- AAPL stock finds it hard to hold onto gains as obstacles arise.

- Needham downgrades AAPL shares on growth worries.

- Counterpoint Research cut the prediction of 2025 global smartphone growth in half.

- AAPL stock faces multiple resistance barriers and is likely set for further downward movement.

Apple (AAPL) stock is holding tightly to a meager gain on Wednesday afternoon. The iPhone maker rose to $206.00 at the start of the session but has fallen back toward $203.00 as the session progressed amid several headwinds.

Among them, the company’s Apple Intelligence feature appears to be holding up trade talks with China as regulators in that country are slow to approve the rollout of the AI feature for iPhones. Counterpoint Research trimmed its outlook for global smartphone growth due to the Trump administration’s rollout of far-reaching tariffs. Then Needham downgraded Apple stock from Buy to Hold due to earnings concerns.

The wider market is mixed, with the Dow Jones Industrial Average (DJIA) slightly down, while the NASDAQ has advanced 0.4%. The Trump administration went ahead with its hike in tariffs on steel and aluminum from 25% to 50% on Wednesday. Observers believe this will cause prices to rise in the back half of the year for American consumers.

Meanwhile, the ADP Employment Change report showed job gains in May of 37K, well below the expected 115K number and April’s revised 60K figure. The market views this as a bad omen for Friday’s Nonfarm Payrolls (NFP) report, in which expectations are for 130K new hires in May.

President Donald Trump took to his Truth Social account to blast Federal Reserve (Fed) Chair Jerome Powell for being slow to cut interest rates this year, but a poor showing on Friday’s NFP could help Powell and company do just that.

Apple stock news

Apple’s AI rollout, termed Apple Intelligence, is being held up by the trade negotiations between China and the US. The Financial Times reported on Wednesday that the Cyberspace Administration of China was holding off on approving both Apple’s and its AI partner Alibaba’s (BABA) separate applications.

Back in February, Alibaba Chairman Joseph Tsai announced that Apple would utilize Alibaba’s Qwen large language model for its Apple Intelligence offering to China.

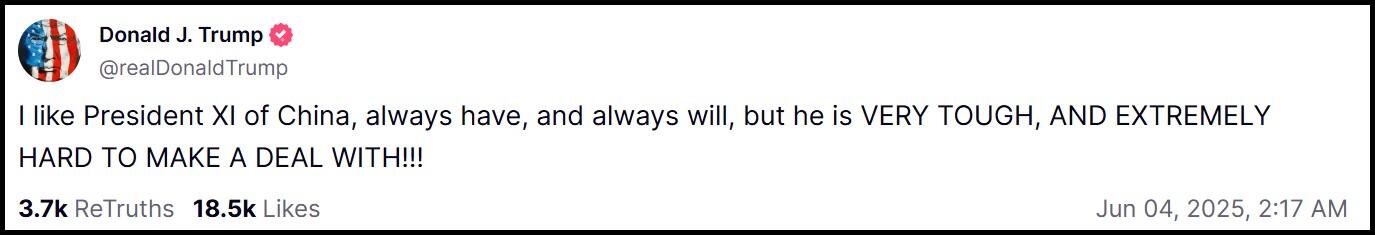

As a sign of how those trade negotiations are going with China, President Trump posted the following:

Separately, Needham analyst Laura Martin suggested that Apple stock does not deserve to trade at 28 or more times forward earnings due to moribund growth. Martin removed her prior $225 price target for AAPL and said that the region between $170 and $180 was a better entry for buyers.

“Despite AAPL’s premium valuation, it is growing [revenue] and margins slowest among its Big Tech competitors,” analyst Laura Martin wrote in a note to clients. “In fact, the other 3 Big Tech companies we cover reported 2x-3x faster rev growth and 3x-12x faster margin expansion than AAPL for the March quarter.”

Martin also pointed to App Store customers finding ways around paying Apple its 15% to 30% commission on in-app purchases, a product of Apple losing its litigation with Fortnite creator Epic Games.

Lastly, Counterpoint Research says it now expects global smartphone sales to grow by just 1.9% in 2025 compared to its prior guidance of 4.2% growth. The firm largely blames the Trump administration’s tariff policy for creating higher prices.

The pullback in growth is largely expected in the US and China, while many other locations are still expected to show robust growth.

“We still expect positive 2025 shipment growth for Apple driven by the iPhone 16 series’ strong performance in Q1 2025. Moreover, premiumization trends remain supportive across emerging markets like India, Southeast Asia and GCC – these are long-term tailwinds for iPhones,” said Counterpoint Research’s Associate Director Liz Lee.

However, China’s Huawei is expected to see much better global growth than Apple in 2025.

Apple stock forecast

Apple stock has been in a downtrend since last December, so it doesn’t seem surprising that this downturn would continue. The Relative Strength Index (RSI) is decidedly neutral at this point, and bulls don’t seem to be interested.

At the moment, AAPL shares are up against the upper descending trendline of the pattern on the daily chart. Running into that feature of resistance, as well as the 50-day Simple Moving Average (SMA), should mean another pullback is coming.

The first obvious level is the mid-$190s, where AAPL found support twice in early and late May. The second would be early April’s tariff induced bottom near $170. Let’s see if Needham’s Laura Martin is correct.

AAPL daily stock chart