Ether (ETH) price rallied toward $4,000 at the week-open on Monday, a level not seen since December 2024, fuelled by hopes of increasing crypto regulatory clarity and persistent spot Ethereum exchange-traded fund (ETF) inflows.

The largest altcoin by market capitalization is up more than 30% in the last seven days and 56% month-to-date, to hit a 7-month high at $3,825 on Bitstamp on July 21. Its trading volume has jumped 66% to $8 billion over the last 24 hours, reinforcing the intensity of the demand side activity.

Ethereum’s performance comes on the heels of a busy “Crypto Week” in the US and is backed by increasing network activity and persistent spot Ethereum exchange-traded fund (ETF) inflows.

Favorable Regulatory Action Boosts ETH Price

The recent surge in Ethereum’s price, which saw it climb to within a hair’s breadth of $4,000, has been significantly influenced by the US “Crypto Week,” a period marked by heightened legislative and market activity surrounding cryptocurrencies.

Last week saw three key pieces of crypto legislation passed by the US House of Representatives, with the GENIUS Act set to establish a federal framework for stablecoins. This has sparked optimism across the crypto market, with Ethereum leading the charge among altcoins.

Posts on X and web reports highlight a confluence of factors, including a more crypto-friendly regulatory environment anticipated under a new administration.

For instance, the Financial Times reported that US President Donald Trump is preparing to sign an executive order allowing 401(k) accounts to invest in cryptocurrencies, signalling a shift toward mainstream acceptance.

Ethereum breaks out with strongest rally in weeks, outpacing BTC and Solana as “global stablecoin adoption prompts central banks to fast-track crypto frameworks,” said a crypto investor Azeezaht Adeola in a July 17 post on X, adding:

“Crypto Week heats up as the US House greenlights final votes on big crypto laws.”

This legislative momentum has bolstered investor confidence, driving capital inflows into Ethereum and other digital assets.

Record-breaking Spot ETF Flows Fuel Ether’s Rally

A significant driver of Ethereum’s rally has been the unprecedented inflows into US spot Ethereum exchange-traded funds (ETFs), which have solidified ETH’s status as a long-term institutional asset.

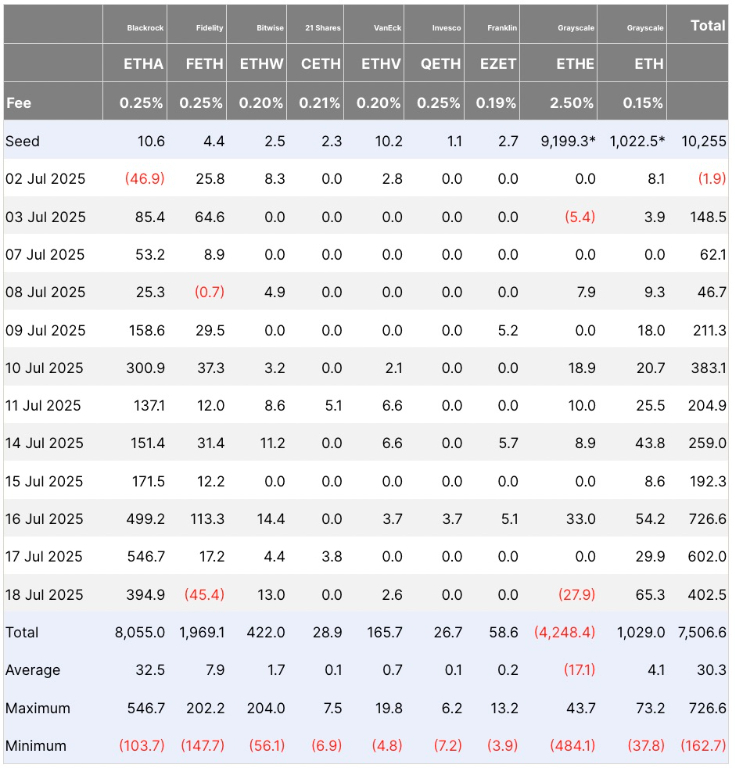

On July 16, 2025, spot ETH ETFs recorded a historic $727 million in daily net inflows, with BlackRock’s ETHA fund alone attracting over $499 million.

These ETFs have seen inflows for eleven consecutive days, amassing approximately $2.2 billion in inflows, with total holdings now exceeding 4.95 million ETH, or roughly 4% of Ethereum’s circulating supply.

