I wrote on 15th June that the best trades for the week would be:

- Long of the EUR/USD currency pair. This ended the week lower by 0.26%.

- Long of Gold in USD terms. This ended the week lower by 1.87%.

- Long of Silver in USD terms. This ended the week lower by 0.96%.

- Long of WTI Crude Oil if there is a daily (New York) close above $80.43. This did not set up.

The overall loss of 3.09% equals a loss of 0.77% per asset.

The Middle East and Europe have awoken this morning to shocking news: the USA has joined Israel in combat over Iran, using its advanced weaponry to (apparently) quickly destroy Iran’s nuclear program, after over a week of Israeli attacks on these facilities, the Iranian regime, and the Iranian military. It looks very much like a victory for Israel and the USA.

The USA claims that the strikes have been completely successful. The International Atomic Energy Agency has stated that it can find no increase in radiation levels from these facilities following the strikes.

Al Jazeera is reporting that Iranian technicians spent the past three days removing materials from the key Fordow plant. Whether this is a significant development or not remains to be seen, but there is plenty of jubilation, or at least quiet relief, throughout the Middle East, Europea, and the USA today.

The Iranian government is now also claiming that enriched uranium was removed from Fordow before the attack. One might consider that given the capabilities already demonstrated by Israel and the USA, that these countries are likely to have a good idea where it is now.

Although the Iranian regime has issued blood-curling threats, pledging that no US citizen will be safe anywhere (a clear war crime if ever there was one, to add to its targeting of Israeli civilian buildings with cluster munitions last week), its response so far has been limited to a relatively small (45) missile barrage on Israel, which does not seem to have caused any fatalities. However, at the time of writing, there are initial reports that the Iranian navy is attempting to close the Straights of Hormuz and may be preparing to attack targets in Dubai. If they succeed in closing the Straight, the price of WTI Crude Oil could open above $100 per barrel. However, at present, shipping is passing normally. The Iranian navy was hit yesterday by Israel in Bandar Abbas.

In the USA, many Congressional Democrats are condemning Trump’s action, with some even calling for impeachment proceedings, claiming that Congress was required to authorize such a strike. Others are claiming that Trump has now got the USA entangled in “another Middle East war”.

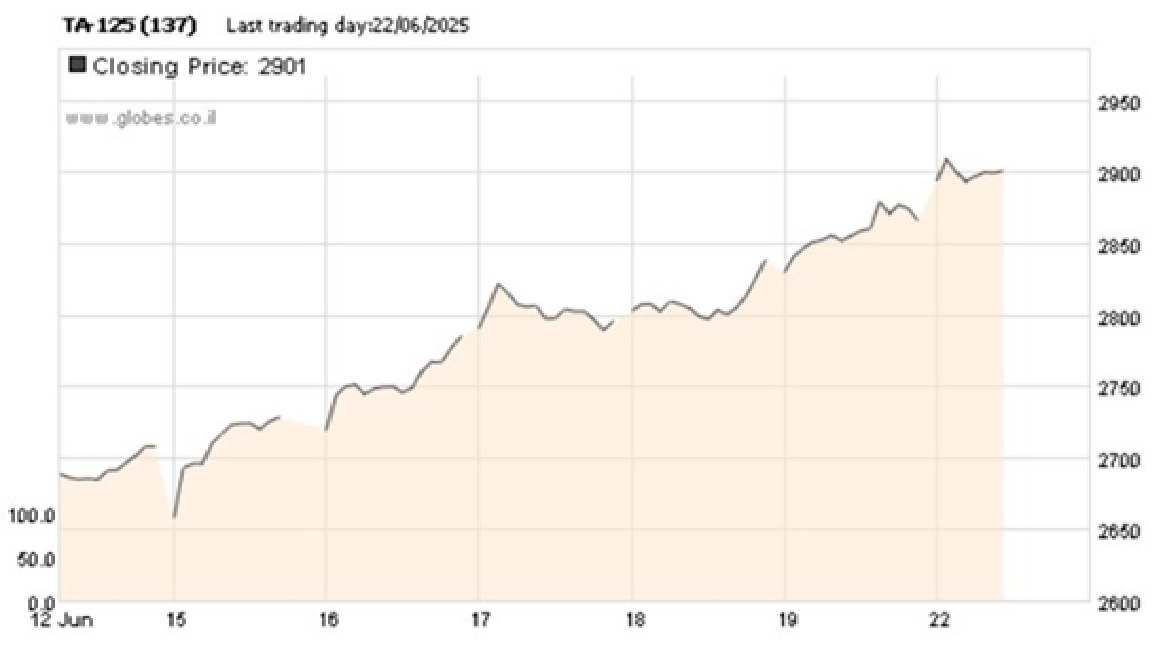

It is hard to say how markets will react to this event. There may be more repercussions later today for markets to absorb before they open. We might look at the evidence of whatever markets are open right now. The Tel Aviv stock exchange is up by over 1.6%. In weekend markets, Gold climbed by about $40 per ounce immediately following the attack but has begun to decline.

