- You can see Bitcoin has fallen pretty significantly during the trading session on Friday as there has been a bit of a shock to the system with the president of the United States, Donald Trump, suggesting that there will be a 50 % tariff on the European Union starting June 1st if the situation doesn’t change between the two countries. Evidently, he’s not happy about how the negotiations are going and this happens.

- Keep in mind that although this doesn’t directly influence Bitcoin in the sense that it has anything to do with Bitcoin at all, it does directly influence the risk appetite of traders around the world.

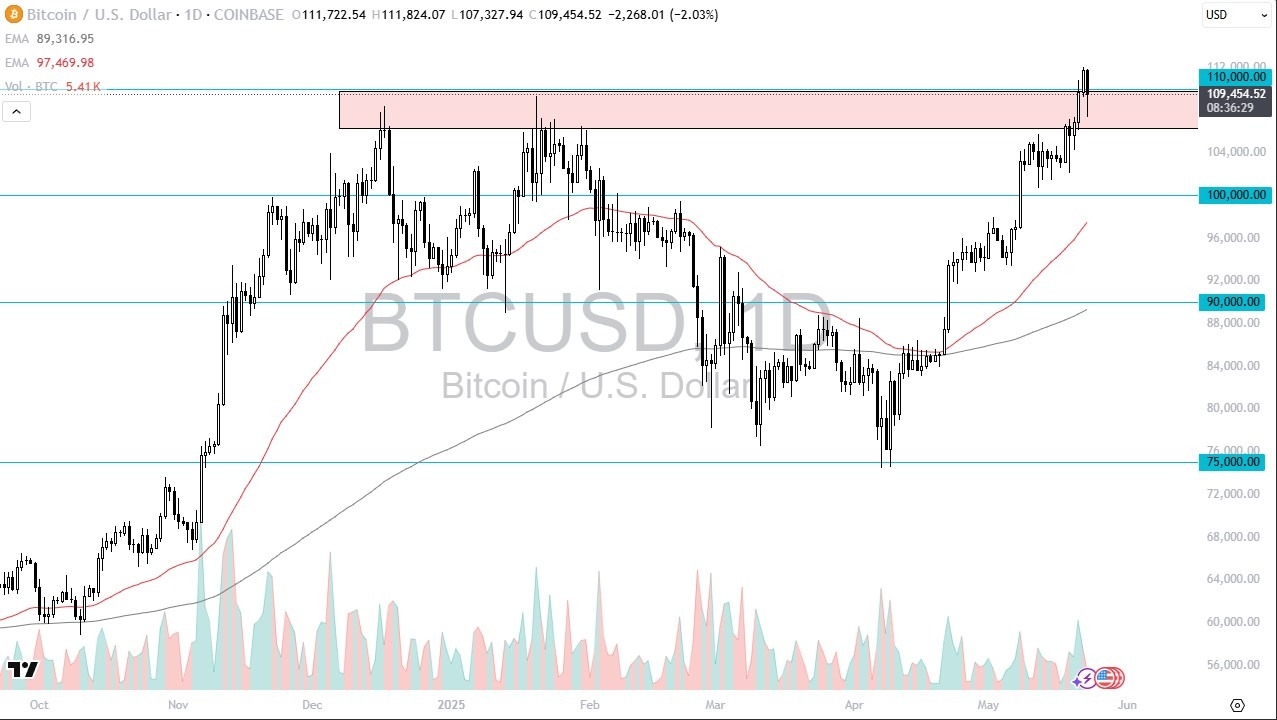

- It looks like we are pulling back from the crucial $112,000 level, but it is worth noting that we are hovering right around the $110,000 level, which was an area of extreme resistance previously. And now it looks like we are trying to find support. Unless something truly drastic happens, I anticipate that Bitcoin will bounce from here and continue to go higher.

If We Don’t Bounce

But even if it doesn’t, I’d be looking at about $106,000 as a potential entry right along with $104,000. I have no interest in shorting this market. It would take something pretty ugly to make everybody dump Bitcoin suddenly. But as the “risk off” move kicked off, it made sense that some of the weaker hands got rid of Bitcoin, probably through the ETF more than anything else. All things being equal, I think it’s very likely that we go looking to the $120,000 level, probably even higher than that, but we are a little extended. There’s also the argument that maybe the headlines just gave people an excuse to take some profit out of what has been an impressive move to say the least.

Ready to trade daily BTC/USD forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.