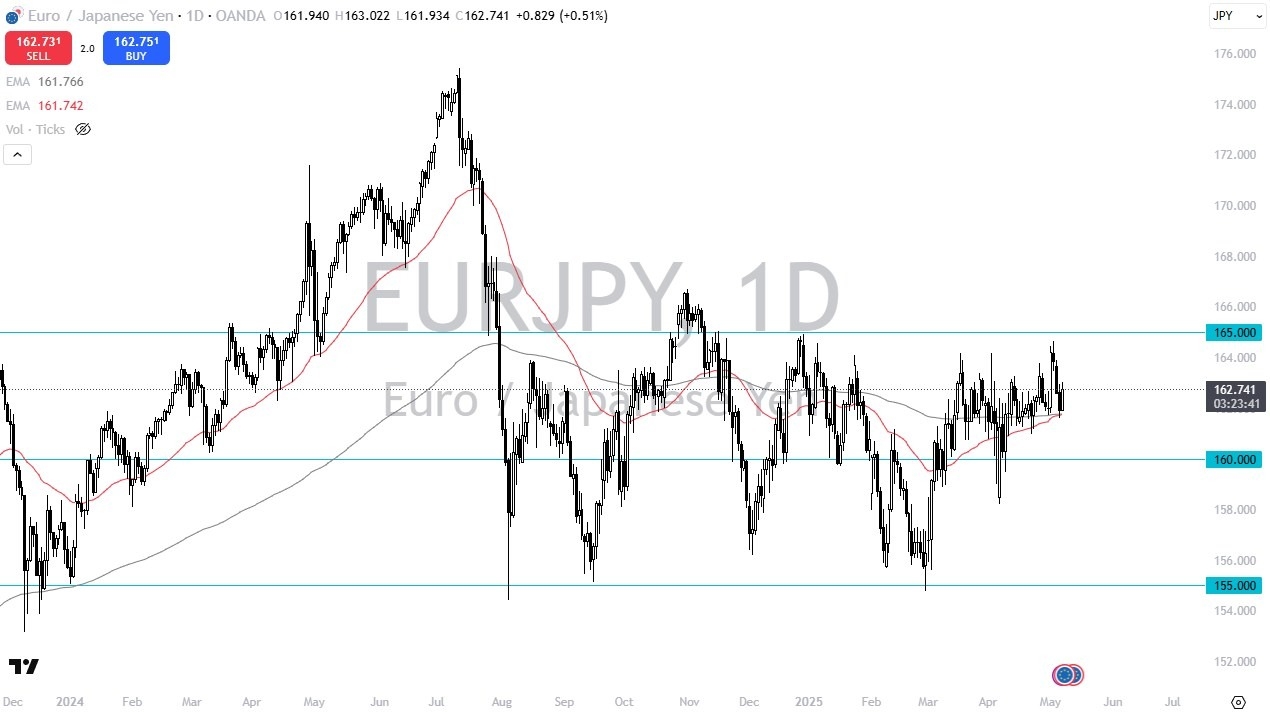

- The euro has rallied quite nicely during the trading session on Wednesday against the Japanese yen as we had bounced from a significant support level.

- The 200 day EMA is sitting right there right along with the 50 day EMA in fact, it looks like they are getting ready to cross and that suggests that we are going to see the golden cross soon.

- This is a market that probably tries to go higher based on this, assuming that we have the overall attitude staying in the market, which looks like it is favoring shorting the Japanese yen with some of the better performing currencies such as the Euro.

A rally from here probably opens up the possibility of a move towards the 165 yen level, which has been like a pretty significant ceiling here for some time. If we can clear that level, then we have the chance of breaking out. Underneath, if we were to break down below the moving averages, then we could move down to the 160 yen level, which is basically the middle of the overall consolidation.

Three Levels I am Watching

You’ll notice on the charts that I have the 155 yen level and the 165 yen level drawn out with the 160 yen level right in the middle, you can see where price has flipped there multiple times. The interest rate differential does favor the euro, although not drastically, but at the end of the day, that is something that matters.

Furthermore, I am starting to see the Japanese yen give up some of its grip on other currencies, so that might translate into higher prices here as well. Keep in mind that the Bank of Japan recently flinched when it came time to tighten monetary policy, and it’s difficult to imagine a scenario where traders forget that. I do favor the upside.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.