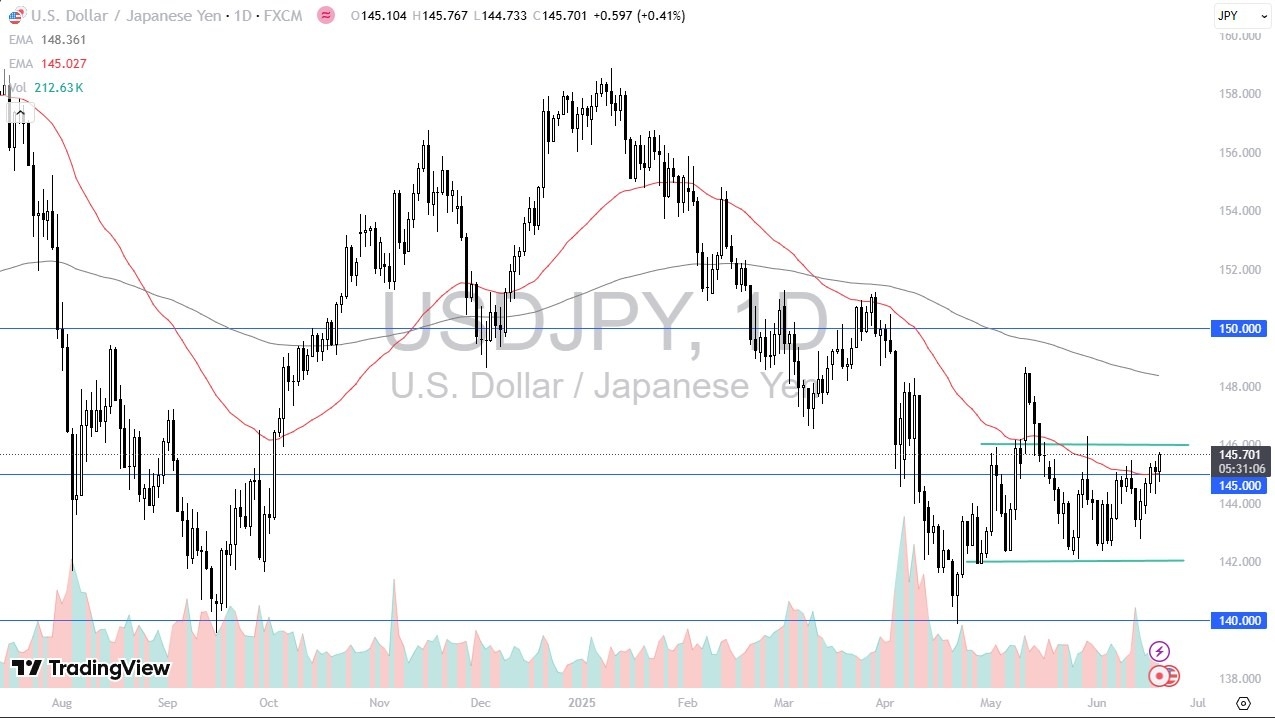

Potential Signal:

- If the USD/JPY pair can break above the ¥146.25 level, I’m a buyer of this pair with a stop loss at ¥145.

- I’d be aiming for the ¥148.20 level.

The US dollar has rallied against the Japanese yen during the trading session on Thursday, as it looks like we are trying to do everything we can to reach the ¥146 level. If we can break above there, then the market is very likely to continue to go looking for the 200 Day EMA. If it does reach that level, slightly above the ¥148 level, then I anticipate that longer-term traders will probably be very interested in trying to play that move. However, by the time we get to that area, it’s very likely that a lot of things may have changed anyway.

Risk Appetite

It’s interesting because this is a pair that is highly sensitive to risk appetite, but it also has a lot of other external factors at the moment. While the US dollar is considered to be a safety currency, so is the Japanese yen, and therein lies the major problem in this market. That being said, the market is likely to continue to see a lot of external factors that will move this market, far beyond risk appetite. After all, the US dollar is starting to see a little bit of a resurgence, and that might be due to fear overall, although one could say that the Japanese yen typically would be a beneficiary of this. However, there are also a lot of other concerns out there at the moment, not the least of which would be the fact that the Japanese Government Bond market has seen a couple of “zero bid days” recently. This of course means that the Bank of Japan will more likely than not have to do a bit of quantitative easing soon.

This is a market that sees the ¥142 level as a massive support level, and that very well may be the potential floor in the market after a massive selloff. Only time will tell, but this is starting to look like a major support level that just simply cannot be breached.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.