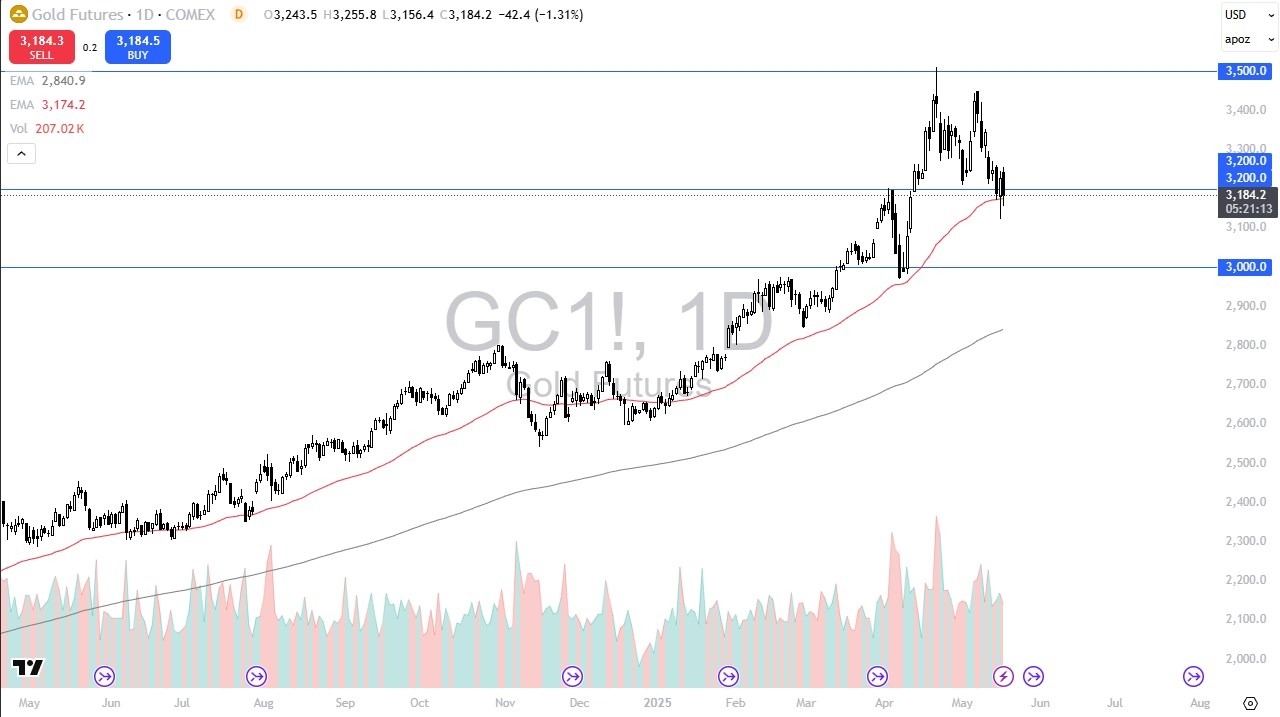

- You can see gold has plunged a bit during the trading session, but it is starting to show signs of life again right around the 50 day EMA.

- This is a market that I think is basically in the process of trying to bottom, but it is easier to let the market bounce first before trying to jump in during the Thursday session, we had been fooled a little bit by forming a hammer, but technically the buy signal hasn’t been violated, even though it is going to be very noisy.

- If we can break above the highs of the last three sessions, that’s a perfect V, which is a signal for a lot of people that might be willing to buy.

The market could go as high as $3,400 on that move, but we’ll just have to wait and see whether or not that actually comes to be. If we were to break down below the lows of the Thursday session, then we could drop to the $3,000 level, where you would anticipate seeing a little bit more in the way of support as well, not only from a psychological standpoint, as it is a large round figure, but it’s also an area where we’ve seen support come in previously, as well as resistance.

There should be a certain amount of market memory in that region. Ultimately, I think you have to believe that gold is still very much in an uptrend. And therefore, we are trying to get our footing before our next move higher. If we were to break down below $3,000, that could change quite a bit. But we’ll just have to wait and see how that plays out. At this point, gold still have a chance, but ultimately, this market is very volatile, and caution should be exercised as far as position size.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.