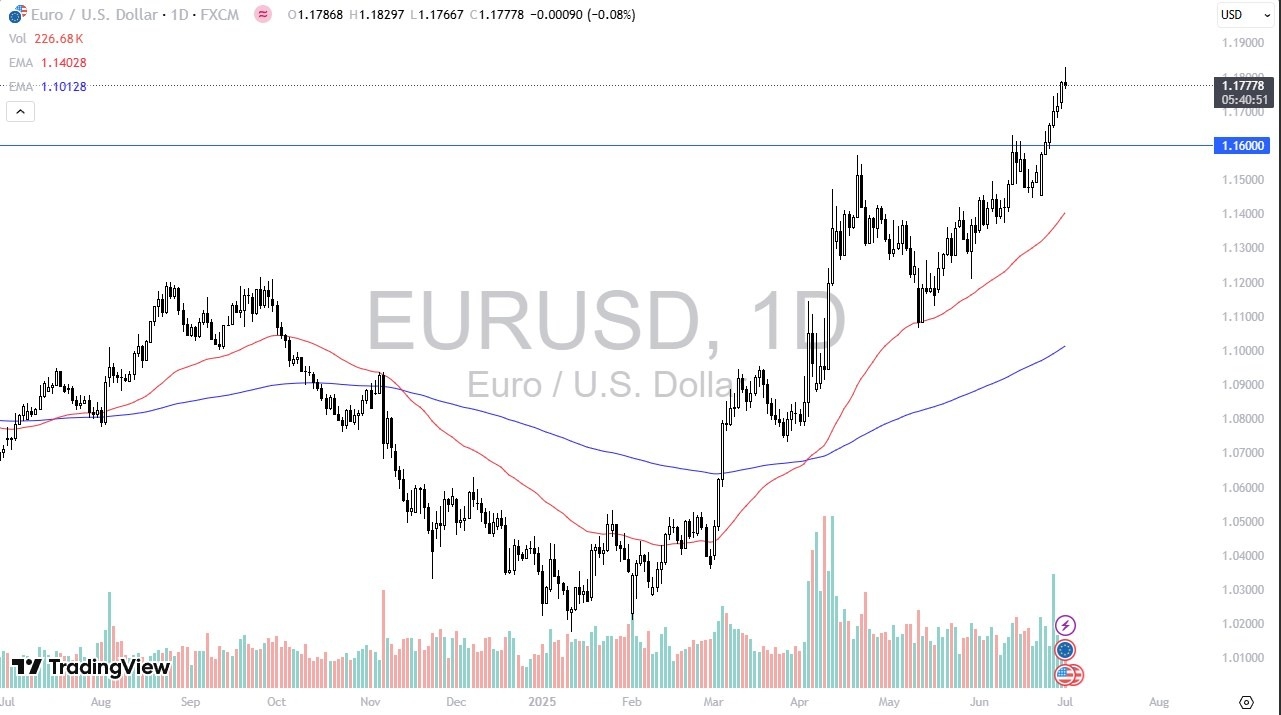

- The euro initially rallied during the trading session here on Tuesday but has given back quite a bit of the gains as we just flat out got too extended.

- So, I think you’ve got a situation where traders are looking at this through the prism of overbought, but also the reality that the U.S. economy isn’t dead.

- The job opening number was much stronger than anticipated.

And it’s likely that people will need to continue to look at this through the prism of a market that may be way ahead of itself. The federal reserve may or may not cut later this year, but if the job market remains strong, that’s not going to happen. Ultimately, the market is pulling back like this, it makes a lot of sense. doesn’t necessarily change the trend, but it could drive the euro back down to the 1.16 level. On the other hand, if we can turn around and take out the top of the candlestick, then maybe 1.19 gets targeted, followed by the 1.20 level.

The Narrative is a bit Overdone?

Nonetheless, I think we have gotten so far into the death of the US dollar story that people are just piling in without thinking and every time you start to see those headlines everywhere, you’re close to the end. If the Federal Reserve cannot cut later this year, it’s going to be disastrous for a lot of these other currencies. Do I expect that to happen? Not yet. I do think it will happen eventually because the cycle just repeats time and time again.

So, recognize that we’ve had a nice rally. We need to pull back at the very least. All things being equal, I believe that the situation probably continues to be volatile, but I recognize that 1.16 will be a very important level, especially as we approach the jobs numbers on Friday.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.