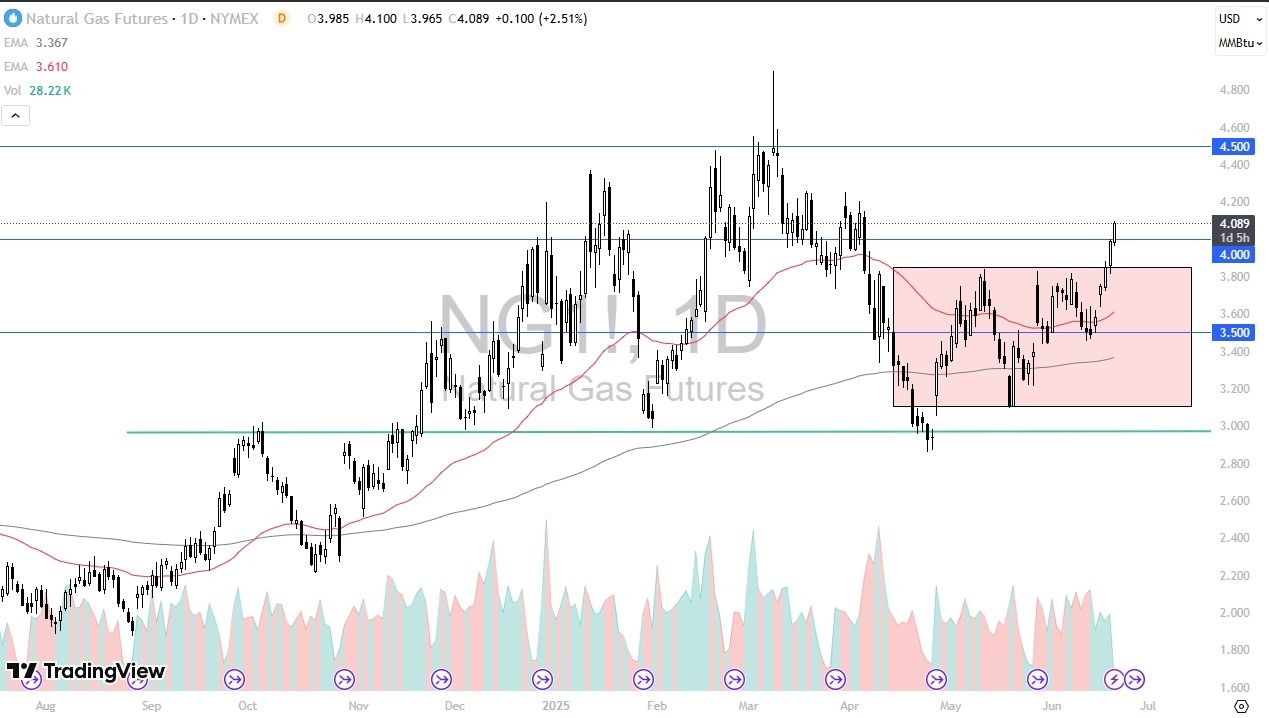

- Natural gas has shot through the $4 barrier during the trading session here on Thursday in what will have been pretty thin trading anyways due to the Juneteenth holiday.

- The forecast for next week here in the eastern part of the United States is for roughly 38 degrees Celsius for those of you outside of the country, about 95 to 100 here in the States in Fahrenheit.

- So, the idea being there will be a lot of demand during the heat wave for power.

Natural gas is a major producer of electricity in this country. So again, this time of year typically isn’t this positive for natural gas, but external factors such as that and the concerns about natural gas production in Iran has led to a breakout. Now, I still favor longer term the downside. And I certainly don’t know if I want to chase natural gas in this environment. I suspect as soon as the forecast in the eastern part of the United States start to cool off, which could be a week or so away, this thing will turn right back around and start dropping.

A Potential Fade? Maybe.

So now I’m looking for signs of the market trying to get ahead of that. Unfortunately, natural gas is highly driven by weather forecast in basically about 15 states in the United States. That is a bulk of what moves price. This is a US contract, and a lot of my friends overseas don’t really pay too much attention to that at their own peril. So, you’ll have to stay advised of the temperatures in places like Boston or New York. But really at this point, I think you may have missed the move unless you’re a short term momentum trader. Now you’re looking for exhaustion to start shorting. It’s going to be a difficult market. Natural gas always is. It’s probably one of the hardest markets to trade in because it’s so highly specialized and it can get very thin. So, keep that in mind. But I also like the idea of if you’re patient enough, you can get pretty heavily rewarded when we come back to a more normal temperature.

Ready to trade daily Forex forecast? Here’s a list of some of the best commodities brokers to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.