Market Index Analysis

- The Uber Technologies (UBER) is a member of the S&P 500 Index.

- The S&P 500 is near record highs, but cracks in the bullish trend have emerged.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence, which is a bearish signal hinting at a potential price action reversal.

Market Sentiment Analysis

Equity markets started the third quarter and the second half with a moderate decrease, but this week’s holiday-shortened week is unlikely to produce a significant move. All eyes are on US President Trump’s Megabill, which passed the Senate, but still lacks sufficient votes in the House. President Trump also signaled that he is unwilling to extend the July 9th 90-day deadline to reach a trade deal, and he doubted reaching a trade deal with Japan before then. Tariff uncertainty could magnify selling pressure this week.

Uber Technologies Fundamental Analysis

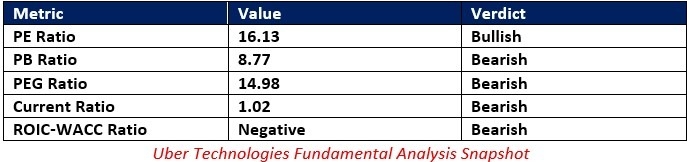

Uber Technologies is the world’s largest ridesharing company with over 150 million monthly users and six million drivers. It is a controversial and disruptive company with excellent profit margins, but high debt levels and balance sheet issues.

So, why am I bearish on UBER with prices near record highs?

UBER is destroying value as it expands with balance sheet issues. Economic uncertainty could hit profit margins as consumers have less disposable income, and higher interest rates may threaten its weak balance sheet fundamentals. UBER also increases its share count, which further erodes value.

The price-to-earnings (PE) ratio of 16.13 makes UBER a cheap stock. By comparison, the PE ratio for the S&P 500 is 28.59.

The average analyst price target for UBER is $96.68, which suggests marginal upside potential. I believe the challenging economic backdrop could result in downward revisions.

Uber Technologies Technical Analysis

Today’s UBER Signal

UBER Price Chart

- The UBER D1 chart shows the Fibonacci Retracement Fan rejecting UBER.

- It also shows a narrow rising wedge, a bearish chart pattern.

- The Bull Bear Power Indicator is bullish but shows a decrease over the past five sessions.

- Trading volumes over the past week were higher during risk-off sessions.

- Three of the last five candlesticks show bearish patterns at resistance levels.

Short Trade Idea

Enter your short position between $89.97 (the lower band of a horizontal resistance area) and 94.38 (the upper band of a horizontal resistance area).

My Call

I am taking a short position in UBER between $89.97 and $94.38. UBER has little upside potential, its fundamentals are mediocre, but its value destruction stands out. From a technical perspective, UBER flashes many bearish signals, and the uncertain economic outlook and consumer trends do not bode well for UBER.

- UBER Entry Level: Between $89.97 and $94.38

- UBER Take Profit: Between $75.41 and $77.58

- UBER Stop Loss: Between $96.68 and $99.58

- Risk/Reward Ratio: 2.17

Ready to trade our daily signals? Here is our list of the best brokers worth checking out.