- During the trading session on Monday, we have seen a lot of volatility in the crude oil markets, and the Light Sweet Crude grade of crude oil will not have been any different at all.

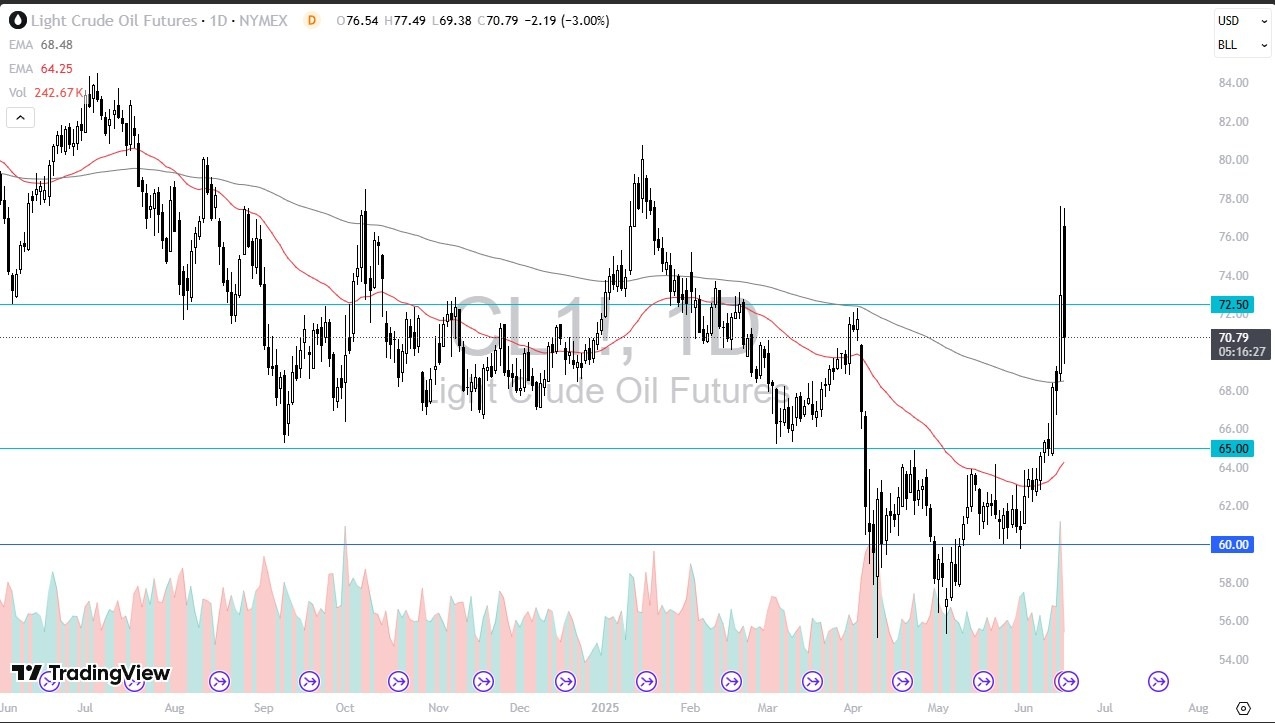

- In fact, we gapped at almost $3.50 at the open, rallied slightly, and then plunged to go negative.

- All things being equal, this tells me that somebody in the Middle East or with a lot of money believes that there is going to be plenty of oil.

In other words, they believe that perhaps there is some hopeful green shoots showing up in the Middle East. That is a little bit difficult to believe that the moment, but this might be one of the situations where traders are acting before the news hits the headlines.

Technical Set Up

The technical situation for this market is still bullish, I just think we got out of our comfort range rather quickly. The market probably needs to work off some of the excess froth in this market, so therefore a little bit of back and forth trading will probably help. The market has gained roughly $13 a barrel in just a few quick sessions, so to give that back is not necessarily out of sorts.

That being said, I don’t have any interest in shorting the crude oil, and I do think that eventually we will see buyers coming back in. That being said, the market is probably one you need to stay away from in the short term, mainly due to the fact that there is so much out there that could go wrong. The 200 Day EMA currently sits just above the $65 level, and it could offer a bit of support going forward. Ultimately, the market is going to look at this through the prism of offering value I suspect, as shorting this market would be far too dangerous for most traders. However, I need to see momentum reenter the fray, and I would prefer to get on the “right side of a V-shaped move” in this market, meaning that a little bit of patience probably goes a long way.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.