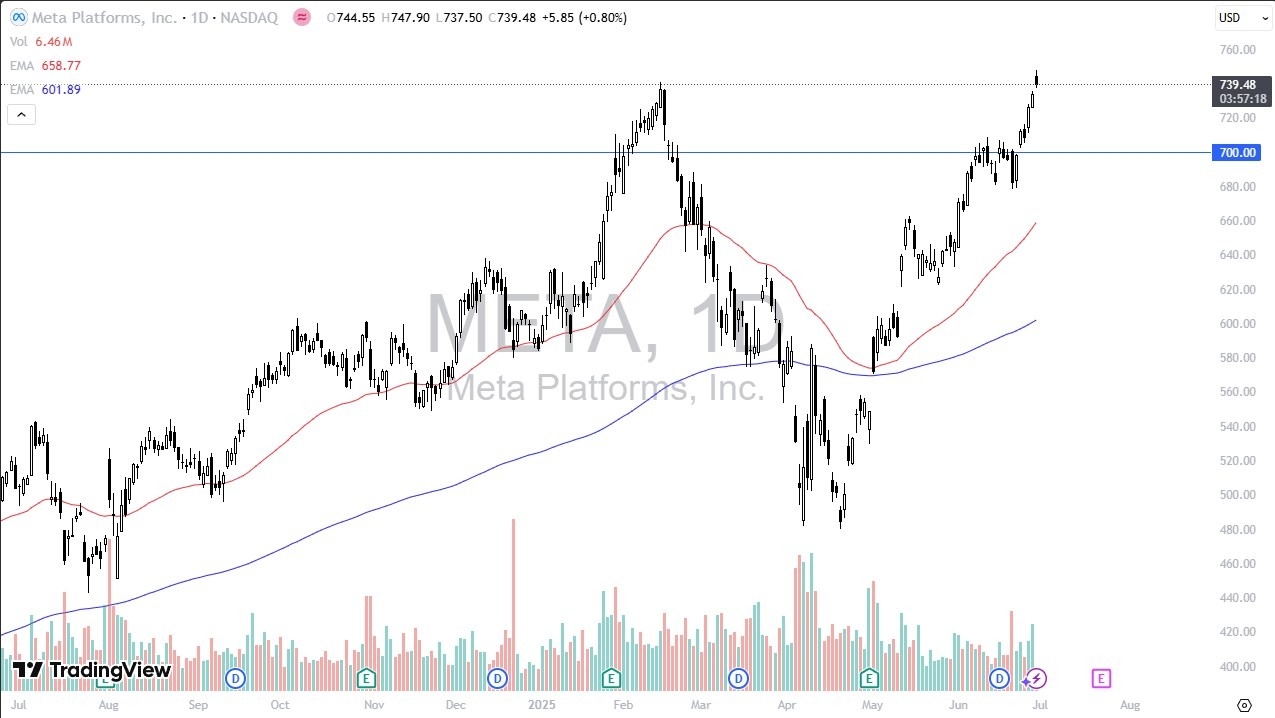

- During the Monday session, we have seen Meta kick off the week on a positive note, and with a reasonable volume to make a fresh, new, all-time high.

- This of course is a very bullish turn of events, but it’s also worth noting that this has been like a freight train going higher over the last several months, and sooner or later there is probably going to be some type of pullback.

- The question at this point in time will be whether or not that pullback is significant enough to attract more value hunters.

I do suspect that the $700 level will continue to be important as it had been previously, and with that being the case, I think a lot of traders would love to get involved in Meta if we get anywhere near that level. If we were to break down below there, it’s probably worth noting that there is a “wall of support” extending down to the $680 level, which is also a potential target for the 50 Day EMA which is just $20 below there.

Wall Street Darling

When trading stocks like Meta, you need to keep in mind that EE is a staple for Wall Street, and those who own large funds typically will have at least some exposure to a company like this, so therefore it starts a bit of a “feedback loop” for those looking to get exposure overall. It is because of this that it’s very difficult to short this stock, which is the same thing I can say for Netflix, Apple, and others like Tesla. It’s not that the stocks don’t fall, it’s just that you can save yourself a lot of stress by simply looking for a pullback that then bounces, showing that institutions are starting to come back into the fray. That is certainly the case in Meta, and this is exactly the type of set up you are looking for.

As far as a target is concerned it would not be overly surprising to see Meta hit $800 relatively soon, which is just another 5 or 6% from here. I will not short this stock, but I do recognize that if we were to break down below the $680 level, then we may see a deeper correction.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.