The evidence suggests that markets are likely to treat the weekend’s events as positive for risk appetite, possibly excepting crude oil, the traffic of which might be very vulnerable to an Iranian revenge attack.

In other news, last week’s most important data releases were:

- US Federal Reserve Policy Meeting – the Fed kept rates on hold, as was widely expected, but indicated towards a slower pace of rate cuts. This was a very small hawkish tilt, as the CME FedWatch tool still show a consensus expectation of two further rate cuts of 0.25% by the end of 2025, in September and December. This helped to strengthen the Dollar over the week.

- Bank of Japan Policy Meeting – the Bank agreed to remain on a path to further rate hikes, but some Board members saw the need for a pause, which is a very minor dovish tilt, helping to weaken the Yen over the week.

- Bank of England Policy Meeting – the Bank left rates unchanged as expected, but more members voted for a cut, which was a slight dovish tilt, helping weaken the Pound over the week.

- Swiss National Bank Policy Meeting – the SNB cut its rate by 0.25% to 0.00%, as expected.

- US Retail Sales – this was considerably worse than expected, showing a contraction of 0.9% month-on-month when only 0.5% was expected.

- UK CPI (inflation) – this was a fraction higher than expected at an annualized rate of 3.4%.

- New Zealand GDP – this was a fraction higher than expected, showing an annualized rate of 0.8%.

- UK Retail Sales – this was far worse than expected, showing a month-on-month decline of 2.7% when a decline of only 0.5% was foreseen.

- Australia Unemployment Rate – held steady at 4.1%.

The coming week has a lighter program of high-impact data releases, with the most notable event likely to be either Fed Chair Powell’s testimony before the US Congress, or the release of Core PCE Price Index data. In any case, the fallout from the Iran war is quite likely to be an even bigger factor in moving the market.

This week’s important data points, in order of likely importance, are:

- Fed Chair Jerome Powell Testifies Before US Congress

- US Core PCE Price Index

- US Final GDP

- Canadian CPI (inflation) data

- Australian CPI (inflation)

- Canadian GDP

- US, German, UK, French Services & Manufacturing PMI

- US Unemployment Claims

The most impactful events on the Forex market will likely be the top three items.

For the month of June 2025, I forecasted that the EUR/USD currency pair would increase in value. The performance of this forecast so far is:

As there were no unusually large price movements in Forex currency crosses over the past week, I make no weekly forecast.

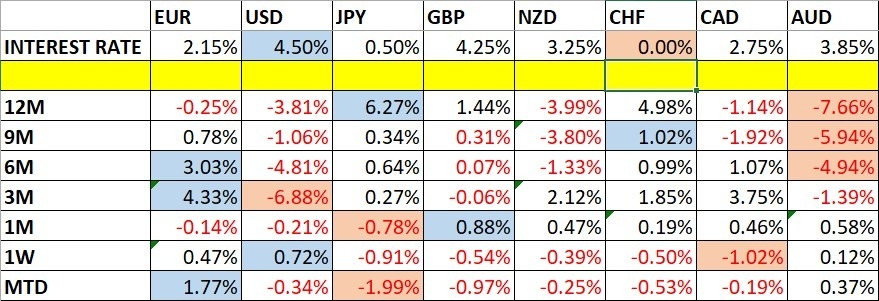

The US Dollar was the strongest major currency last week, while the Canadian Dollar was the weakest. Volatility decreased last week, with 19% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to be at a similar relatively low level.

You can trade these forecasts in a real or demo Forex brokerage account.

Last week, the US Dollar Index printed a bullish inside candlestick after last week made the lowest weekly close since February 2022. The weak bullish move rejected the key support level at 97.54. There is clearly a long-term bearish trend in the US Dollar.

