- The Euro initially pulled back during the trading session here on Wednesday but then turned around to show signs of life.

- All things being equal, this is a market that I think will probably be very volatile during the trading session on Thursday as it is a non-farm payroll day as we continue to see a lot of questions asked about the US economy during the Wednesday session.

- We have seen the ADP nonfarm number came out weaker than anticipated, but ironically the day before the JOLTS jobs opening number came out stronger, meaning that there were plenty of jobs out there.

I think there’s a lot of questions at the moment of the US economy overall, and that continues to see a lot of US dollar selling. It does look like we are trying to continue that later in the day with the European Union possibly exiting some type of recession. We’ll just have to wait and see.

Short-Term Opportunities Abound

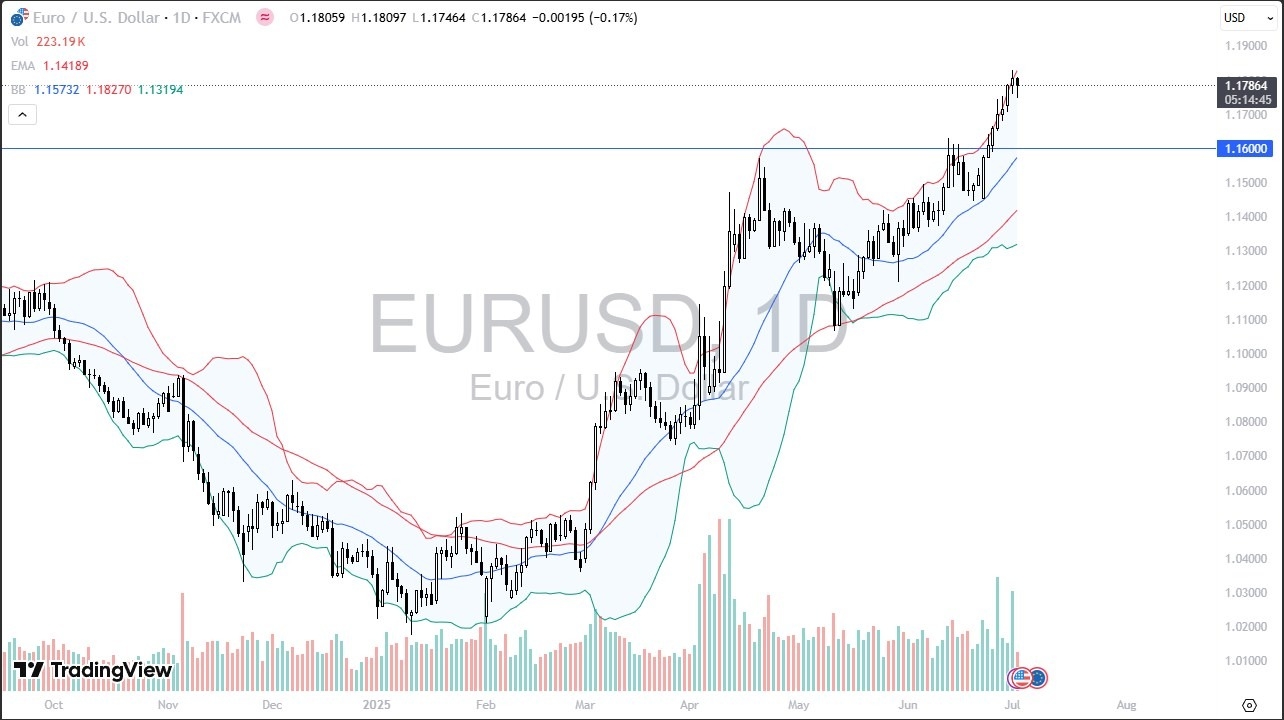

Short-term pullbacks are very likely, but I think the 1.16 level would be an area that a lot of people will be paying close attention to. This is an area that previously had been a major resistance barrier. Now, if we get back to that area, then we could see a potential bounce and an opportunity for people to pick up a little bit of value. The Bollinger band is pretty wide right now.

We are close to the top of it, so we are a little stretched, a little more stretched at least than I would like to see. So, I think all of this comes back to the idea of if we drop, there might be a certain amount of value. If we break down below the 1.15 level though, then I think at that point in time, you probably have serious issues.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.