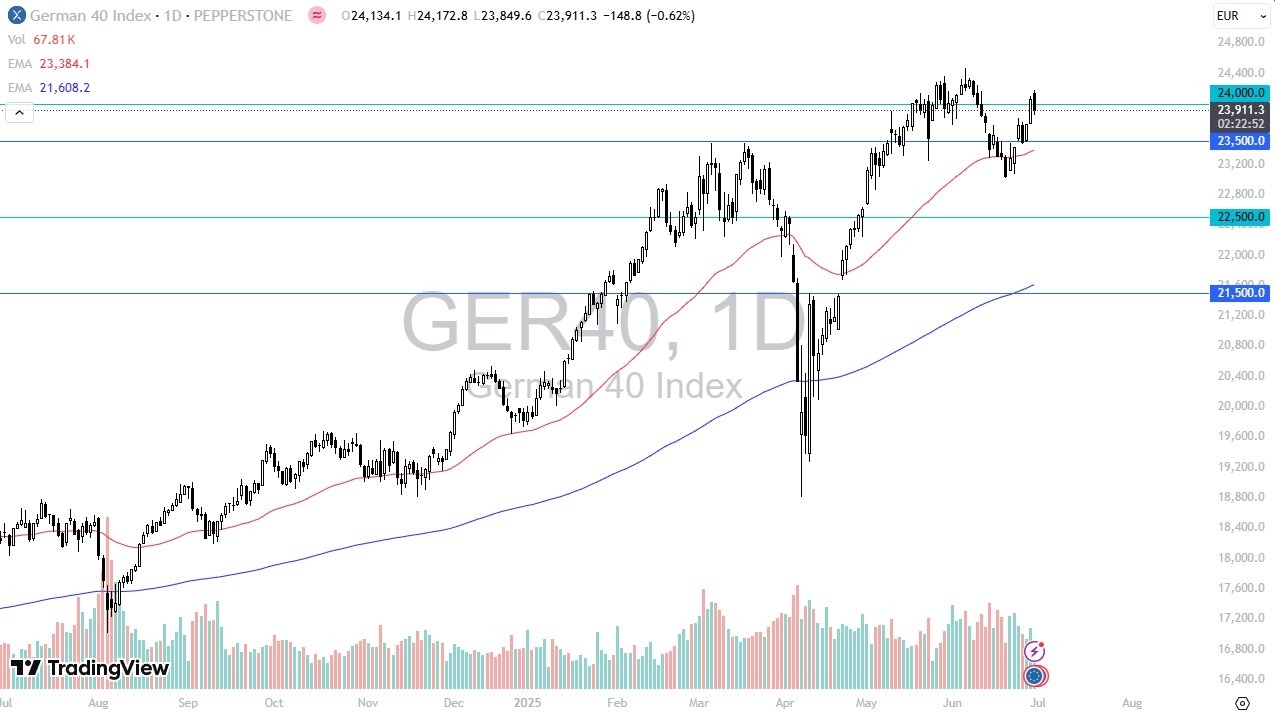

- The German DAX has initially gapped higher only to turn around and fall pretty significantly.

- That being said, the market of course has seen a lot of bullish pressure previously, so I think it’s not a huge surprise to see this market drop a bit in order to perhaps offer value.

I do not want to short the decks. think ultimately the 23,500 level is offering significant support, especially with the 50 day EMA racing toward it. The 50 day EMA of course is something that a lot of people pay close attention to. But I also recognize that if we do drop towards that area, I think there will be a lot of value hunting in that region. If we can turn around and break above the 24,500 level, then I think it opens up the possibility of a move to the 25,000 euro level over the longer term. In general, this is a situation where traders will continue to see the German index as a way to play the European Union overall. And that of course looks very strong. Momentum enough probably gives you an opportunity to get long here.

I Have No Interest in Shorting This Market

I just don’t see a situation where I would short this market right now. Yes, we could get a deeper correction, but really at that point, I think that just becomes even more interesting. Industries around the world continue to rally on a sector by sector basis. And of course, indices are doing the same thing. So, with all of that, I believe this is a market that does break out to the upside given enough time. Really don’t have any interest whatsoever in trying to fight this trend that is so clearly defined. Remember, Germany is the leader of the European Union, and this is something that cannot be underestimated.

Ready to trade daily forex analysis? Here are the best CFD brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.