After a strong two-month rebound, the S&P 500 has entered July hovering near all-time highs. But can this momentum continue, or are we topping into volatility?

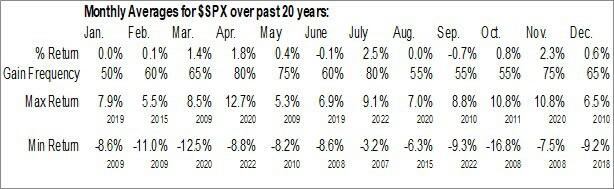

Historically, the first two weeks of July are the most bullish stretch of the year. Seasonality wise as well, July is on average a bullish month for the SPX across the last 20 years. However, while seasonal trends look great, several catalysts could shake things up this time.

Source: EquityClock

Potential risks

The key fundamental risks to watch for this July are the following:

-

Tariff Freeze Ends July 9 → Any re-escalation could spook markets

-

Fiscal Bill Deadline (July 4) → Policy delays may revive deficit fears

-

Overbought Conditions → RSI nearing 70+; upward momentum is strong, but extended

Earnings season begins Mid-July

Watch for key results from the MAG-7 (Microsoft, Apple, Google, Amazon, Meta, Nvidia, Tesla).

| Company | Expected Report Date |

| Tesla | July 17 (est.) |

| Microsoft | July 23 (est.) |

| Meta | July 24 (est.) |

| Amazon | July 25 (est.) |

| Google (Alphabet) | July 25 (est.) |

| Apple | July 30 (est.) |

| Nvidia | Aug 14 (est.) |

Current technical landscape of SPX

-

Price is above the 20, 50, and 200 EMAs.

-

Anchored VWAP (April) still providing dynamic support.

-

Breakout above 6,100 shows clean bullish structure.

-

Next psychological targets: 6,200 → 6,300 → 6,500.

This structure favours continuation if sentiment holds — but we’re also nearing round-number resistance zones and overbought territory.

Neutral trading scenarios

If Bullish:

-

Look for continuation toward 6,300 and 6,500 — especially if volume confirms.

-

Buy-the-dip opportunities near EMA-20 (6,010) or prior breakout zone (6,120).

If Bearish:

-

Watch for bearish divergence (RSI/MACD) or rejection candles near 6,300.

-

Key support zones: 6,120 and 5,885 (EMA-50).

-

A break back below anchored VWAP may trigger rotation lower.

Final thought

July is known for strong performance —but this time, macro risk, policy deadlines, and earnings volatility are looming. While we’re technically bullish, it remains a good idea to keep a close eye on fundamental developments.

Overall, the mini rally seems to be a go, even if we cool off a little here and retest the EMA-20 or even EMA-200 zones — as long as we can stay above those prices ($6,000 and $5,700 respectively).