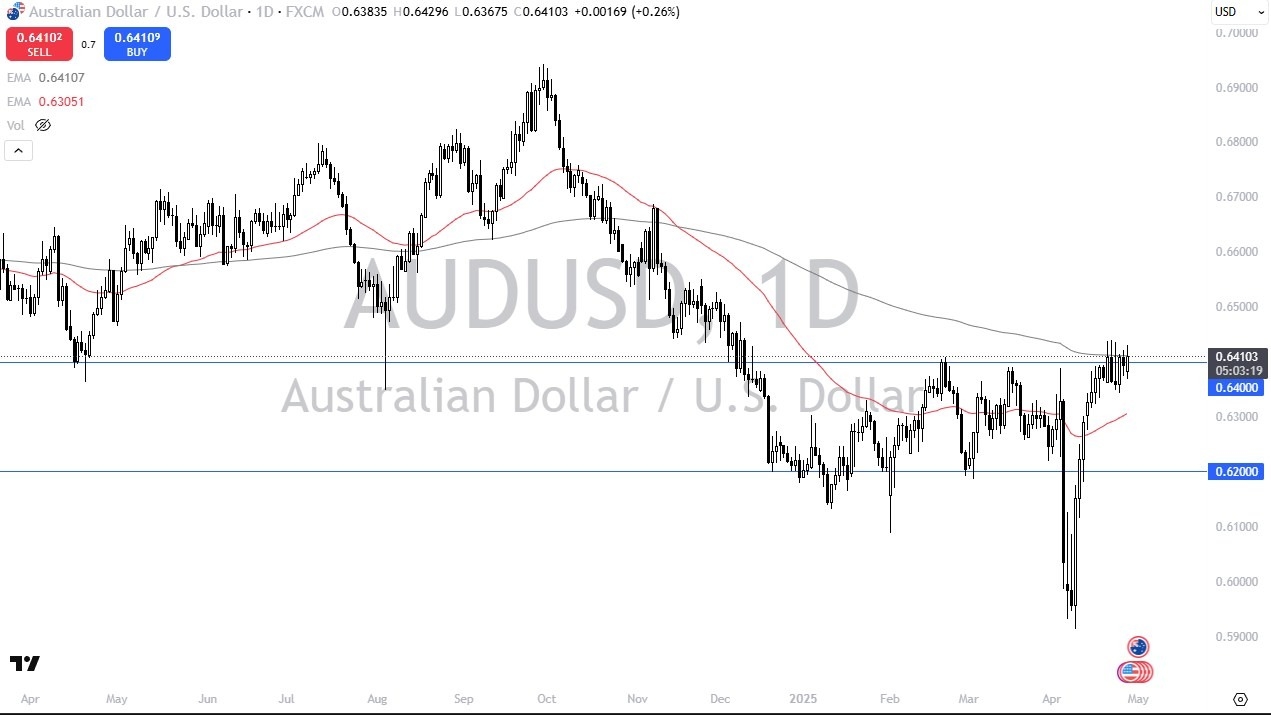

- The Australian dollar has rallied a bit during the trading session on Monday to test the 200 day EMA.

- The 200 day EMA is a situation that continues to be watched very closely by traders as it makes quite a bit of sense that technical traders continue to be a little bit nervous in this region.

- And with that being said, it allows traders to have a spot, a line in the sand, if you will, as to how far we should go to the upside.

If the market were to break over the 0.6450 level, effectively clearing the 200-day EMA easily, then I think you’ve got a situation where the Aussie could go much higher. In general, this is a market that has been sideways for quite some time here over the last nine days or so, and sooner or later, we are going to have to make a decision.

A Major Resistance Point Here

Ultimately, this is a market that I think is at a major resistance point as it has been very important right around this level, multiple years. And with that, I think it does make a certain amount of sense that traders will watch this area. Once we get an impulsive candlestick to the upside or the downside, then we might be able to make better decisions.

If we clear to the upside, then 0.67 could very well be the target. If we clear to the downside, then the 50-day EMA and then eventually the 0.62 level comes into focus. As things stand right now, this is a very tight market but is looking for an explosive candle. This could be the start of a bigger move, as the market continues to see a lot of questions asked about the next directional move.

Ready to trade our daily Forex analysis? Here’s a list of the best licenced forex brokers in Australia to choose from.