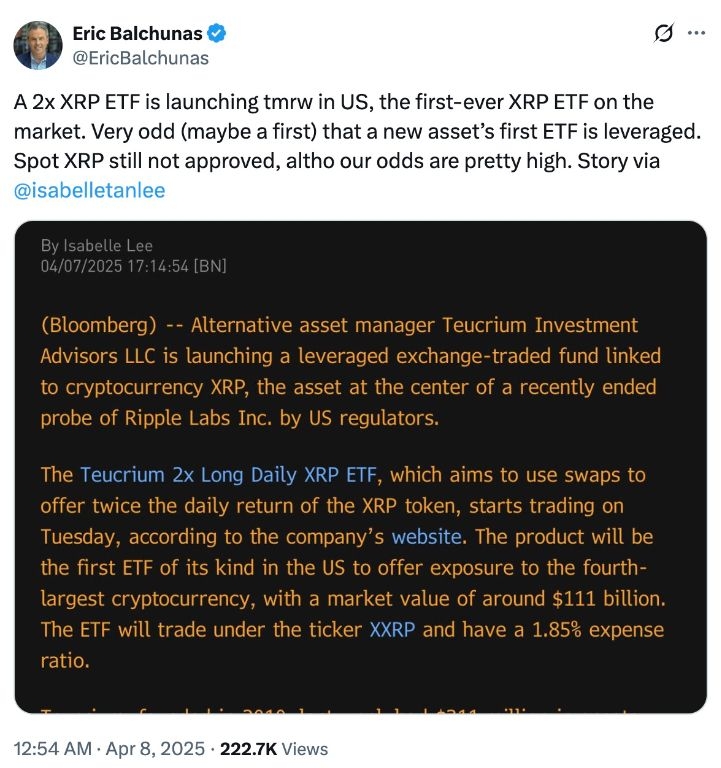

The approval comes on the heels of Teucrium’s successful launch of the first US XRP futures ETF earlier in April, which recorded over $5 million in trading volume on its debut day. This development signals a maturing market for XRP-focused investment vehicles, positioning the cryptocurrency as a frontrunner among altcoins for mainstream adoption.

Bloomberg Senior ETF Analyst Eric Balchunas noted the unusual nature of Teucrium’s ETF being leveraged, especially since a spot XRP ETF has not yet been approved.

Source: Eric Balchunas

Meanwhile, the SEC has acknowledged several XRP spot ETF applications so far, with fund manager Grayscale’s filing facing a critical May 22 deadline.

The launch follows Ripple’s legal victory over the SEC in March, which clarified XRP’s ‘security’ status and removed significant regulatory hurdles, further fueling market optimism.

Falling Wedge Pattern Paints a Bullish Outlook for XRP

The XRP price action had validated a falling wedge pattern in the daily timeframe, reinforcing the ongoing bullish reversal.

A falling wedge chart pattern is a bullish reversal pattern that appears during a downtrend. It’s characterized by two converging trend lines sloping downward, indicating a narrowing range of price movements. This pattern suggests that selling pressure is diminishing and buyers are gaining control, potentially leading to an upward price reversal.

XRP/USD daily chart. Source: TradingView

Notably, the bullish reversal structure has been narrowing since February 2025. The pattern resolved following a breakout above the wedge’s upper trendline, currently around the $2.08 area, signals the start of a new rally.

Falling wedge breakouts typically target a move equal to the pattern’s maximum height.

In XRP’s case, if it breaks above the 200-day simple moving average at $2.41, the projected upside target lands near $4.00.

The relative strength index (RSI) has increased from 31 on April 8 to the current value of 62, suggesting the bullish momentum is building.

On the other hand, failure to rise above the 200-day SMA would signal the inability of the buyers to sustain the recovery. Key support levels to watch on the downside are the 50-day SMA at $2.16 and the psychological level at $2.00, where the upper trendline of the wedge and the 100-day SMA appear to converge.

Ready to trade our daily Forex analysis on crypto? Here’s our list of the best MT4 crypto brokers worth reviewing.