Short Trade Idea

Enter your short position between 106.08 (the intra-day low of a previous price gap higher) and 110.28 (yesterday’s intra-day high).

Market Index Analysis

- Dollar General (DG) is a member of the S&P 500.

- This index remains near record highs, but bearish trading volumes are rising.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Equity markets pushed higher yesterday and recorded fresh intra-day records, but the underlying factors suggest bullish exhaustion. The S&P 500 has not moved more than 1% intraday for several weeks, and the NASDAQ 100 displays momentum not seen since 1999, before the Dot Com Crash. The EU is preparing for a no-deal with the US, and big tech earnings face a big test to confirm the recent rally. Overall, the obstacles to a continuation of the rally increase.

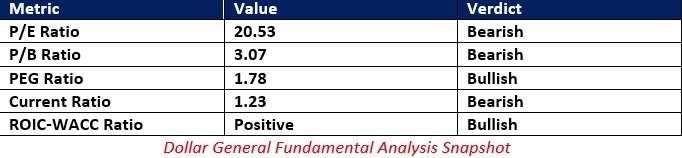

Dollar General Fundamental Analysis

Dollar General is a discount retailer with over 19,000 stores and more than 170,000 employees. It is also under heavy criticism for creating food deserts and low-wage jobs.

So, why am I bearish on DG after its breakdown?

The underlying fundamentals do not support the current share price. High valuations and issues at its stores are reasons enough to approach Dollar General cautiously. The loss of its CFO, which drove the recent stock surge, adds to further issues. DG has a tremendous brand and image issue, and I see more selling ahead. Any turnaround will be capital-intensive, which can magnify short-term issues.

The price-to-earnings (P/E) ratio of 20.53 makes DG a cheap stock compared to the market, but expensive for its sector. By comparison, the P/E ratio for the S&P 500 is 29.06.

The average analyst price target for DG is 115.05. It suggests modest upside potential, but I cannot rule out downgrades.

Dollar General Technical Analysis

Today’s DG Signal

Dollar General Price Chart

- The DG D1 chart shows a breakdown below a horizontal resistance zone.

- It also shows price action at its 38.2% Fibonacci Retracement Fan level with massive bearish momentum.

- The Bull Bear Power Indicator is bearish and has been contracting for weeks.

- Trading volumes are higher during selloffs than during rallies.

- DG corrected as the S&P 500 rallied to fresh highs, a significant bearish development.

My Call

I am taking a short position in DG between 106.08 and 110.28. High valuations, brand issues, the CFO’s departure, and the increasing bearish technical factors should drive the share price lower. I see more breakdowns ahead.

- DG Entry Level: Between 106.08 and 110.28

- DG Take Profit: Between 86.25 and 92.11

- DG Stop Loss: Between 114.18 and 116.30

- Risk/Reward Ratio: 2.45

Ready to trade our daily signals? Here is our list of the best brokers for trading worth checking out.