Spot Ethereum ETFs Flows Table. Source: Farside Investors

This surge reflects growing institutional demand, as major players like BlackRock and Fidelity are not only buying ETH but also proposing to include staking in their ETF offerings, signalling a commitment to long-term yield generation.

Corporate treasuries, such as SharpLink Gaming, have also joined the fray, with the latter becoming the largest corporate ETH holder by acquiring over 280,706 ETH, surpassing even the Ethereum Foundation.

This accumulation, coupled with a 64% increase in ETH futures open interest to a record $46.58 billion since June 22, underscores the robust market participation fuelling the rally.

The combination of ETF inflows and corporate buying has reduced available ETH supply, particularly as 29.44% of total supply is now locked in staking contracts, according to Ultra Sound Money, further tightening market dynamics and supporting price appreciation.

ETH Traders Now Focus on Resistance at $4,000

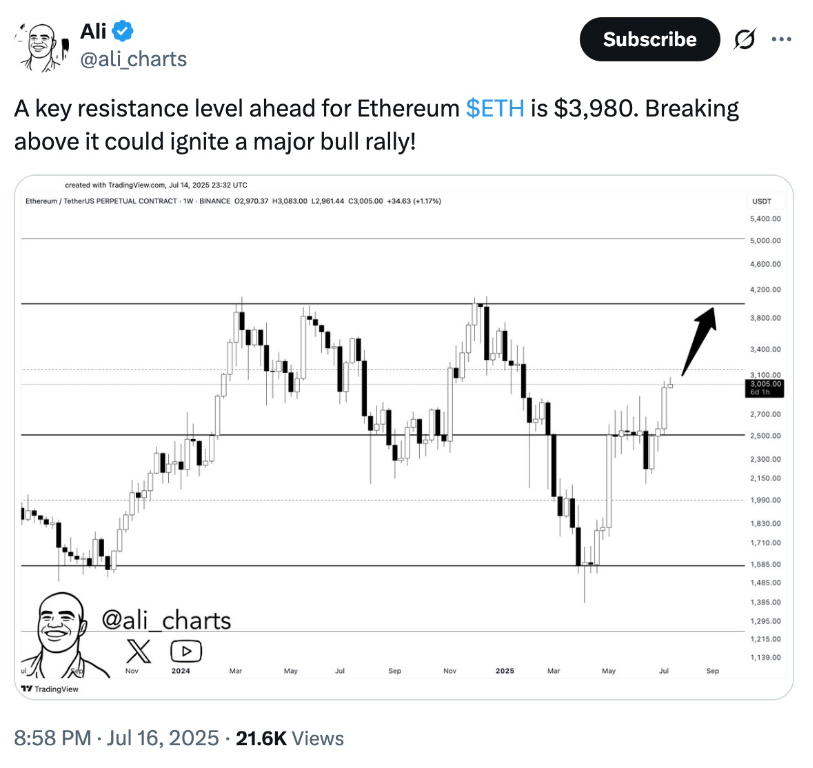

As Ethereum approaches the critical $4,000 resistance level, traders are closely monitoring technical indicators for signs of a breakout.

Breaking the $4,000 level, which is an important historical barrier, would open the way to 2021’s all-time high of $4,869.

Note that the price has been rejected from this level thrice in the recent past, with the latest drawdown in December leading to a 65% drop in ETH price.

ETH/USD Weekly Price Chart. Source: TradingView

When the ETH first crossed this level in 2024, it triggered a 22% upward move to all-time highs.

Analyst Ali Martinez suggests that a decisive close above $4,000 could potentially set the stage for a “major bull rally!” propelling ETH toward $5,000 and probably to the five-digit zone.

Source: Ali Martinez

Several analysts have set ambitious targets for Ether following the latest rally, with DeFi Dad predicting ETH could reach $15,000-$30,000 by 2026, driven by Ethereum’s dominance in decentralized finance (DeFi), Layer-2 scaling solutions, and tokenization trends.

However, caution should be taken as risks such as regulatory uncertainty or macroeconomic shifts could temper the rally, necessitating vigilance among traders eyeing these lofty targets.

Ready to trade our Ethereum analysis? Here’s our list of the best MT4 crypto brokers worth reviewing.