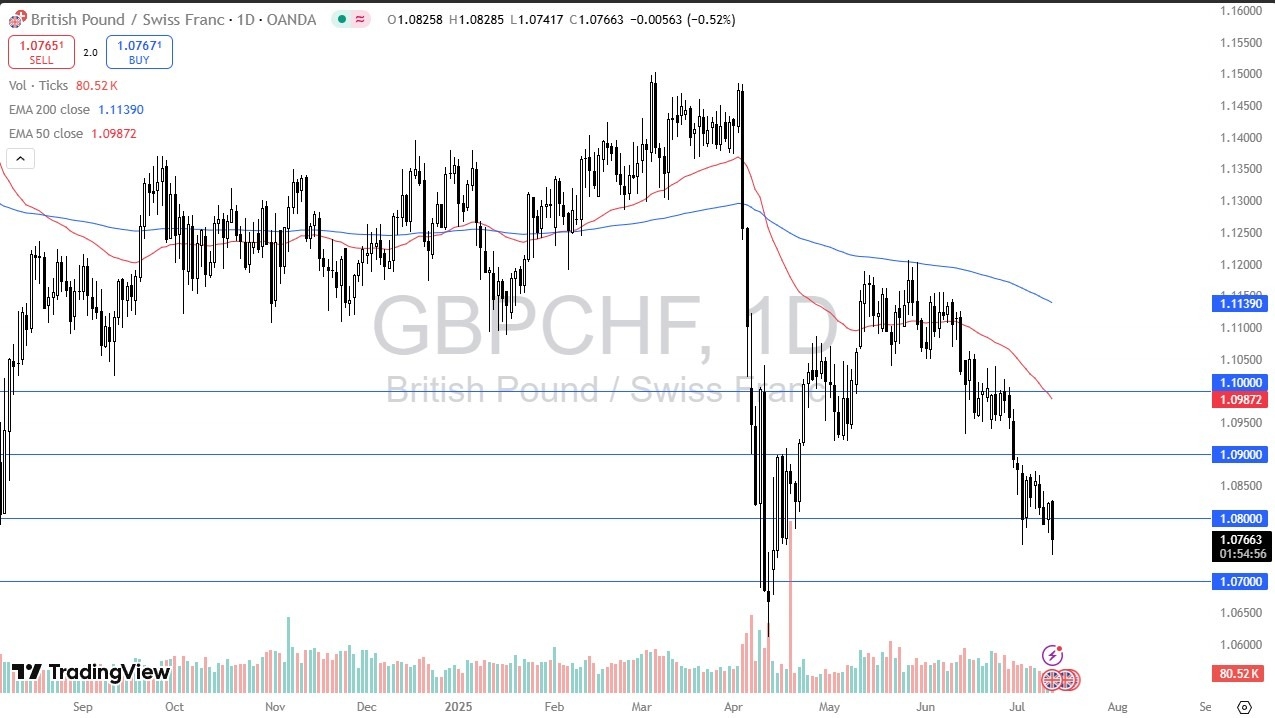

- The British pound has fallen against the Swiss franc during the trading session on Friday as we find ourselves below the crucial 1.08 CHF level.

- This is an area that’s been important multiple times in the recent past, and I think you have to look at it as a potential value play, but we also need to see some type of bounce.

- At this point, it would not surprise me at all to see the British pound dropped to the 1.07 level, as the Swiss franc has been very attracted to a lot of traders, due to the uncertainty involving tariffs yet again.

Technical Analysis

The technical analysis for this market is obviously very negative, as the 50 Day EMA is all the way up at the 1.0987 level and dropping. In other words, we could rally all the way to the 1.10 level, and I don’t know if the trend will change. However, we are obviously in the middle of some type of attempt to bottom here, so we all be looking for an impulsive candle to perhaps play a bounce. If we break down below the bottom of the candlestick for the trading session on Friday, I think at that point in time we are almost certainly going to go looking at the 1.07 level underneath. That’s an area that’s been very important for support, and as long as we stay above there, it’s possible that the British pound can bounce. If we break down below that level, then I think it opens up like a bit of a trapdoor.

Ultimately, this is a market that will continue to be noisy, but it’s also very sensitive to risk appetite, as it is a pair that features the Swiss franc, perhaps the ultimate “safety currency”, and the highflying British pound. If risk appetite starts to pick up around the world, this will be one of the quickest ways to express that potential trade. On the other hand, if we get a shaking of the financial markets around the world, this pair will more likely than not drop.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.