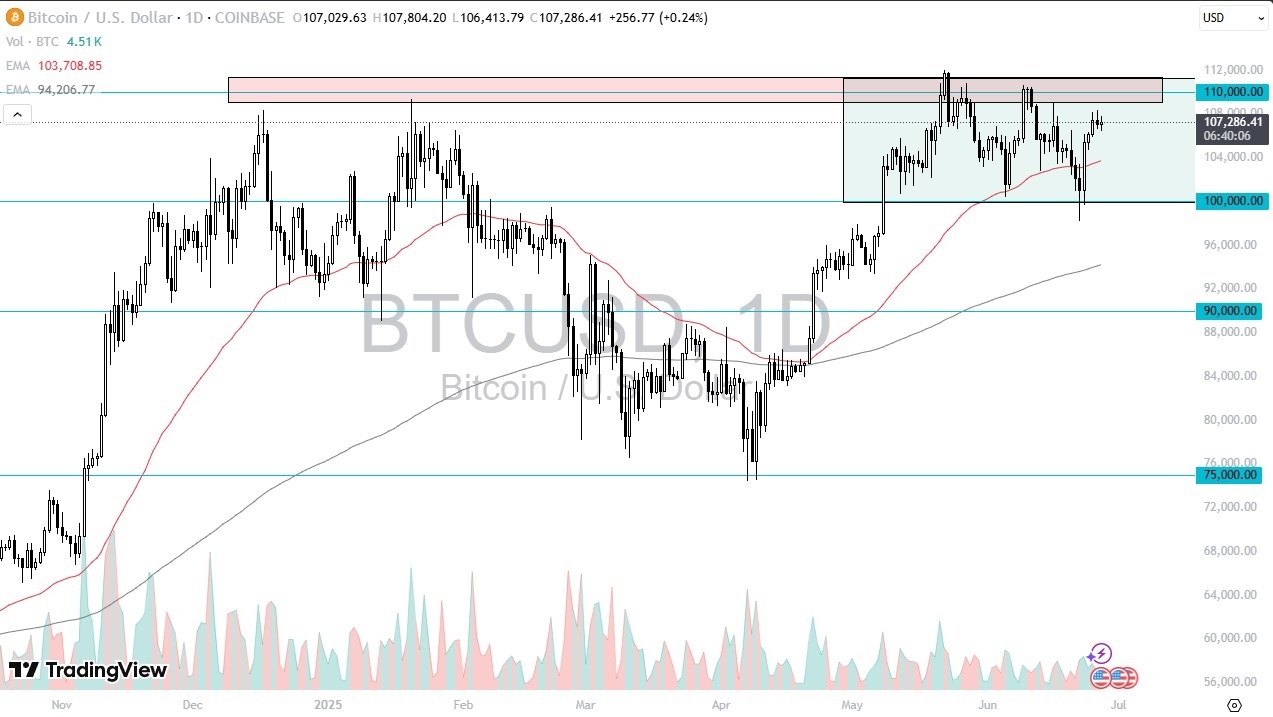

- Bitcoin has gone back and forth during the trading session here on Friday as we continue to hover around the $107,000 level.

- Ultimately, this is a market that I think if you see it pull back a bit, you’re probably looking to buy it.

- The 50-day EMA sits just below the $104,000 level, which is an area where we’ve seen action previously.

If we can break to the upside and above the shooting star from the session on Thursday, then it opens up the possibility of a move to the $110,000 level, which is the top of the $10,000 range we have been in. Now, keep in mind that we did break above the $110,000 level previously and reached as high as $112,000, but did not manage to continue the uptrend.

So, I think really what you need to see for more of a larger impulsive move is for Bitcoin to break above $112,000 and sustain it. If it can, then I don’t see anything stopping it from going to $120,000. But quite frankly, I’ve been saying that for two and a half months now. And that’s part of what makes trading Bitcoin so difficult, because it does tend to put traders to sleep for months at a time. And then eventually we’ll find a reason to go higher.

Institutions Hold This ETF

It is an industrial and institutional held ETF now. So that does help at least put a little bit of a bid in it, regardless of what’s going on. So, it’s almost impossible to short. It’s almost like trading an index. You just don’t short indices very often. That’s going to be the same thing with Bitcoin. If we broke down below the $100,000 level, then we could drop towards the 200 day EMA, but I don’t see that happening, at least not with some type of major risk-off occurrence.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.