- The US dollar has been pretty back and forth during trading here on Thursday as we continue to see a lot of noise against the Canadian dollar and in the forex markets overall Thursday was very choppy.

- And at this point in time, I’m watching the US dollar against the Canadian dollar because we could possibly be forming a bottoming pattern, although it is a little early to call all clear to get long of this market.

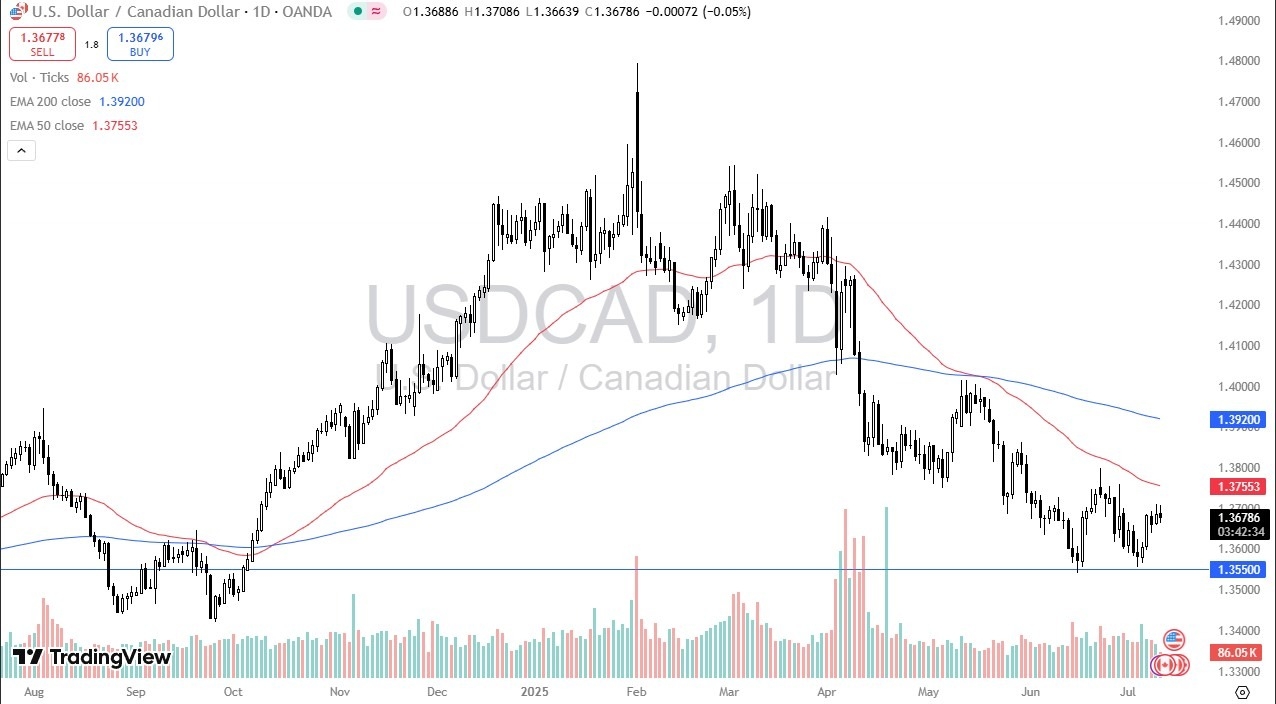

- It is worth noting that there is a little bit of a double bottom here.

And I think ultimately the 1.3550 level is an area that you need to be watching closely. It’s an area that has been important multiple times in the past. And now that we have formed a potential double bottom, I’m definitely watching it closely at this point.

On a Move Higher

If we can break above the 50 day EMA near the 1.3750 level, then I think you get a little bit of rocket fuel for this market and you eventually see a bigger break towards the 200 day EMA at 1.3920. In that environment, I think you have to look at this as a market that will eventually do whatever it can to take off to the upside. But I also recognize that the interest rate differential is a big factor here.

So, people will be watching that with rates in America much stronger than they are in Canada. I believe that eventually people will pay attention to the fact that they get paid to hold on to this market. This is a market that is typically very choppy and grindy, if you will. So, you will have to be patient. But again, like I said, if you go long in this market here, you get paid to hang on to it. If it breaks down below the 1.3550 level, then you could be looking at a move down to 1.3450.

Ready to to trade our daily USD/CAD analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.