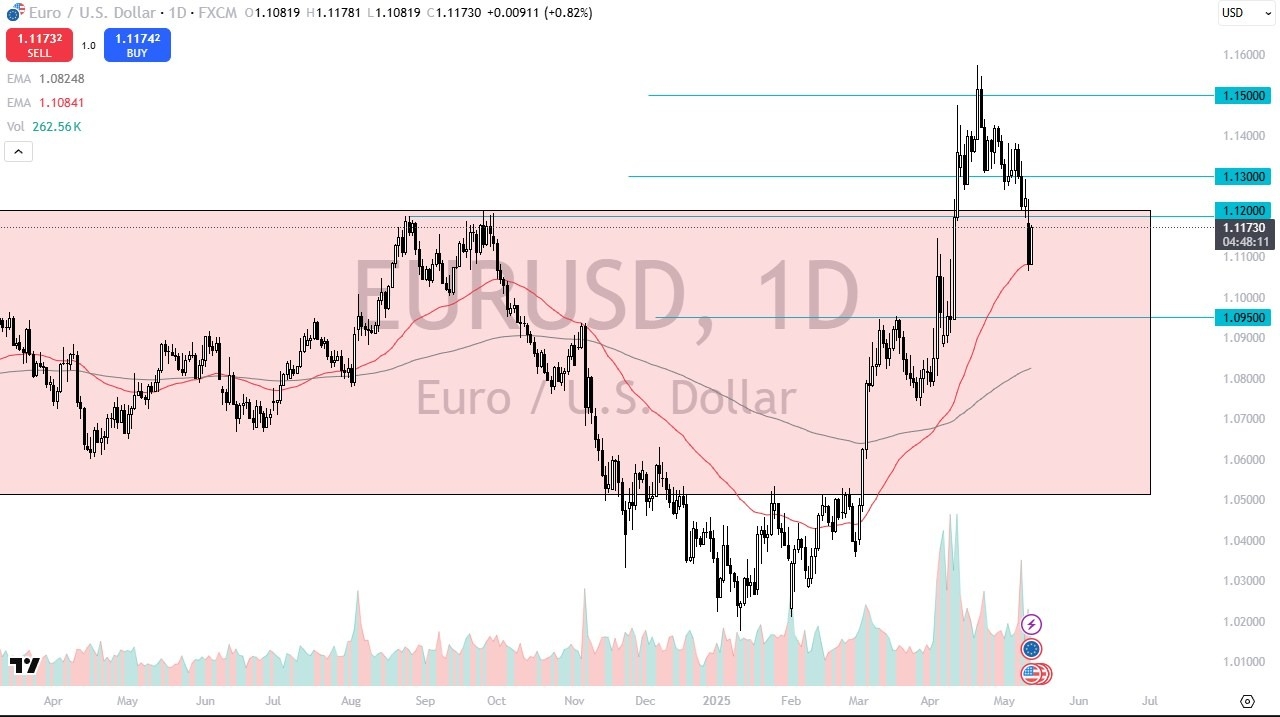

- During the session on Tuesday, we saw a significant bounce from the crucial 50 Day EMA, an indicator that a lot of people will look at as potential support.

- The fact that we bounced from there, and perhaps even more importantly the 1.11 level, suggest that there is still a certain amount of life left in the Euro still.

- That being said, I am watching an area above to see if we get more selling pressure, because when I look at the longer-term charts it seems as if the momentum is starting to swing a little bit more favorably for the US dollar, although there are a lot of different things happening at the same time.

Technical Analysis

The technical analysis for this EUR/USD pair remains bullish, and the fact that we bounce from the 50 Day EMA is something worth noting. However, it would be foolish not to notice the fact that we just broke down through a 100 pips support range in the form of the area between 1.12 and 1.13. This is a market that got a little ahead of itself, and it is worth noting that the 1.12 level was the top of a massive consolidation range that we have been in previously. Because of this, if we do continue to fall from here, we may simply reenter the previous consolidation range as we’ve seen this market have a “throw over” to the downside, so one to the upside makes a certain amount of sense as well.

The size of the candlestick is reasonably strong, but when you look at it through the prism of what happened during the previous 24 hours, it still lacks true conviction. The one thing that does go for it is of course the fact that we bounce from the EMA, and of course the fact that the Euro has been bullish for the last couple of months. Ultimately though, I think we are about to see a lot of noisy behavior because the United States and Europe still do not have a trade agreement, which could cause some issues for the EU itself.

Ready to trade our EUR/USD analysis and predictions? Here are the best European brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.