- The US dollar has rallied a bit during the Thursday session, which was a federal holiday in America against the Canadian dollar.

- It was Juneteenth, so it was a federal and bank holiday, and therefore liquidity could have been an issue, especially in this pair as, although Europeans do trade this pair, they don’t trade it as actively as you see in North America.

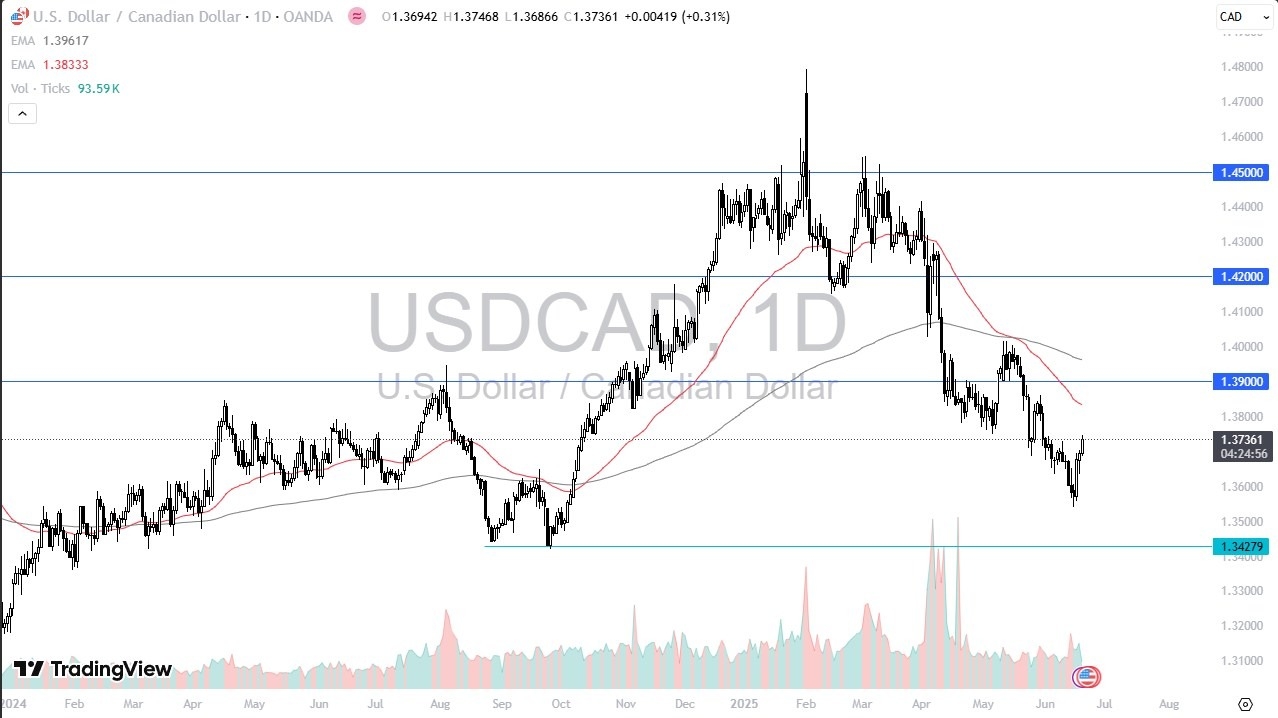

- Nonetheless, we have broken above a short-term resistance barrier, and it does suggest that perhaps buyers will be willing to get into this market on dips.

The 50 day EMA sits right around the 1.3825 level. And if we can break above that, then the 1.39 level is a very real target. Any breakdown at this point in time would have to deal with quite a bit of support near the 1.3550 level. And then again at the 1.3427 level. This is a pair that does favor the US dollar as far as interest rates are concerned. And quite frankly, there are still a lot of tariffs on Canadian goods coming into the US.

Tariffs?

While the Canadians bought some time by getting rid of the reciprocal tariffs, thereby avoiding a bit of a recession, the reality is that if the United States stops buying as many Canadian goods as possible, it’s absolutely toxic for that country. A little over 80 % of all Canadian exports end up in the United States.

We have a different behavior in this pair now that the US is such a heavy producer of crude oil. If this is going to be a situation where people are looking to trade this based on the fact that oil is rallying, they may be sorely surprised. At this point, I do expect a lot of volatility, but it looks like the buyers are at least in the process of trying to build some type of basing pattern.

Ready to trade our USD/CAD daily analysis and forecasts? Here’s a list of the best Forex Trading platform in Canada to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.