- The US dollar has gone back and forth during the trading session on Tuesday against the Mexican peso.

- As we continue to see a lot of lackluster trading.

- That being said, what I do find interesting here is that unlike the other currency pairs where we had seen the US dollar really sell off, the Mexican peso remains fairly steady.

And I think part of this comes down to the massive interest rate differential that favors the Mexican peso. But furthermore, the fact that if the US economy is doing fairly well and the consumer confidence numbers during the day came out much stronger than anticipated, that means Mexico is going to be selling a lot of goods to Americans.

Dollar Could Continue to Slip

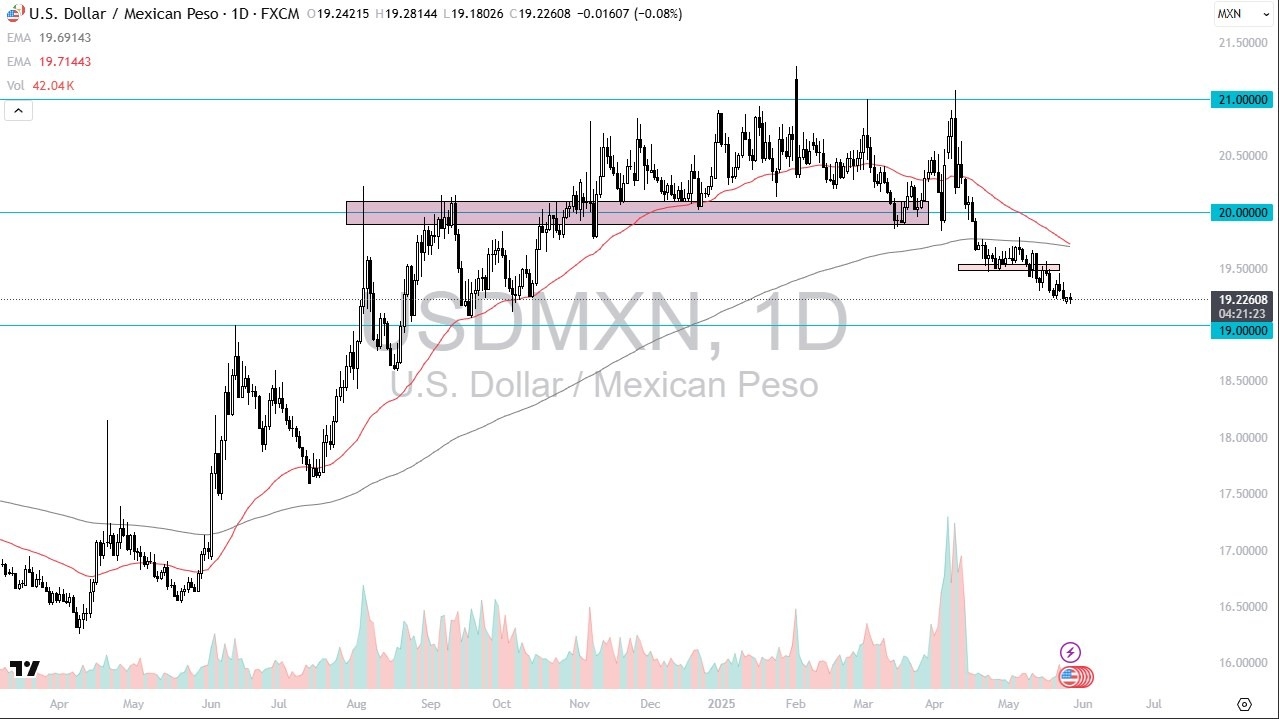

As long as that’s the case, it does make sense that the dollar slips a little bit against the Mexican peso. And now we have the technical analysis signal of the 50 day EMA perhaps breaking below the 200 day EMA, kicking off the so-called death cross. Although I would postulate that the more natural direction of this pair is lower simply because Forex traders get paid to hold it to the short side.

Now that it appears that the terror situation between the United States and Mexico has cooled off a bit and people aren’t as wound up, I do think that Mexico ends up the victor here in the sense that accelerated growth becomes a situation that we see in Mexico. And I certainly think that the peso will benefit from that. While I don’t necessarily think that the Mexican economy is going to catch up with the U.S. economy anytime soon. I do think that the peso is one of the outliers at the moment that traders are looking to get away from the US dollar that might be a little bit more stable than maybe the Canadian dollar or the euro or whatever. So, I remain bearish of this pair, but I would love to see a little bit of a bounce to sell into with the 19.5 level being resistance and the 19 level being support and a potential target.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.