Technical Indicators Signal Short-Term Caution Amid Bullish Trend

Litecoin Price Chart | Source: TradingView

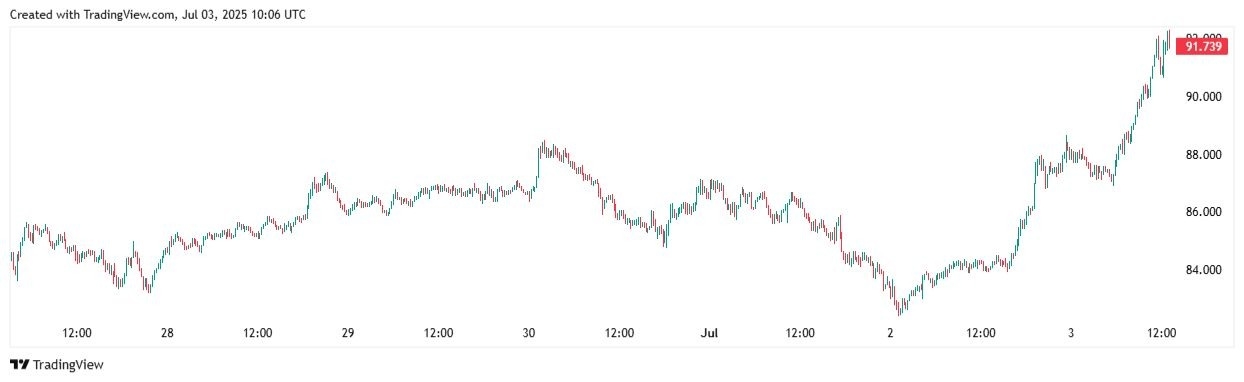

LTC’s current price behavior suggests a potential consolidation phase just below the $92 psychological level.

Meanwhile, the Relative Strength Index (RSI) stands at approximately 78.9, which shows that Litecoin is entering overbought territory. This elevated RSI indicates strong bullish momentum but also suggests the possibility of a short-term pause or correction.

The Moving Average Convergence Divergence (MACD) remains in positive territory, with the MACD line above the signal line. It confirms that bullish momentum is still intact. However, momentum indicators such as Stochastic RSI echo the overbought signal, with readings near 78.7.

Litecoin continues to trade well above both its 50-day and 200-day moving averages, highlighting a bullish long-term trend. The 50-day MA is currently near $86.90, while the 200-day MA sits closer to $88.40.

These levels could act as significant support if there is a retracement and could offer potential buying opportunities for traders seeking to enter the market on a dip.

Whale Activity and Accumulation Trends Support Bullish Case

On-chain data and exchange wallet flows suggest that whales have been steadily accumulating Litecoin over the past several weeks.

This trend, combined with a reduction in LTC held on exchanges, points to growing long-term confidence among significant market participants.

Institutional interest, while not as pronounced as in Bitcoin or Ethereum, has also shown signs of improvement, particularly as Litecoin continues to hold its position as one of the most liquid and widely integrated cryptos across payment platforms.

Support and Resistance Levels to Watch

For traders keeping a close eye on Litecoin’s price action, several key levels warrant attention.

Immediate support is observed near $90.33, with stronger support resting around $88.50–$89.00, where both the 50-day and 200-day moving averages converge.

On the upside, immediate resistance lies near $91.63 (intraday pivot), with the next significant resistance at approximately $92.50.

A decisive break above $92.50 could open the path toward the $95.00–$96.00 zone, where Fibonacci extension levels indicate the next logical target.

Conversely, failure to hold the $90.00 level could trigger a deeper pullback toward the $88.00 region.

These levels are likely to shape Litecoin’s short-term price direction as traders assess whether the recent rally has the legs to continue.

Final Thoughts: Bullish Momentum Meets Overbought Conditions

Litecoin’s recent rise marks a resurgence in bullish momentum, driven by technical strength and steady on-chain fundamentals. The alignment of moving averages and positive MACD readings supports the view that Litecoin’s broader trend remains upward.

However, overbought signals from the RSI and Stochastic indicators suggest that traders should remain cautious in the immediate term. A period of consolidation or a modest pullback would not be surprising given the pace of the recent move.

Traders and investors should closely monitor key support and resistance levels, as well as on-chain metrics and broader market sentiment, to gauge Litecoin’s next move. While the long-term outlook appears constructive, short-term traders may find better entries on dips toward the $89–$90 range.

As Litecoin approaches a potential breakout above $92.50, all eyes remain on whether bulls can maintain control or if bears will step in to cool the rally.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.