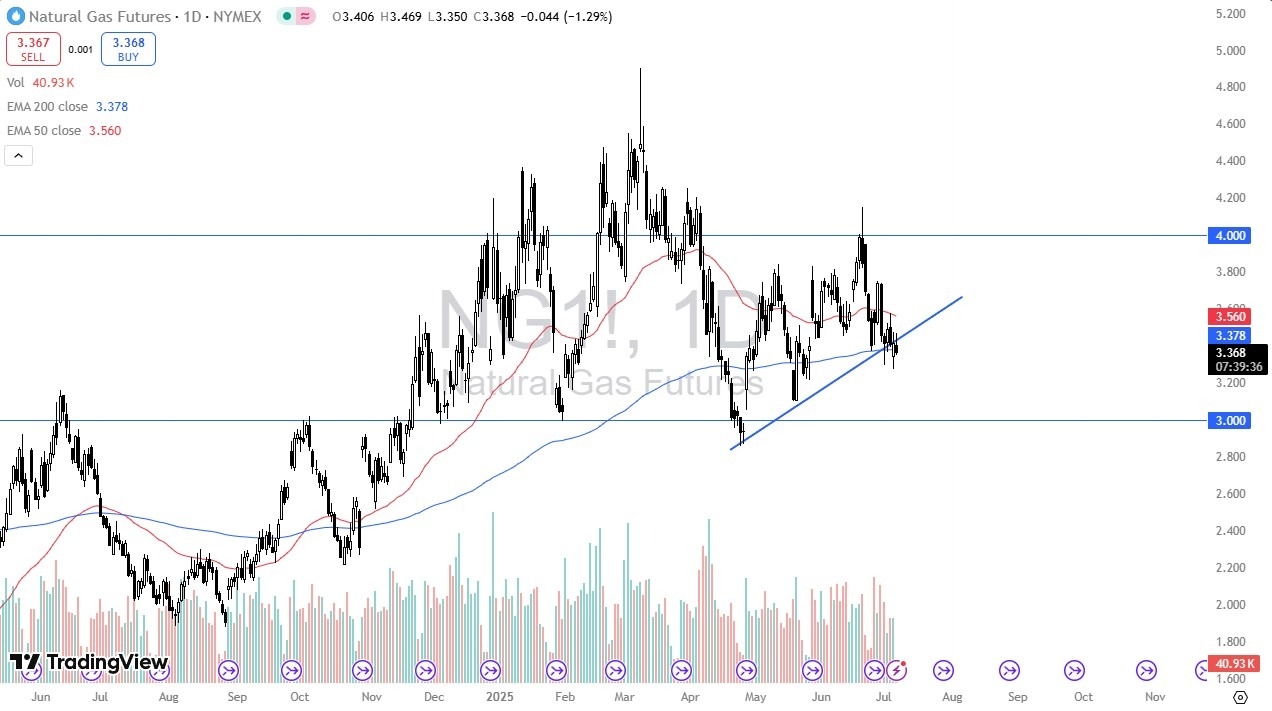

- Looking at the natural gas markets, the first thing that captures my attention is the fact that there is an uptrend line that we are trying to slip through.

- If we can continue to drop from here, then the market is likely to continue to see a lot of selling pressure.

- After all, this is the time of year when natural gas typically struggles as the demand for heating drops off a cliff in the United States, but this year has been a bit different due to a few external factors.

To begin with, the European Union has an issue with buying Russian natural gas; therefore, they have been importing more American natural gas, which, of course this contract is based on. This, of course, has a little bit more of an elevated attitude for this market, and the fact that we recently had a heat wave in the United States has also driven demand for natural gas higher, because natural gas is used for electricity, which, of course, is used for air conditioning. However, that heatwave has come and gone, and now we start to focus on supply and demand metrics.

Technical Analysis

The technical analysis for this market is somewhat neutral at the moment, but the fact that we are breaking through the trendline does have me at least paying close attention. The uptrend line being broken isn’t reason enough for this market to be falling apart, but it is something worth noting. We have the 200-day EMA sitting just below, offering a significant amount of support, and breaking down below there would probably have a lot of people looking at the market to the short side, perhaps opening up the possibility of a move down to the $3 level. If we do rally from here, the 50 Day EMA hangs around the $3.56 level, which could offer a bit of resistance, followed by the $3.75 level. Ultimately, I believe that short-term rallies continue to offer selling opportunities on signs of exhaustion, and therefore, that’s exactly how I will approach this market if we do in fact, rally.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.