Crypto bulls were emboldened over the past week as improvements on the trade war front provided a boost to financial markets and helped Bitcoin climb back above $105,000 for the first time since late January.

Data provided by TradingView shows that after several failed attempts to break above $98,000, King Crypto surged past $100,000 on Thursday, and is now consolidating above the psychologically important level, with $102,000 acting as support.

BTC/USD 1-day chart. Source: TradingView

Multiple factors have contributed to Bitcoin’s breakout rally, including heavy inflows into spot BTC ETFs and the rush to acquire by businesses, which have been the largest net buyers of Bitcoin so far this year.

Businesses are the largest net buyer of bitcoin so far this year, lead by @Strategy which makes up 77% of the growth. pic.twitter.com/Bbj89gyk2h

— River (@River) May 12, 2025

Strategy (formerly MicroStrategy) is by far the largest corporate crypto whale, accounting for 77% of all holdings, but the list of businesses accumulating BTC on their balance sheet is growing.

In April, Bitwise reported that at least twelve public companies bought Bitcoin for the first time in Q1 2025. The amount of Bitcoin held on the books of publicly traded companies rose by 16% for the period, with more than 95,000 Bitcoin added to corporate portfolios. Notable newcomers to the Bitcoin market this year include video streaming platform Rumble, which made its first purchase in March, Hong Kong construction firm Ming Shing, and Hong Kong investment firm HK Asia Holdings Limited.

As a result of increased purchases by businesses, Bitcoin has become deflationary, according to CryptoQuant founder and CEO Ki Young Ju.

#Bitcoin is deflationary.@Strategy is buying BTC faster than it’s mined. Their 555K BTC is illiquid with no plans to sell. MSTR’s holdings alone mean a -2.23% annual deflation rate—likely higher with other stable institutional holders. pic.twitter.com/9VKT3IdcYo

— Ki Young Ju (@ki_young_ju) May 10, 2025

While some analysts warn that BTC looks overheated and could see a pullback in the near term, overall, an extended rally is expected, with most predicting a peak between $125,000 and $140,000.

Ethereum Rebound Hints at Approaching Altseason

It wasn’t just Bitcoin that enjoyed a bullish run-up over the past week, as altcoins, including Ethereum (ETH), exploded higher, with Ether recording a 44.5% gain.

ETH/USD 1-day chart. Source: TradingView

The spike higher followed the successful launch of Ethereum’s Pectra upgrade on its mainnet, which improved the storage of layer-2 scaling data, validator user experience, and smart account wallet user experience features.

As a result of Ether’s performance, the token broke the long-running downtrend on the ETH/BTC chart, a development many analysts had been anticipating for some time.

ETH/BTC 1-day chart. Source: TradingView

At the time of writing, Ether trades at $2,650, with many analysts speculating that a run toward $10,000 will happen in the coming months.

While Bitcoin’s 7% rally over the past week was impressive, altcoins in the top 50 vastly outperformed the top dog, stoking hopes that an altseason – defined as periods when 75% of the top 50 altcoins outperform Bitcoin over a rolling 90-day time frame – is on the horizon.

Strong bearish divergence on the weekly timeframe indicating that the #Bitcoin dominance has peaked.

The end of the bear market for #Altcoins. pic.twitter.com/koUZtNrxLR

— Michaël van de Poppe (@CryptoMichNL) May 12, 2025

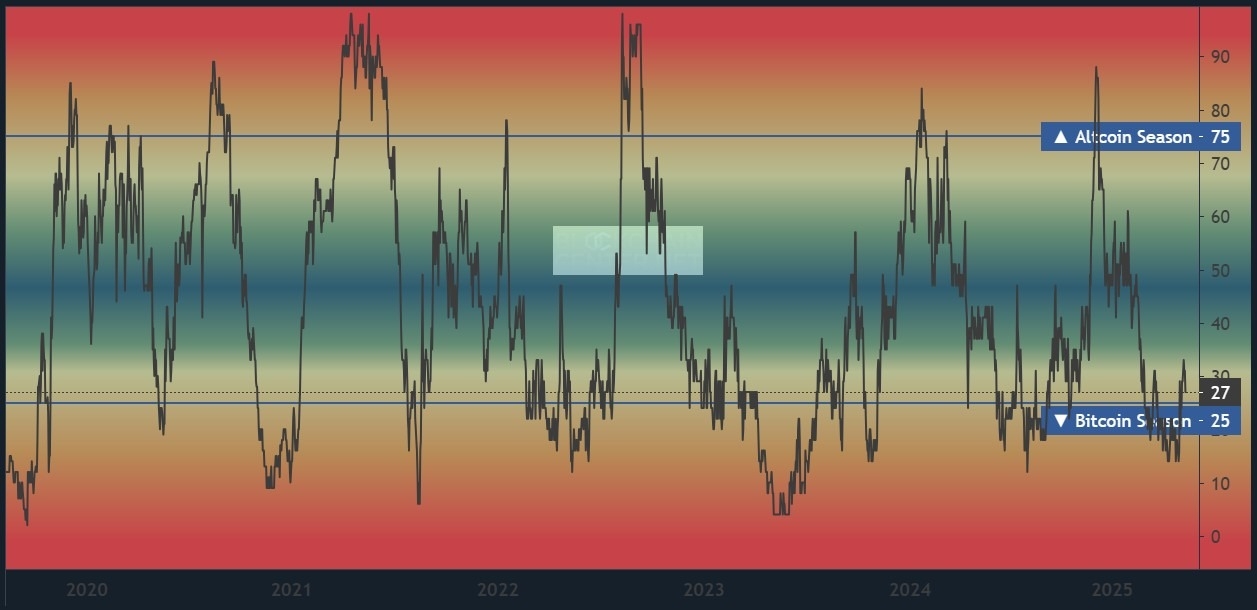

According to the Altcoin Season Index, the recent market surge signals a potential shift away from Bitcoin dominance, and altcoins may soon begin to outperform.

Altcoin season index. Source: Blockchain Center

Another sign of the growing appeal of altcoins is Tether (USDt) dominance, which has dropped to its lowest level since early February, at 4.53% on May 13.

With both Bitcoin and Tether dominance falling while the total crypto market cap rises, it suggests that traders are starting to allocate towards alts ahead of the anticipated rally, which some say will be the most impressive altseason to date.

The biggest #ALTSEASON ever is about to start pic.twitter.com/vI30nmw1v9

— Sensei (@SenseiBR_btc) April 30, 2025

Only time will tell how it all shakes out in the end, but if the performance over the past week is any indication, the second half of 2025 could be exciting for crypto holders.