- Bitcoin traders have pulled back a bit during the trading session on Tuesday, as we continue to see a lot of back and forth action in what can only be thought of as a larger consolidation range.

- Ultimately, this is a market that I think will continue to see a lot of noise, as there are serious questions about the overall risk appetite of markets.

- After all, it takes quite a bit of risk appetite does start pushing the Bitcoin market higher, due to the fact that it is so far out on the risk spectrum of markets.

Technical Analysis

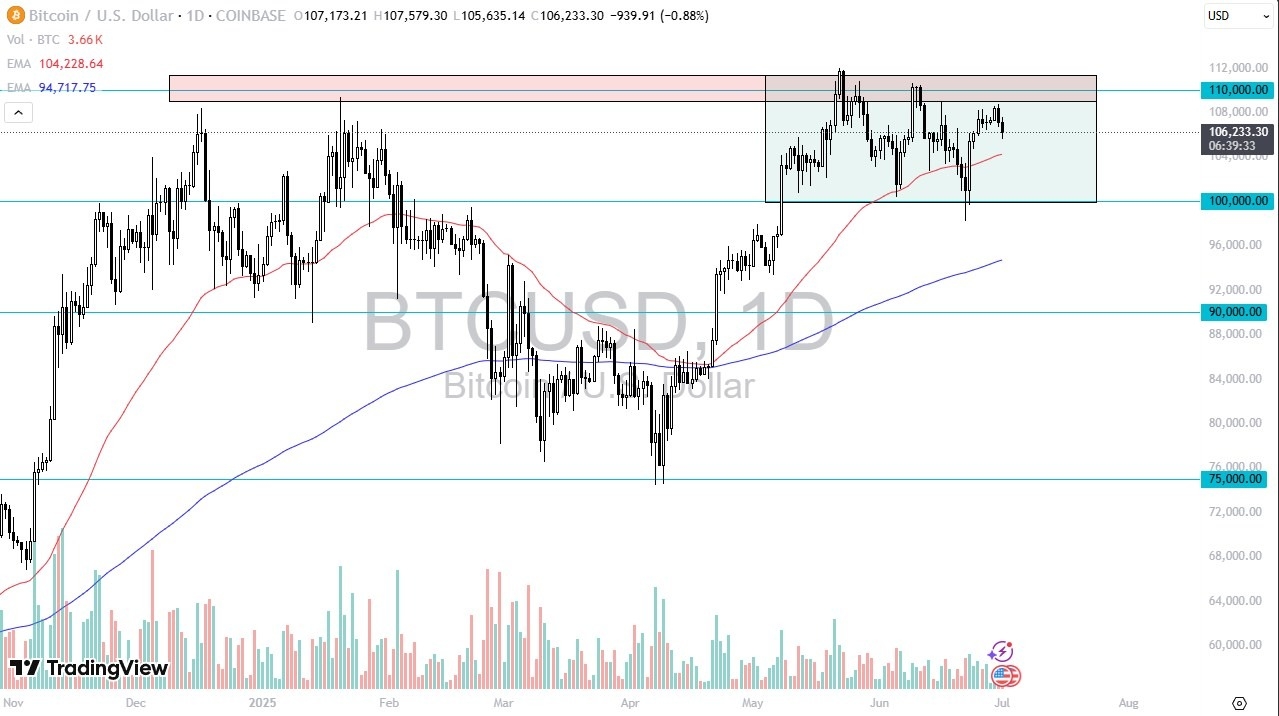

The technical analysis for Bitcoin continues to be something worth paying attention to, as the $100,000 level underneath offers support, and the $110,000 level offers resistance. At this point in time, it looks like we are continuing to see a lot of back and forth questions asked, as the market just simply doesn’t have any idea what to do at this point in time. Ultimately, the market will have to have some type of external catalyst to get going, but if we do get more “risk on” going forward, that will certainly help Bitcoin reach toward the $110,000 level, which shows resistance to $112,000 level.

If we break down from here, the 50 Day EMA offer support, opening up a move down to the $100,000 level. The $100,000 level has been important multiple times, and I think that’s essentially your “floor in the market.” As long as we can stay above there, then I think it’s likely that the market will continue to see plenty of buyers, but if we were to break down below that level, then it’s possible that the market could go looking to the $95,000 level underneath, where the 200 Day EMA currently resides. Ultimately, this is a market that I think will be very noisy but ultimately, I think it’s probably only a matter of time before we do break out to the upside. If and when we do, then I think Bitcoin goes looking to the $120,000 level.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.