- Mexican Peso strengthens against the US Dollar as the Moody’s downgrade on US debt weighs on the Greenback.

- The Federal Reserve (Fed) is expected to review the discount rate on Monday, the rate at which it charges commercial banks.

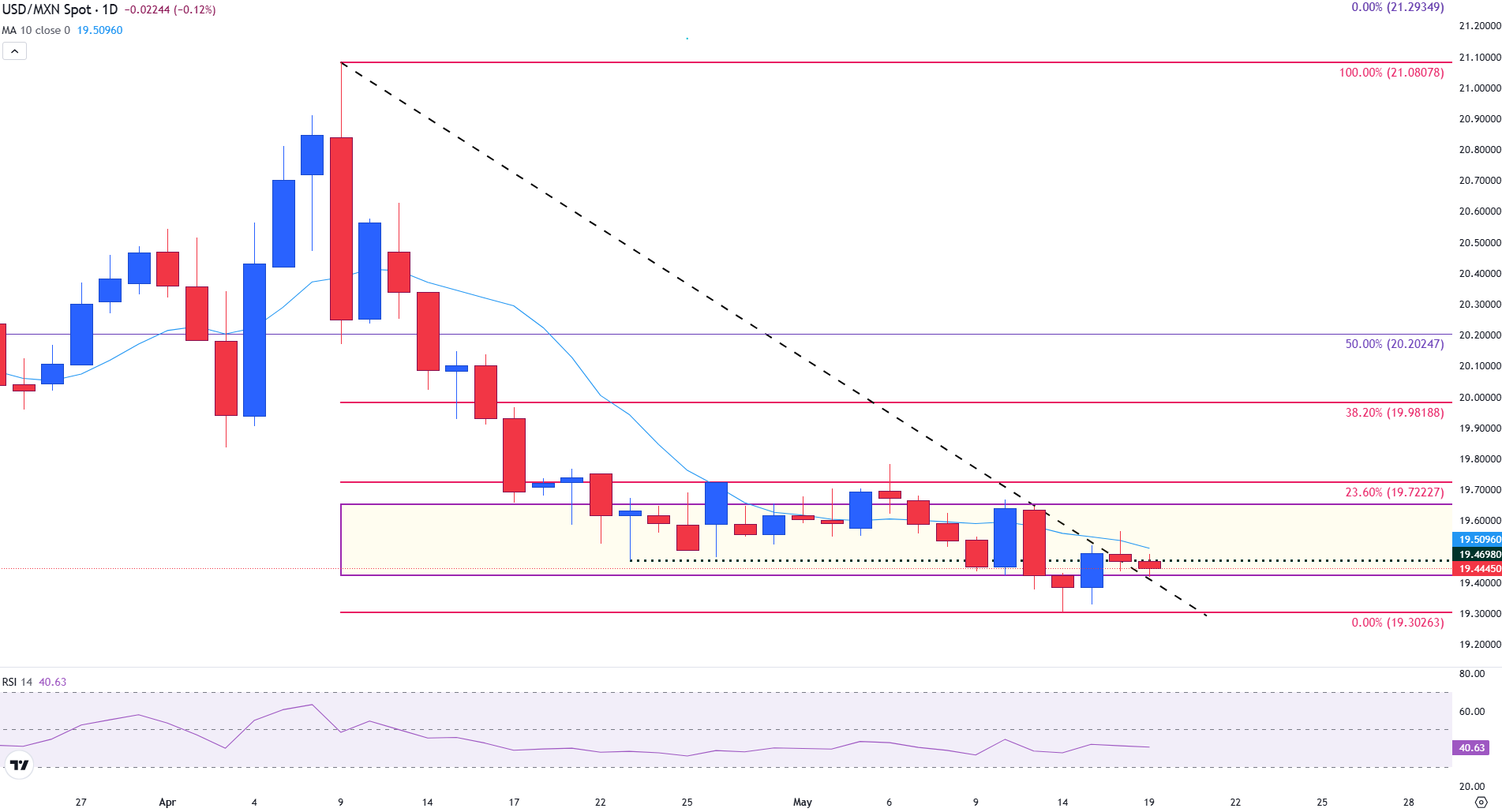

- USD/MXN remains cautious below critical psychological resistance at 19.50.

The Mexican Peso (MXN) remains firm against the US Dollar (USD) as markets react to renewed uncertainty following Moody’s downgrade of the US credit rating. The decision to lower the sovereign rating to AA1 from AAA has prompted a reassessment of the US Dollar’s status. While the MXN slightly benefits from the USD’s weakness, the broader risk-off tone in the market causes the Mexican currency to fall against other peers such as the Euro (EUR), the Pound Sterling (GBP), or the Australian Dollar (AUD).

While the Greenback has retained its global reserve status and safe-haven appeal, mounting concerns over trade tensions, tariff instability, and a deteriorating fiscal outlook are weighing on sentiment. Structural headwinds, including ballooning US debt and subdued growth prospects, have tempered interest rate expectations and contributed to the Greenback’s broad weakness.

At the time of writing, USD/MXN is trading near 19.43, down 0.12% on the day. The former psychological support at 19.50 has now turned into a resistance barrier, with market participants watching to see whether the Peso can sustain its upward momentum.

Mexican Peso daily digest: USD pressured by Moody’s downgrade and Fed focus

- Moody’s became the latest major credit agency to downgrade the US sovereign rating, triggering a rise in Treasury yields and a slump in the DXY US Dollar Index.

- As perceived credit risk rises, the US must offer higher interest rates to attract investors who might otherwise shift capital to alternative safe-haven assets. While rising yields tend to be supportive for the USD, the broader context of fiscal instability has the potential to weigh on the Greenback.

- Comments from Fed speakers throughout the day may provide insights into the trajectory of US monetary policy, influencing the performance of the US Dollar against global counterparts, including USD/MXN.

- Five Fed officials are on the agenda: Atlanta Fed President Raphael Bostic, Fed Vice Chair Philip Jefferson, New York Fed President John Williams, Dallas Fed President Lorie Logan, and Minneapolis Fed President Neel Kashkari.

- Persistent trade tensions between Mexico and the United States continue to create downside risks for the Peso. With roughly 80% of Mexican exports directed toward the US, any disruption or tariff-related uncertainty could magnify market volatility in the pair.

Mexican Peso Technical Analysis: USD/MXN lingers as bulls and bears battle below 19.50

USDD/MXN continues to consolidate within a narrow range, holding below the 10-day Simple Moving Average (SMA), currently at 19.51, which acts as dynamic resistance. The pair remains capped beneath the 23.6% Fibonacci retracement level of the October–February rally at 19.72, reinforcing the broader bearish bias. Despite repeated attempts to reclaim higher ground, price action remains confined within a consolidation zone marked between 19.40 and 19.70, with a clear downside tilt.

USD/MXN daily chart

A decisive break below 19.40 — the lower bound of the current range — could expose the May swing low and key support at 19.30. On the upside, bulls would need a daily close above 19.72 to shift momentum and target the 38.2% retracement level at 19.98, followed by the psychological 20.00 barrier.

The Relative Strength Index (RSI) flattens at 41.07, signaling slight bearish momentum and increasing the risk of a continuation lower.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.