- During the trading session on Wednesday, we have received the ADP Non-Farm Employment Change numbers out of the United States.

- They came in at in addition of 37,000 jobs during the month of May, much less than the anticipated 111,000.

- The previous month was revised down from 62,000 to 60,000 jobs added, and now traders are starting to question whether or not the US economy is slowing down.

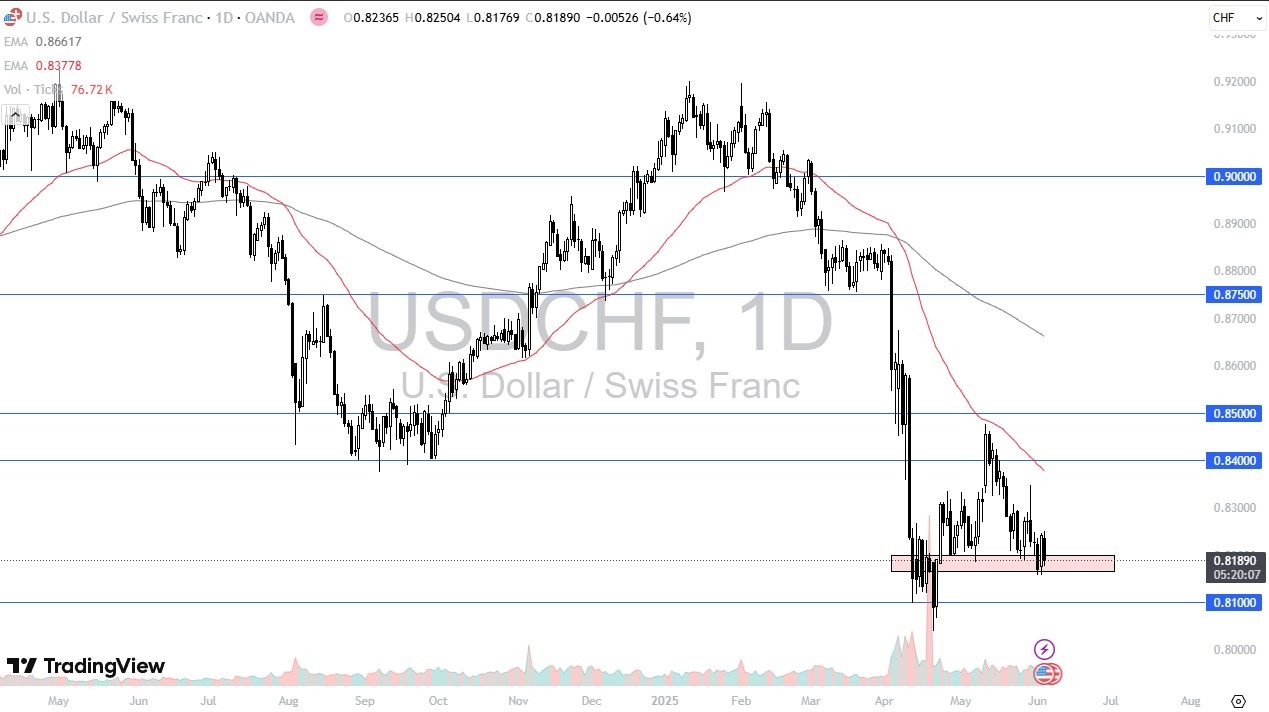

To add even more fuel to the fire, the ISM Services PMI numbers came out at 49.9, just barely in contraction mode. It was expected to come out at 52.0 even, so this was a little bit of a shock as well. Nonetheless, the market is starting to question whether or not the Federal Reserve will have to loosen monetary policy quicker than anticipated. This creates an interesting trade in the USD/CHF currency pair.

Central Banks

Keep in mind that the Swiss National Bank has put a lid on interest rates in that country for some time, and they are nowhere near trying to change that anytime soon. Because of this, the Swiss franc will continue to be a “funding currency”, which does make it cheaper to use for the so-called carry trade. That being said, the US dollar does have a lot of noise around it right now, because the numbers are starting to slow down in the United States, and this of course will have people betting against the greenback.

That being said, if we start to see a major problem across the world, then the US dollar will suddenly find itself a lot more attractive as people try to find ways to protect their wealth, typically through the US Treasury market. In order to buy US bonds, you need US dollars. From a technical analysis standpoint, this is a market that is fairly close to a major swing low, so I do think it is probably only a matter of time before people try to lift the market, but if we were to break significantly below the 0.81 level, it could have a knock on effect down to the 0.80 level underneath.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.