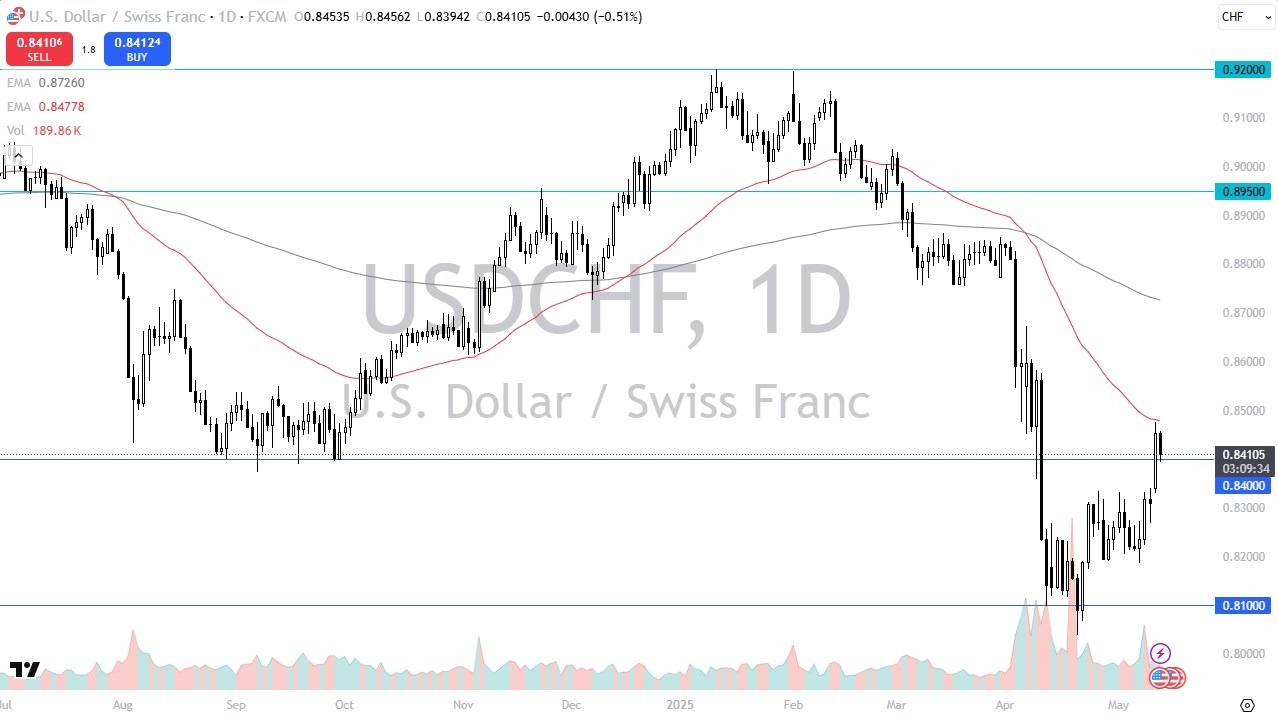

- The US dollar has fallen a bit during the trading session here on Tuesday to test the 0.84 level.

- The 0.84 level is an area that has been important more than once and therefore it’s not a huge surprise to see that we are getting a little bit of a reaction here.

- This is a market that simply follows the overall action of the US dollar, as we are seeing the greenback drop a bit on Tuesday.

Ultimately, this is a market that tested the 50 day EMA but failed. We have a lot of noisy behavior right there in that same region. So, with that, we’ll have to wait and see whether or not we can break above the 0.8550 level, which I think is your next kind of major resistance barrier.

Even if we do get a short-term pullback from here, I do believe that it’s very likely to be a buying opportunity, especially near the 0.83 level, unless you see a massive risk off move across financial markets that would obviously greatly impact what happens in this pair due to the fact that the Swiss franc is considered to be the ultimate safety currency.

Caution is Important

Nonetheless, be cautious with your position size. But when you look at the chart, we have just broken through the bottom of a major consolidation area, going back multiple years. So now the question is, can we reenter it? If we do, we could go as high as 0.8950, but there’s a lot of work to do to get to that point. The next couple of days could be crucial for this pair. So, keep an eye on the dollar against the Swiss franc. This could give us a great look at the overall risk appetite in the larger markets worldwide.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.