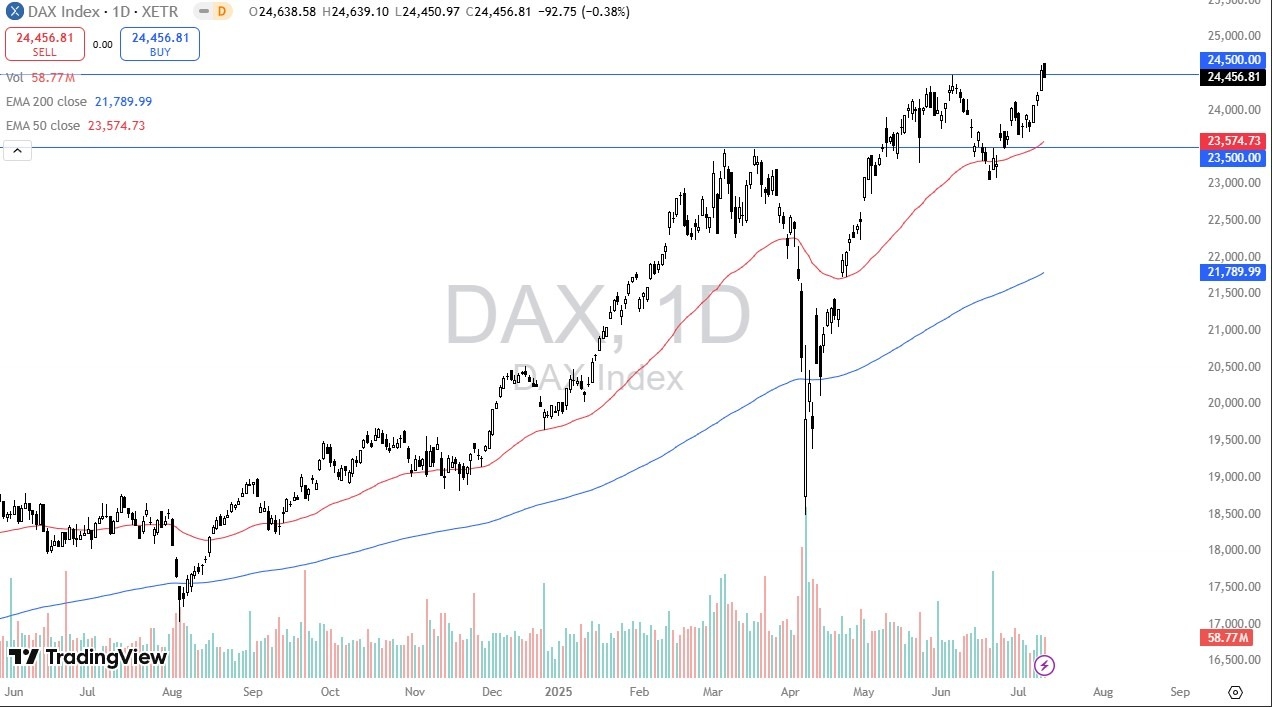

- The German index did initially gap higher to kick off the trading session here on Thursday but then fell as we had reached all-time highs again.

- Ultimately, this is a market that I think will continue to find buyers on dibs as Germany leads the way for the rest of the European Union.

- But I also recognize that there is definitely an air of caution around the world right now as the stock markets may have gotten a little bit ahead of themselves.

Clearly the U.S. indices are taking off, but they also are seeing a lot of volatility. think part of this is just a simple lack of volume in New York and that will have a knock on effect around the world as traders start to look at risk appetite through a different prism. Germany is the first place money goes to when you’re talking about the European Union. So, it does make a certain amount of sense that the DAX has rallied nicely.

On Any Real Break Lower

If we do break down from here, the 50 day EMA sits just above the 23,500 euro level, which I think is your floor at the moment. To the upside, I would aim for the 25,000 euro level, but I think we’re probably going to be very choppy and grinding to the upside more than anything else. I don’t think this is a market that’s going to have a lot of really super clean moves after the type of bounce that has occurred.

Now that we have wiped out all of that tariff concern and volatility and negativity. Now people are looking for a reason to start buying stocks again. Typically, the month of July is pretty quiet around the world. And that may be part of what we’re seeing here. It’s still positive. I just think that you get the opportunity to buy pullbacks occasionally, perhaps massaging an upward position and working it back and forth instead of trying to just simply buy and hold here.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.