It might make sense to be trading in line with the long-term trend which will be short of the greenback, but the American destruction of Iran’s remaining nuclear sites a few hours ago and possible Iranian retaliation, notably concerning the crude oil market, could well send the Dollar higher if the week starts with investors looking for a flight to safety.

I say, if you are trading the USD in the Forex market, watch whether 97.54 is being respected here and trade accordingly. If you are trading other markets, don’t worry much about the greenback.

The Tel Aviv Stock Exchange 125 Index opened 1.6% higher this morning after having its best week in about 5 years last week.

While it might seem counterintuitive to many that Israel’s stock market boomed last week – rising to a new all-time high – one must factor in that Israel’s military campaign against Iran has gone far better than anyone in Israel expected.

Last night, the Americans completed the destruction of Iran’s nuclear facilities, and the retaliation against Israel, at least so far, has been nothing stronger than what Iran has already thrown at Israel.

While analysis of a nuclear Iran tended to focus on the danger of a nuclear attack on Israel, even the possession of a nuclear weapon by Iran would have created a chilling effect on Israel’s economy, and this is likely to be the main factor pushing the stock market higher.

Israel’s economy faces challenges after nearly two years of war, but it is quite possible that the coming week could see more upside here, although few brokers offer Israeli stock market indices.

The EUR/USD currency pair is within a valid long-term bullish trend, and this currency pair has an excellent record of respecting such a trend.

The price made a multi-month high recently, but made quite a large retracement, and then ended the week rising again. It ended up printing a large doji candlestick on its weekly chart.

The big questions for me are:

- Will the week open with a relieved market at the US success in Iran, or flying to safety in fear of the Iranian retaliation?

- Will the US Dollar benefit much from a flight to safety? Will the Euro?

I think if the first hour or so of the Tokyo session later today is bullish for this currency pair, it would be wise to try to ride this trend higher.

Gold in US Dollar terms had a down week last week, but a look at the weekly chart below shows that the major precious metal still looks quite bullish and is well within a clear and strong long-term bullish trend.

The immediate prospects for Gold will depend upon whether markets fly to safety when they open in a few hours, and that will mostly depend on whether the Iranians are able to pull off any meaningfully damaging retaliations. Iran fired at Israel a few hours ago but it was nothing out of the ordinary.

Gold in the few markets which trade on Sundays is trading higher, but not by anything dramatic – prices were about $3,420 per ounce, higher but still below the recent record high.

More cautious traders might want to wait for Gold to print a new record above $3,500 per ounce before entering any new long trades.

Silver in US Dollar terms again reached a new thirteen-year high last week, above $36 per ounce, but a look at the weekly candlestick shows that it is a bearish pin bar. This, after the previous week’s small candlestick, suggests a fall in value is coming. Nevertheless, there is a clearly strong bullish trend in precious metals generally, and in Silver.

More cautious traders might want to wait for a new long-term high to be reached, or at least a strongly bullish daily close, before entering a new long trade here.

Looking at the daily price chart for WTI Crude Oil below, a lot of interesting and bullish things can be seen:

- The bullish double bottom at around $55.00.

- The cup and handle chart pattern which followed the double bottom, or at least something very close to that pattern.

- The continuin bullish momentum of last week.

Of course, crude oil has been broadly rising following the outbreak of all-out war between Israel and Iran. This long-anticipated hot conflict outbreak has dramatically pushed up the price of crude oil, and led to fears of American involvement leading the Iranians to throw everything they can at the Gulf area, including closing the Strait of Hormuz, a nightmare scenario for the supply of crude oil as 80% of crude oil passes through it.

Last night’s apparent destruction by the USA of Iran’s remaining nuclear facilities has led to all kind of threats by Iran, including closing the Strait – but so far, it appears that the Israeli attack on the Iranian navy in Bandar Abbas and action by the USA has prevented that from becoming a reality.

We are likely to see volatility in Crude Oil unless Iran agrees an end to the war. Any successful Iranian retaliation could see the price spike higher to more than $100.

Be careful trying to trade such a volatile market – the best approach could be waiting for the end of the day, and only going long if we see a new 6-month high closing price above $80.43.

I see the best trades this week as:

- Long of the EUR/USD currency pair.

- Long of Gold in USD terms.

- Long of Silver in USD terms following a daily (New York) close above $37.13.

- Long of WTI Crude Oil if there is a daily (New York) close above $80.43.

Ready to trade our Forex weekly forecast? Check out our list of the best Forex brokers.