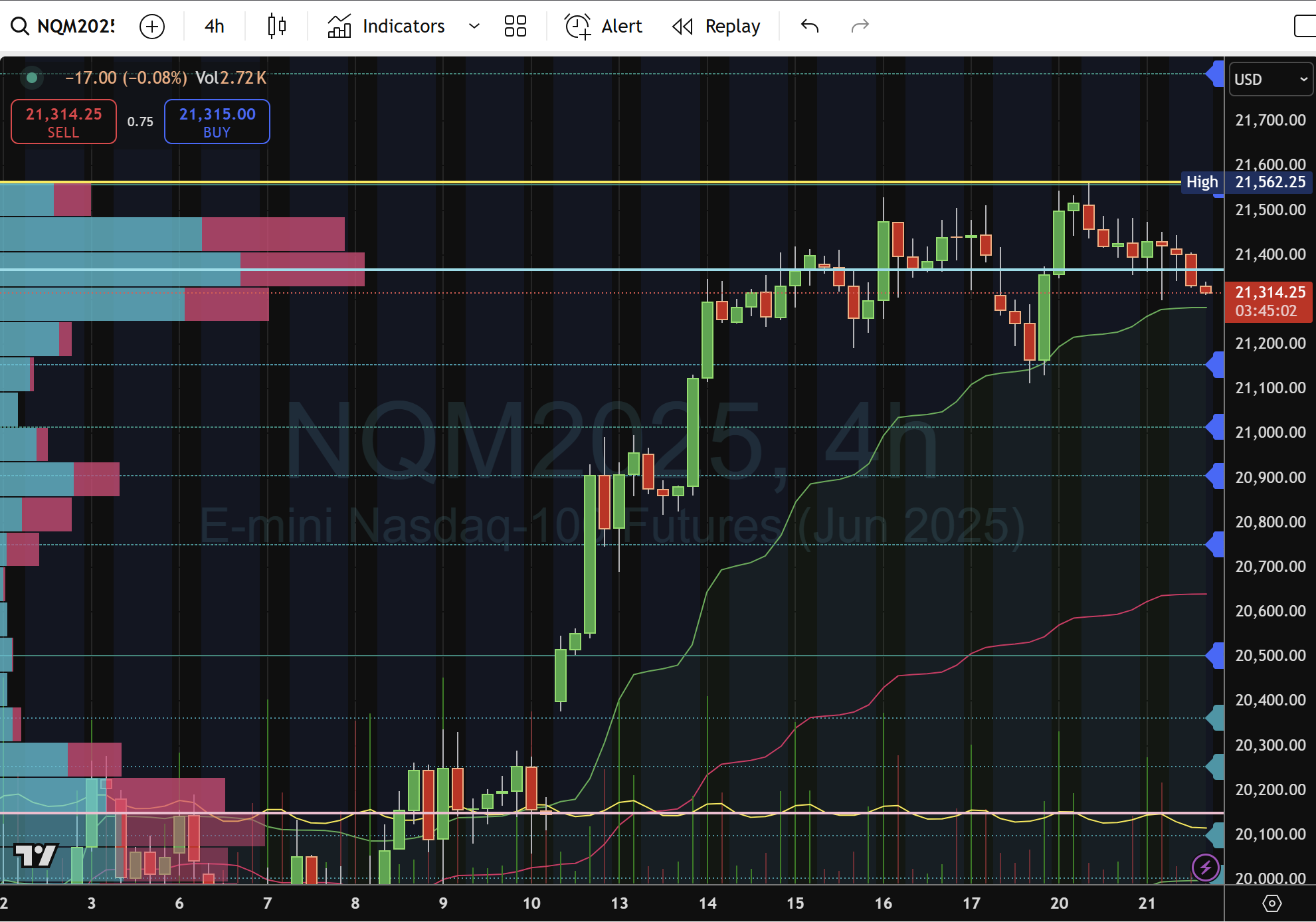

Nasdaq futures Tuesday recap

H4 time frame highlights

-

Resistance rejection: Multiple tests of 21,461 (23.6% Fib & VAH) failed to clear, capping upside.

-

Support hold & bounce: 21,311 (61.8% Fib & POC) held intraday, underpinned a temporary recovery.

-

Range defined: Confined to 21,311–21,461, setting clear boundaries for Wednesday.

Five-minute time frame highlights

-

Mid-session chop: Price oscillated around 21,405 (VWAP mid-line, red), flipping it three times before succumbing.

-

Late-session break: A slide below 21,360 (50% Fib) drove NQ down to 21,315 (61.8% Fib & VWAP lower band) into the close.

-

Key levels tested:

-

Failed break: 21,461 → Ceiling through London into NY open.

-

Flipped VWAP: 21,405 → Support turned resistance.

-

Final hold: 21,315 → Demand base into late NY session.

-

Wednesday playbook

London Session (GMT).

ScenarioTriggerTargetsStops/Invalidates.

Bullish Hold & bounce 21,315 on 5-min reversal 21,360 → 21,405 → 21,461 Clean 5-min close below 21,300.

Bearish Failure/rejection at 21,360 or VWAP 21,251 → 21,169 → 21,065 Close above 21,380.

-

Key anchors:

-

Resistance: 21,360 (50% Fib), 21,405 (VWAP mid), 21,461 (23.6% Fib/VAH).

-

Support: 21,315 (61.8% Fib/VWAP lower), 21,251 (78.6% Fib), 21,169 (VWAP H4).

-

US Session (NY).

ScenarioTriggerTargetsStops/Invalidates.

Bullish Reclaim 21,360–21,405 21,461 → 21,557 (H4 VAH) → 21,616 5-min close below 21,300.

Bearish Break & hold below 21,315 21,169 → 20,932 → 20,751 → 20,502 5-min close above 21,380.

-

Medium-term cues:

-

A sustained H4 break above 21,557 shifts bias bullish toward 21,806+.

-

A 4-hour close below 21,405 turns bias bearish toward 21,014–20,905.

-

Execution notes

-

Volume confirmation: Seek spikes at VWAP pivots and Fib levels.

-

Position sizing: Risk ≤1% per trade.

-

Alerts: 21,315/21,360/21,405/21,461/21,557.

Leverage these clear H4 & 5-min pivots to maximise your entry precision and align with institutional flow.

Remain patient—let price confirm key pivots before pulling the trigger. Always manage risk with a defined stop-loss and position sizing. This is not financial advice. Good luck!