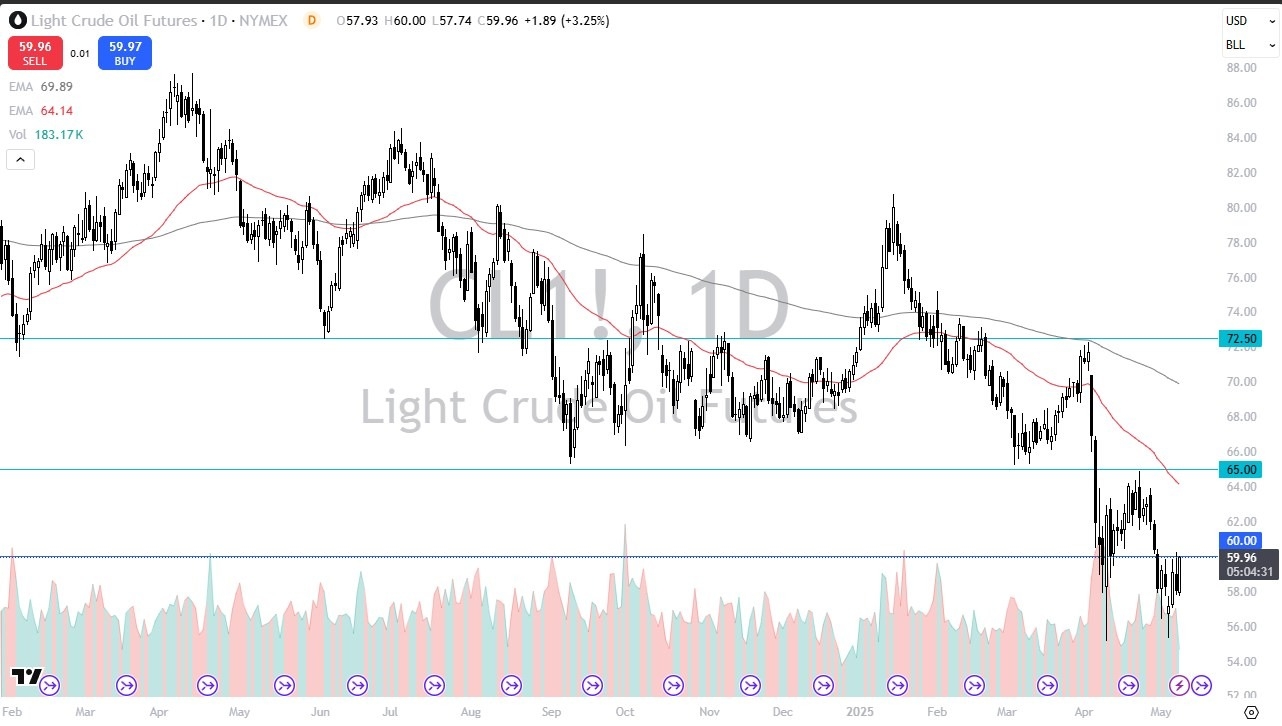

- During the trading session on Wednesday we saw the Light Sweet Crude market rally, reaching the crucial $60 level.

- However, the market has pulled back significantly from that level as we head toward the FOMC meeting, as traders are trying to sort out whether or not the economy is going to get a bit of a boost from the Federal Reserve, or if we are going to plummet into Armageddon.

- Obviously, that’s a bit of a stretch, but the way the markets have been acting and the headlines about what tariffs are going to do basically paint that picture.

Enter Reality

The biggest problem with crude oil right now as OPEC. OPEC continues to expand production of crude oil, and that of course puts downward pressure on it as demand can keep up. While this is typically a very bullish time of year for crude oil due to the fact that Americans tend to drive a lot, and travel picks up worldwide, the reality is that we are awash in crude oil at the moment, and therefore it’s likely that we continue to see this as a market that has to prove itself.

That being said, if the market were to break above the $60 level, then we could see this contract go looking to the $64 level above. That is roughly where we are running to the 50 Day EMA, which could offer significant resistance. On the other hand, if we break down from here, we could test the $55 level, which of course is where we just formed a bit of a double bottom. In general, this is a market that I think might need a little bit of help from the Federal Reserve, but what it needs more than anything else is some type of major trade deal with the United States and some other counterparty. If it gets that, I suspect that crude oil takes off to the upside.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.