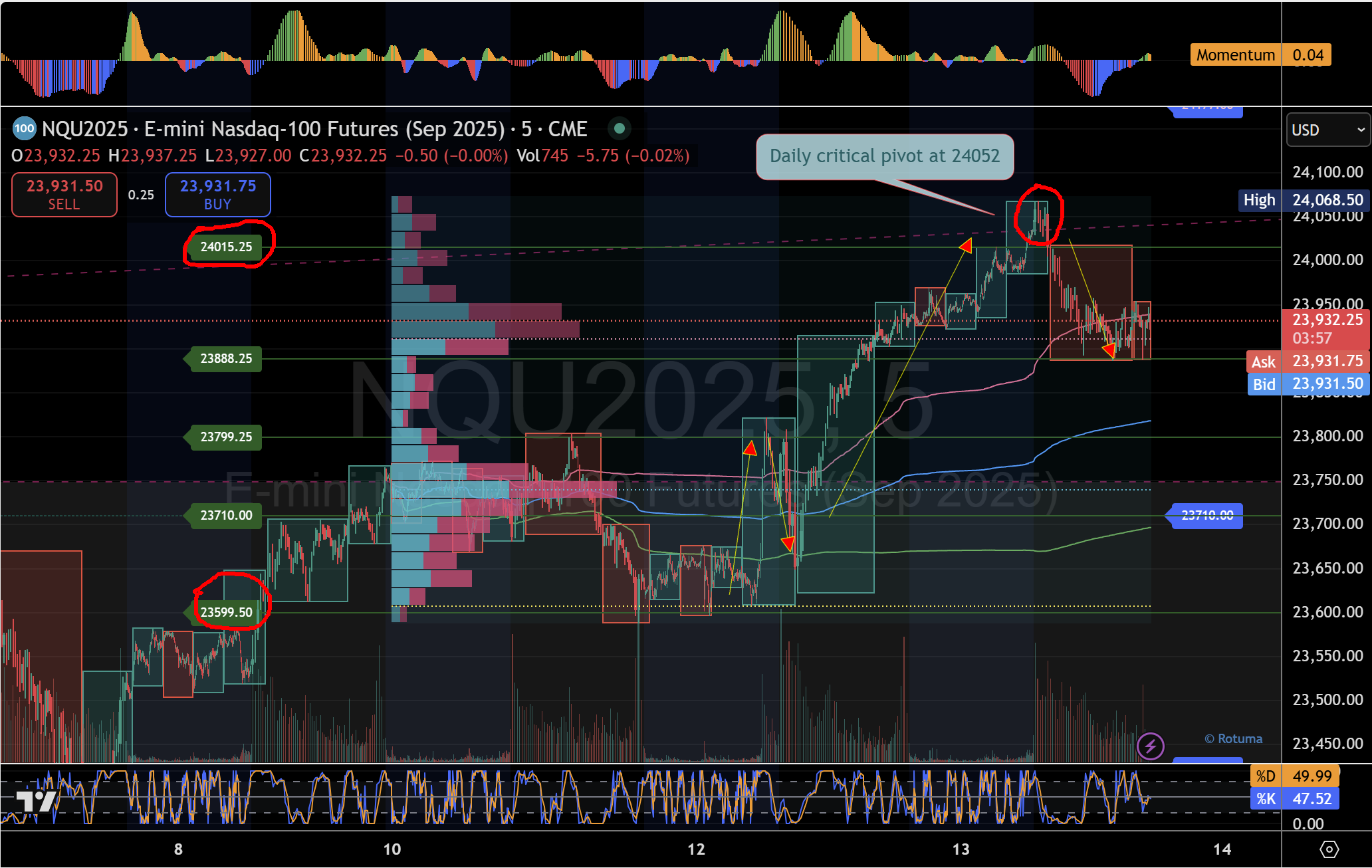

Swing map unchanged: buy Micro 1–2, sell Micro 5–4. Breakout requires acceptance above the daily pivot at 24,052; failure keeps price rotating lower toward 23,799 → 23,710 → 23,599.

- After a clean impulse off Micro-1 23,599 (circled) price stair-stepped through 23,710 → 23,799 → Micro-5 24,015, then stalled with a rejection just under the daily pivot 24,052 (circled).

- We are balancing above Micro-5 (24,015). That’s the line in the sand for the current upswing.

Actionable levels

- Breakout trigger: 24,052 (daily critical pivot). Acceptance above (15-min closes + hold) unlocks 24,015 → 24,177 and continuation higher.

- Support ladder: 23,888 (Micro-4) → 23,799 → 23,710 → 23,599 (Micro-1 base). Lose 23,888, and the rotation lower likely continues down that ladder.

- Fade zone: 24,015 – 24,052 (prior rejection/supply). Look for failure signals here if momentum/volume don’t confirm.

Swing setups (MacroStructure rules)

- Long bias: From Micro-1/2 pullbacks or a reclaim of 23,888–23,950 with confirmation (VWAP/POC reclaim or momentum cross-up).

- Targets: 23,999–24,015 → 24,052 → 24,177.

- Invalidation: Sustained trade below 23,870 or a heavy-volume breakdown through 23,888.

- Short bias: Into Micro-5/4 or 24,015–24,052 on rejection (as shown by the last failed push).

- Targets: 23,950 → 23,888 → 23,799 → 23,710, stretch 23,599.

- Invalidation: Acceptance above 24,052 (don’t fight a confirmed break).

Higher-time-frame check

- Keep a 15m/1h/4h/daily lens on structure and VWAP/volume profile. A daily close above 24,052 would confirm a fresh leg higher; a close back below 23,888 shifts bias to mean-reversion toward 23,710/23,599.

Bottom line

- If 23,888 holds and 24,052 is reclaimed → trend extension.

- If 23,888 fails → expect rotation down the support ladder (23,799 → 23,710 → 23,599).

- No chase—wait for structure + signal alignment, then execute.

The views expressed are for informational and educational purposes only and do not constitute financial advice, a recommendation, or a solicitation to buy or sell any instrument. Trading futures, options, FX, and crypto is highly speculative and involves significant risk of loss. You are solely responsible for your decisions. Past performance is not indicative of future results.