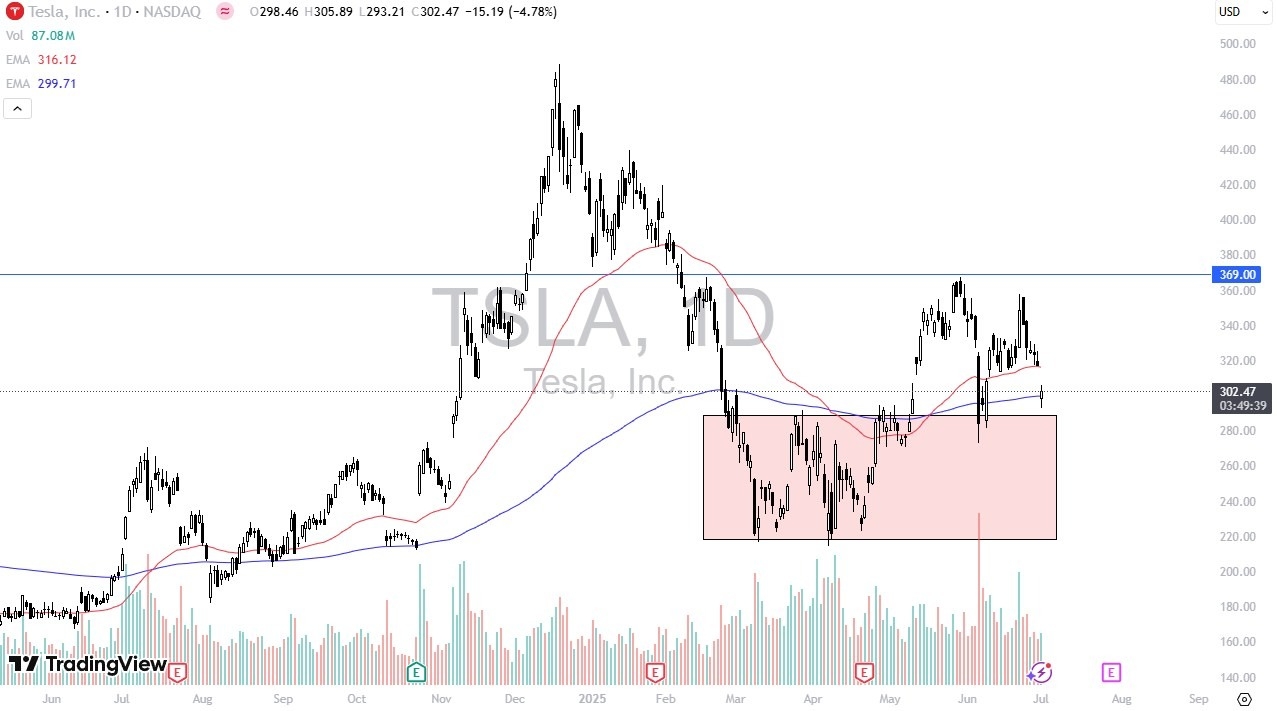

- Tesla is very noisy during the trading session here on Tuesday as we have seen a major problem with the noise between President Trump and Elon Musk again, as we gapped lower losing at one point something like 6%.

- We have seen a major snapback though and the 200 day EMA and I do think it’s probably only a matter of time before we recover.

- This is nonsense. This is just like thinking that Tesla was suddenly going to disappear during their first spat and of course the destructive vandalism on Tesla dealerships and vehicles.

Threats to Musk?

President Trump suggested that maybe we get away from SpaceX, but NASA’s nowhere near being able to do that. So, this is another one of those opportunities, at least in my opinion, that people panicked first and didn’t really think about what was going on. Ultimately, I do think that Tesla recovers, and I think a little bit of sideways action might be perfect. You can see that the last time this nonsense started, we did this, and I think we’re about to do that again.

That doesn’t necessarily mean that you want a huge position in Tesla, but it does look like it’s a pretty easy bet at this point. If we were to break down below $275, then yes, things get ugly. But ultimately, I think this is a market that is setting up an opportunity. Thankfully, we have Twitter and therefore these people can argue and offer nice opportunities for those who are willing to take advantage of them. I believe this is a market that rallies whether or not it breaks above the $369 level is a completely different conversation. But as things stand right now, I think there’s plenty of support here.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.