- The Dow Jones held flat but with a bearish tinge on Wednesday, trapped in a near-term consolidation zone.

- Equities were largely unaffected by the Fed’s latest rate call, which kept rates steady as expected.

- Fed Chair Powell warned that labor and inflation will both need to improve before rate cuts can happen.

The Dow Jones Industrial Average (DJIA) is mostly flat on Wednesday, with equity markets holding steady after the Federal Reserve (Fed) hit the mark and kept interest rates on holds as most investors expected. Traders are still pricing in around 50 basis points in interest rate cuts through the end of 2025, and the Federal Open Market Committee (FOMC) generally seems to agree with that assessment. However, Fed Chair Jerome Powell warned that ongoing policy uncertainty will keep the Fed in a rate-hold stance, and any rate cuts will be contingent on further improvement in labor and inflation data.

Read more: Fed Chair Jerome Powell explained the decision to leave the policy rate unchanged

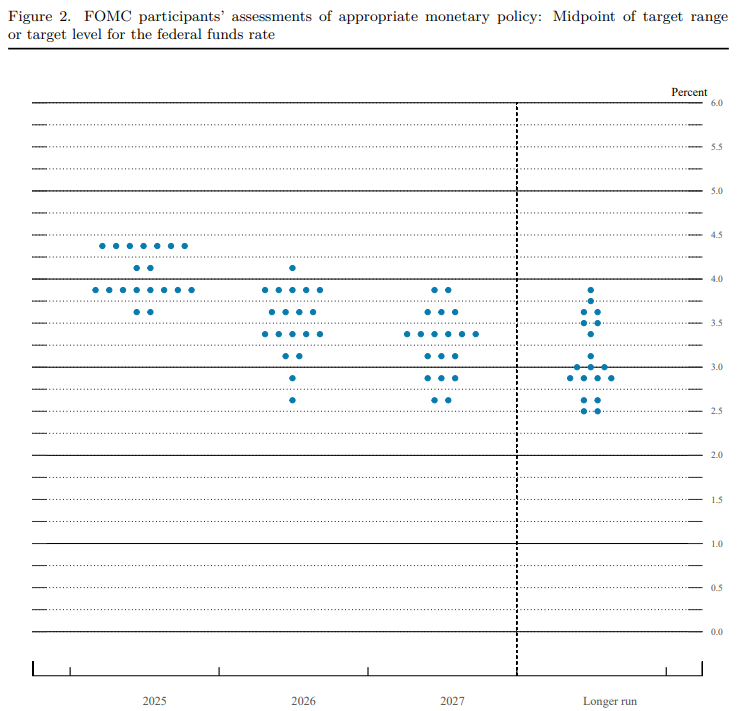

The Fed still sees an average of 50 basis points in interest rate cuts by the end of the year, following closely with what is priced in according to the CME’s FedWatch Tool; however, ongoing trade policy uncertainty has pushed the spread of policymaker rate expectations wider, with some Fed personnel seeing higher year-end rates compared to the previous Summary of Economic Projections (SEP).

According to the CME’s FedWatch Tool, rate traders slightly increased their already-standing bets of a first rate cut in September. Odds of a follow-up cut in October also increased, but odds of a delay in a second rate trim until December are still on the cards.

Dow Jones price forecast

The Dow Jones is churning in a tight midrange, trapped in near-term congestion. The major equity index is caught in a consolidation zone just north of the 200-day Exponential Moving Average near 41,800, and price action is pulling into the midrange with technical oscillators hung in no man’s land.

Dow Jones daily chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.