- As you can see, the silver market has gone back and forth during the course of the trading session here on Tuesday as traders reacted to a lot of noise and concern about the U S economy, perhaps being a little hotter than anticipated.

- Now, while you would think it would be a good thing for demand when it comes to silver.

- The reality is it also increased the value of the dollar.

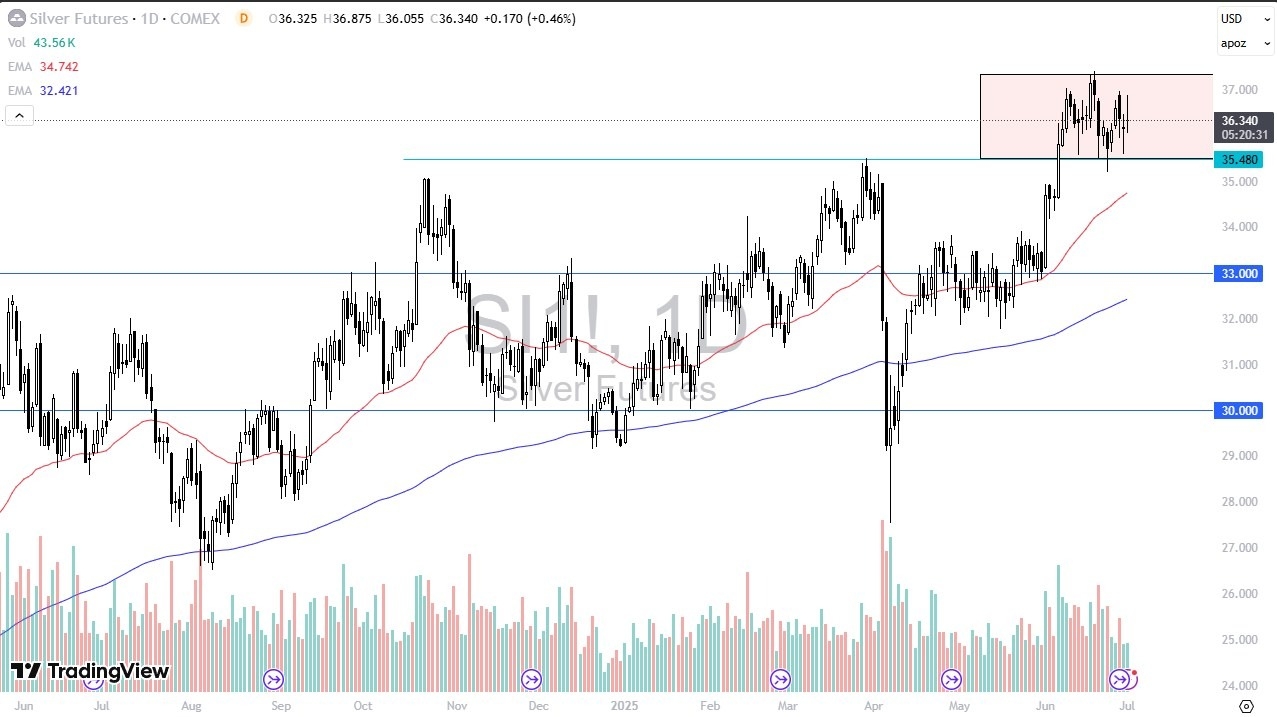

So we’ve seen quite a bit of noisy trading. Ultimately though, I do think this is a market that is still very much in the same consolidation range that we had been in for a while with the $35.50 level offering a floor while the $37.50 level offers a ceiling.

Short-Term Drops Offer Opportunity

Short-term pullbacks offer buying opportunities from everything I see, but if we can break above there, it’s likely that silver will continue to rip towards the $40 level. $40, of course, is a large round psychologically significant figure, and I think there would be a reaction to that, but as things stand right now, I think you’d get a situation where it’s just going to be noisy, choppy behavior that is looking for some type of resolution.

The 50 day EMA is all the way down at the $34.70 level, but it is rising towards that potential support area. So, I think it all ties together quite nicely. With that being the case, this is a market where I like buying dips, but you also have to get rid of your gains pretty quickly, at least until we can break out to the upside. Nothing’s really changed here, despite the fact that it was a pretty wild ride in the early part of the Tuesday session in New York.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.