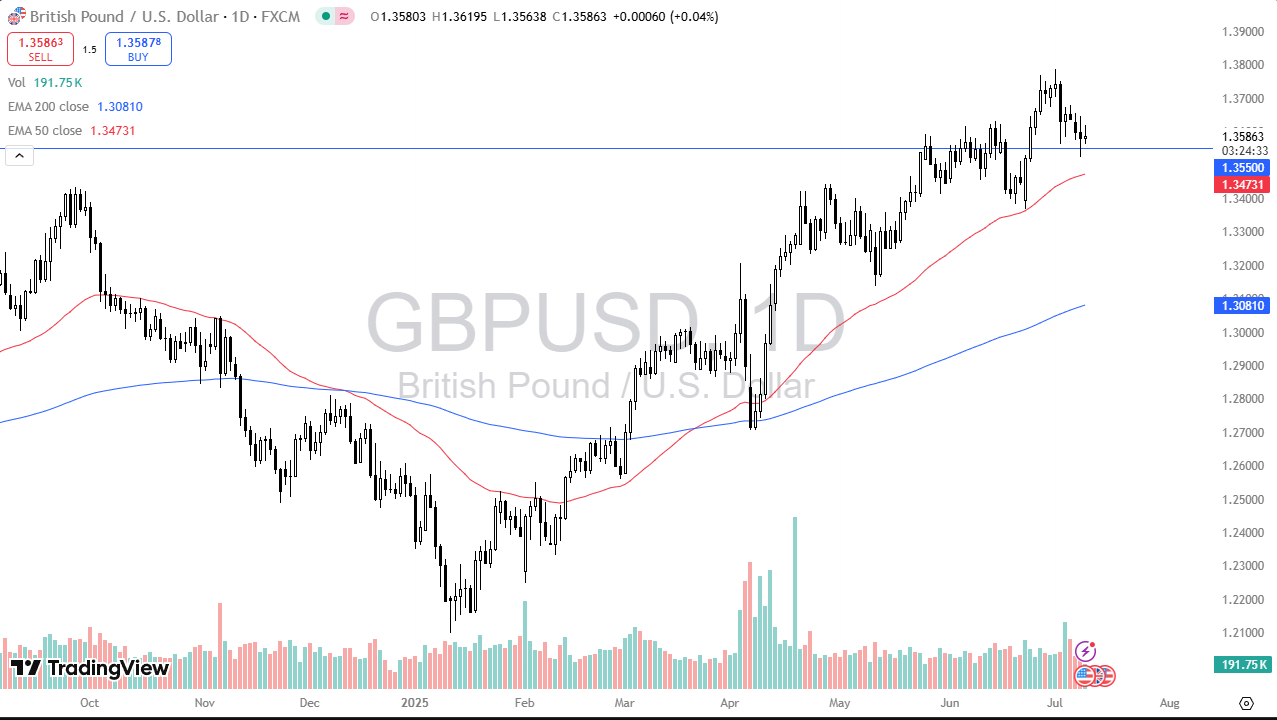

- The British Pound has gone back and forth during the trading session here on Wednesday, as we continue to hang around the 1.3550 level.

- This is a market that has been in an uptrend for quite some time.

- And I do believe that it continues, at least as things stand right now. We’ll just have to wait and see.

But I recognize that the market has been basically in a nice channel since roughly April 20th or so. That being said, it is a market that is getting closer to the bottom of the uptrend channel with the 50 day EMA reaching that level as well. All things being equal, as long as we can stay above the 50 day EMA and the bottom of the channel, I think we have a situation where you’re still looking to buy dibs. If we break down below the 1.3450 level, then I think there’s a very real possibility that things will turn around.

US Dollar Moves Across FX Markets

Remember the U.S. dollar tends to move in the same direction against multiple currencies at the same time. So, we’ll have to wait and see how this plays out. But if the U.S. breaks down through this trend line and starts strengthening against the British pound, that is worth paying close attention to due to the fact that the British pound has been fairly strong against the US dollar, both on the way down and on the way up.

This is a market that I have no interest whatsoever in trying to short at least yet. But again, that 1.3450 level being broken, then I have to start to consider it. The US dollar has been very choppy and noisy, but you can see we are just grinding higher over the longer term and really nothing has changed on this chart.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.