- GBP/JPY edges lower after another failed rejection from bulls to test the 200 mark.

- UK Inflation and Retail Sales data beat estimates, reaffirming the prospects of a BoE rate hold.

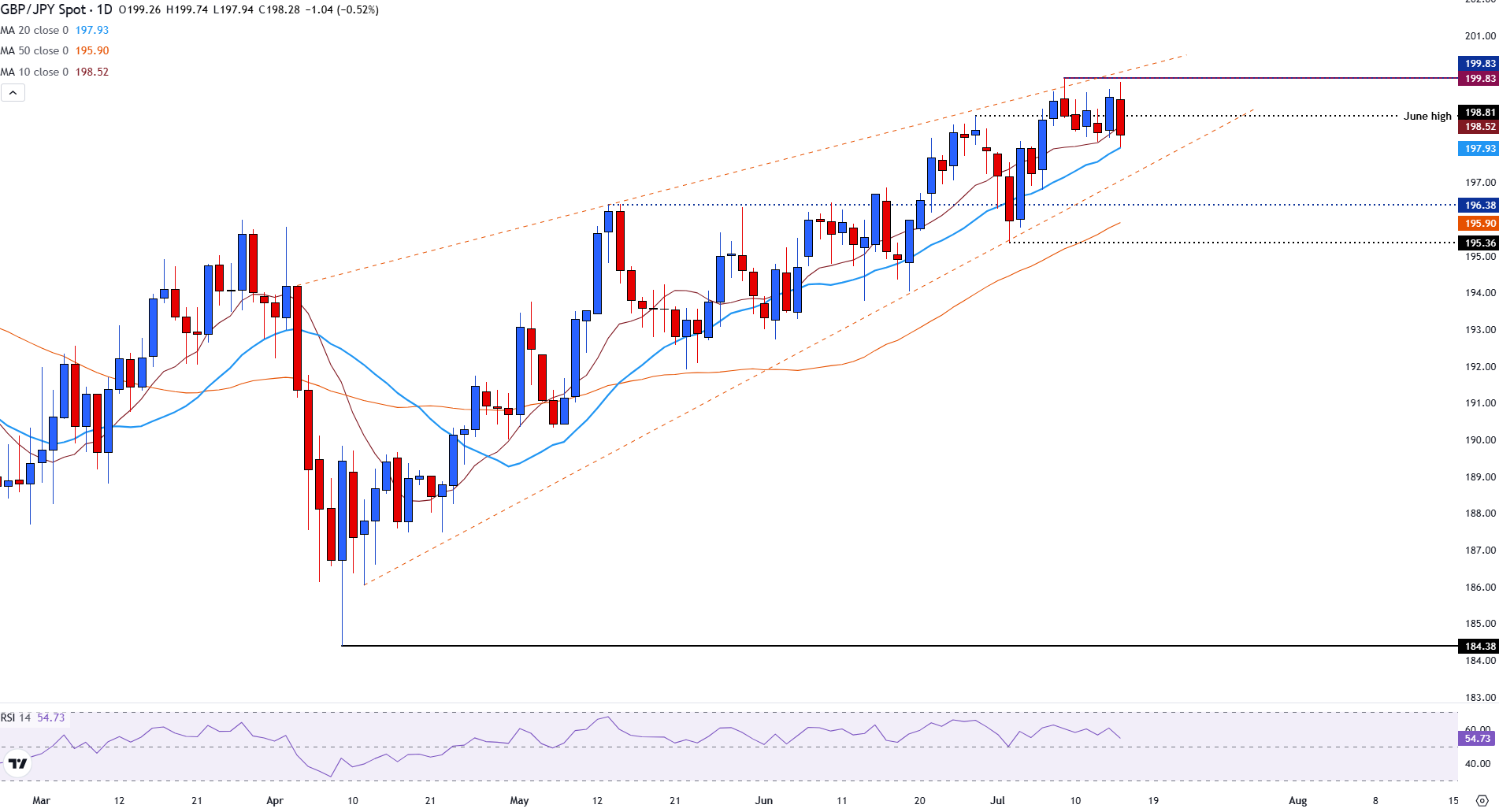

- GBP/JPY remains within the boundaries of a rising channel as price action fluctuates near recent highs.

The British Pound (GBP) is retreating against the Japanese Yen (JPY) on Wednesday after another failed attempt from bulls to push prices above the 200.00 psychological level.

Despite the release of a hotter-than-expected UK inflation print and upbeat UK Retail Sales data, GBP/JPY is trading near 198.00, reflecting a 0.60% decline at the time of writing.

The UK Consumer Price Index (CPI) data released on Wednesday showed that headline CPI increased at an annual rate of 3.6% in June, up from 3.4%, while Core CPI, which excludes food and energy, climbed to 3.7%. Both figures exceeded forecasts and reinforce the view that inflation remains elevated.

Additionally, the Retail Price Index ticked up to 4.4%, signaling resilience in consumer spending.

These upside surprises in inflation increase the likelihood that the Bank of England (BoE) will delay any rate cuts, which has been the narrative that has continued to support the bullish momentum reflected in recent GBP/JPY price action.

GBP/JPY continues to trade within a well-defined ascending channel and remains above all major moving averages, reinforcing its bullish technical structure.

The pair is currently testing key resistance at 199.83, a double-tested high, with the psychological 200.00 level marking the top of the channel.

Recent price action has shown repeated rejections near this upper boundary, indicating the possibility of a short-term consolidation or pullback.

On the downside, initial support lies at the June high of 198.11, followed by the 20-day Simple Moving Average (SMA) at 197.94.

A break below this area exposes the May high of 196.38, which also aligns with a prior channel resistance level.

Further downside could test the stronger support zone around the 50-day SMA at 195.90, with the channel’s lower boundary at 195.36 acting as a key level to watch.

GBP/JPY daily chart

The Relative Strength Index (RSI) currently sits near 56, reflecting neutral-to-mild bullish momentum with room for further upside.

As long as GBP/JPY holds above the 197.90–198.00 support zone, the broader uptrend remains intact. However, a confirmed breakout above 199.83–200.00 is needed to resume the bullish advance, while a close below 197.90 would increase the risk of a deeper pullback toward 195.90.