GBP/USD outlook: Bulls accelerate for the second straight day and approach strong barriers

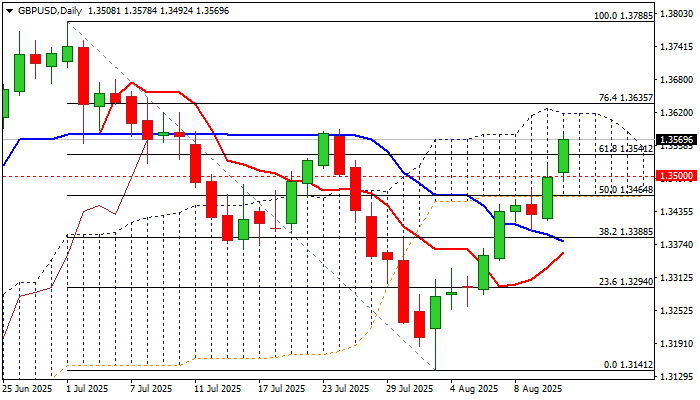

Cable continues to trend higher and nears key near-term barriers at 1.3588 (July 24 high) and 1.3618 (daily Ichimoku cloud top). Weaker dollar on fresh signals of Fed rate cuts (the first cut to be expected in September) and latest data from UK labor sector, which do not urge BoE for immediate rate cuts, provided good support for sterling in last two sessions.

Break above psychological 1.3500 barrier (reinforced by 55DMA) and 1.3541 (Fibo 61.8% of 1.3788/1.3141) generated fresh bullish signal (to be confirmed on close above the latter). Read more…

GBP/USD Forecast: Pound Sterling ignores overbought conditions

GBP/USD gained traction and rose about 0.5% on Tuesday. The pair preserves its bullish momentum on Wednesday and trades at its highest level in three weeks above 1.3550. Although the technical outlook highlights overbought conditions, a technical correction could be delayed unless there is a negative shift in risk sentiment.

The broad-based selling pressure surrounding the US Dollar (USD) fuelled GBP/USD’s rally on Tuesday, as investors saw the July inflation data as a confirmation of a dovish Federal Reserve (Fed) policy outlook in the remainder of the year. Read more…