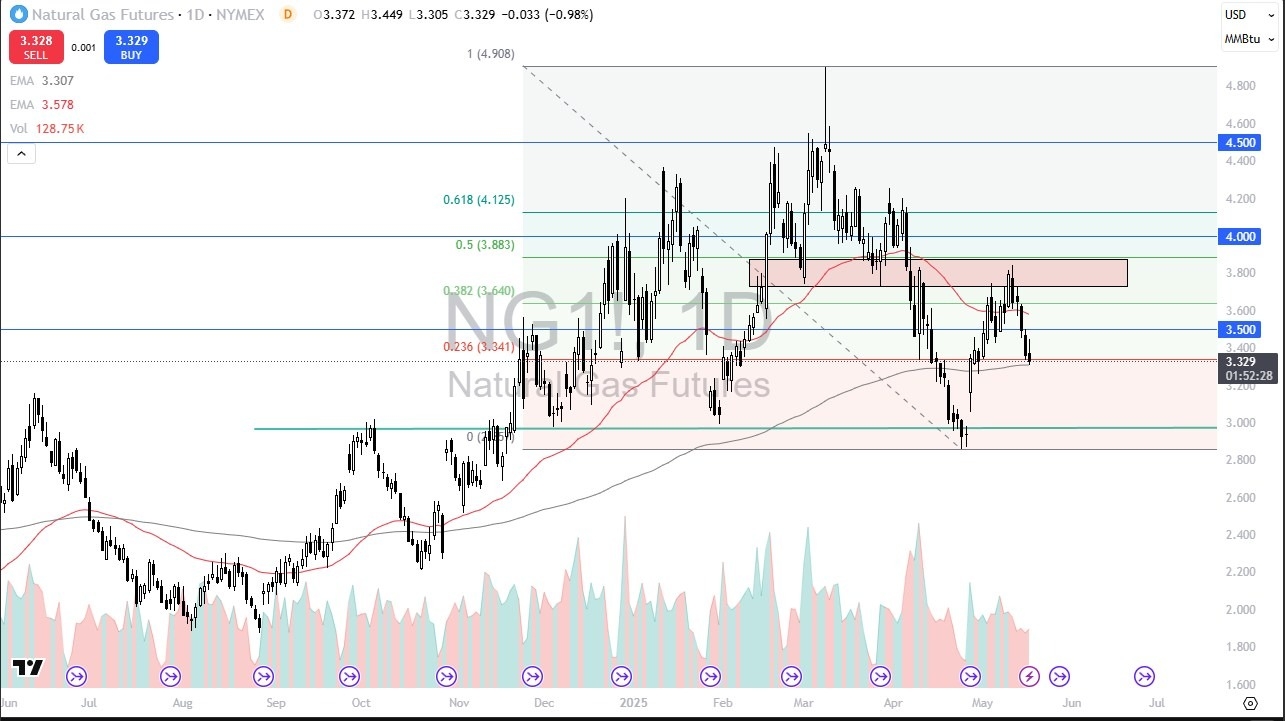

- The natural gas market initially tried to rally during the trading session on Friday, as we have seen the 200 Day EMA offering support, but by the end of the day, we started to see a lot of negativity in the market then looks as if it is testing this 200 Day EMA as well.

- Because of this, we are sitting on significant technical support, but quite frankly I think it’s only a matter of time before we break down.

Keep in mind that the season for natural gas is typically more of a winter season, until you get to the very hottest parts of summer. This is because it is an American base contract more than anything else, and Americans tend to use natural gas to heat their homes, as well as produce extra electricity in order to run air conditioning.

While natural gas of course is important in other parts of the world, the Henry Hub contract is what most people trade, and therefore you have to be aware of what’s going on in America more than anything else.

As of late, we have seen the Europeans buying a lot of liquefied natural gas, which of course has a major influence on what we are seeing here. If we break down below the 200 Day EMA, the market is likely to go looking to the $3.00 level, which obviously has a certain amount of psychology attached to it as it is a large, round, psychologically significant figure. Anything below there would be extraordinarily negative and could send the market down to the $2.40 level before it is all said and done.

Short-term rallies are likely, but those should end up being selling opportunities, as natural gas is going to be less in demand for the next couple of months, so I have no interest in buying this market, unless of course there is some type of external factor that drives up the price such as war, or some type of major disruption in supply for some other reason. I remain bearish, and probably will for a few months.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.