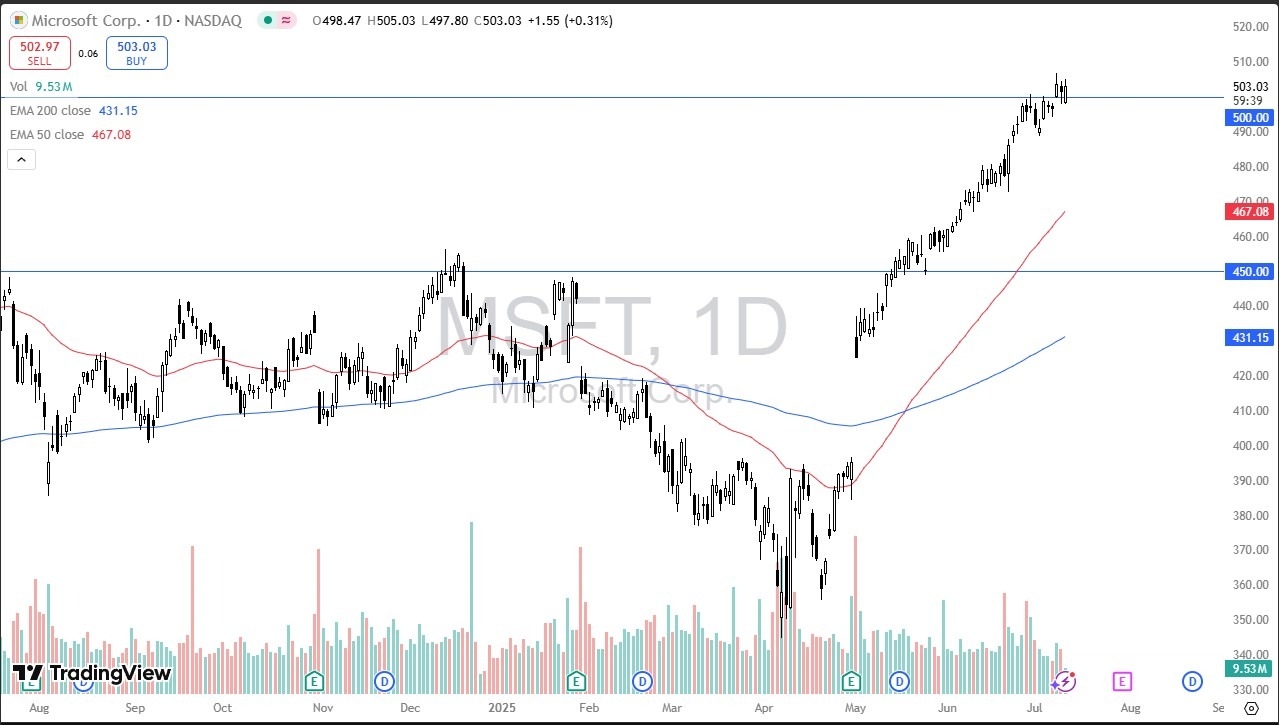

- The Microsoft market has been very bullish since the earnings call in May, as we have jumped from roughly $395 all the way up to the $503 area.

- Currently, we see this is a market that remains bullish and very steady in its uptrend, it should also be noted that sooner or later gravity will come back into the picture.

- After all, we are up a little over 20% in a relatively short term move, especially considering just how big Microsoft is when it comes to the stock market. In other words, it might have gone a little too far into a short amount of time.

That being said, it’s almost impossible to short this market, and I think that if we do get some type of significant sell off, you should be looking for an opportunity to take advantage of this market in order to find a bit of value. The 50 Day EMA is at the $467.08 level and rising at a very sharp angle. Above, we have a certain amount of short-term resistance near the $580 level, but I would not read too much into it, I think we are just simply hovering around the $500 level as a lot of options traders will probably be very active.

Buying the Dip

At this point in time, I think the only way to trade this market is to buy the dip as I suggested, and I recognize that we have a lot of noise out there worth paying attention to, as traders continue to be thrown around by tariffs and of course talks of increasing tension between nations. There also have been geopolitical issues, but at the end of the day, earnings were so positive for Microsoft that people are using it as yet another way to play the market in and push the indices higher. It’s also worth noting that AI is a big part of what’s going on here as well, and anything involving AI teams to be attracting money at them

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.